Rep. Watson Coleman Introduces Legislation to Reward Companies that Share a Greater Percentage of their Profits with their Employees

Rep. Watson Coleman Introduces Legislation to Reward Companies that Share a Greater Percentage of their Profits with their Employees

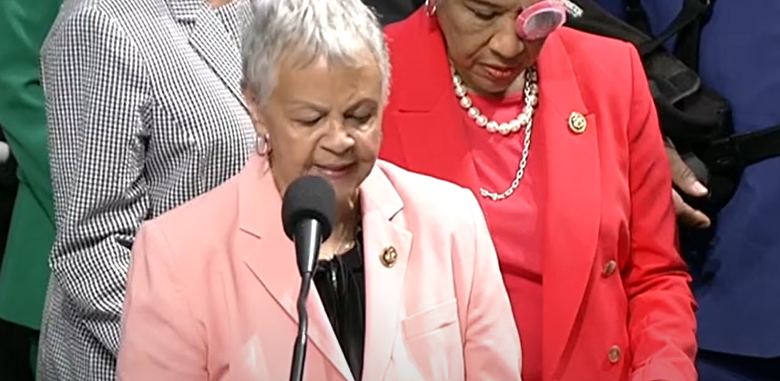

Washington, D.C. (December 3, 2025) - Today, Congresswoman Bonnie Watson Coleman reintroduced the Employee Profit-Sharing Encouragement Act of 2025.

The Employee Profit-Sharing Encouragement Act of 2025 would incentivize large companies to implement an employee profit-sharing plan. This bill would require that any company that makes more than $25 million in earnings must establish an employee profit-sharing plan to provide at least 5 percent of the company’s annual net income as a cash benefit for both full-time and part-time employees who’ve been with the company for one year or more. Qualifying companies that fail to meet these requirements would be prohibited from deducting executive compensation expenses from their federal taxes.

“We have massive companies boosting salaries for their executives while ignoring the majority of their workers and contributing to the national crisis of wage stagnation that’s keeping people out of the middle class. A greater and greater percentage of profits are going to executives and stockholders instead of hard-working employees. That’s a problem that we have the tools to solve, and encouraging profit-sharing is one way we can do it,” said Watson Coleman. “Our tax code is riddled with giveaways for corporations, everything from letting companies borrow from offshore subsidiaries to deductions for ‘manufacturing’ claimed for making burgers or grinding coffee, and Republicans have used their tax bills like the One Big Beautiful Bill Act to add even more loopholes. For all the breaks they get, these companies can and should be investing in their workers — and since so many are unwilling to do so on their own, it’s time for Congress to step in for the people.”

Approximately 51 percent of American workers - about 65.4 million individuals - work for companies with revenue over $25 million and would benefit from profit-sharing. The bill exempts 99.7 percent of American companies to ensure no small businesses are held to an unmanageable standard.

You can find the full texts of the bills here.