The Possible Goldman Sachs Move from Manhattan to Florida – and its Impact on N.J.

In the midst of a maelstrom of political and Coronavirus news in New Jersey and the metropolitan New York region, one recent event of major significance has remained surprisingly ignored in the Garden State. I speak of the news earlier this month, reported extensively in the New York political and business media, that Goldman Sachs is considering moving one its major divisions, specifically its asset management unit to South Florida.

To be sure, Goldman Sachs has no plans to move its core business, namely its famed trading and investment banking divisions away from Wall Street. Still, Goldman Sachs is a leading player in asset management, managing $1.46 trillion as of the end of the third quarter, up 19% from a year earlier. A move of this division from New York would have a major economic and psychological impact on both Manhattan and the New York Metropolitan area, including New Jersey.

The prime factor favoring such a move is an unforeseen consequence of the Coronavirus Pandemic. Costs in Manhattan of commercial real estate, both purchase and lease, have been much higher than in most other urban and suburban office locations. The success of major corporations, specifically in the financial industry in operating remotely during the Pandemic has persuaded business executives that they can move more roles out of the New York area to save money.

So the news about Goldman Sachs is but the latest in a trend of major corporate financial concerns seeking to avoid exorbitant Manhattan real estate costs by abandoning Gotham City and Wall Street and departing for South Florida and other Sunbelt areas. Firms that choose to remain in Manhattan are attempting to cut back on leased square footage and give key executives the opportunity to operate remotely from their homes a certain number of days per month. This Manhattan real estate abandonment and/or cutback by major corporations will lead to a major decline in the value of Manhattan commercial real estate, and inevitably in residential real estate as well.

The departure of financial firms from Manhattan to Florida are facilitated by the fact that Florida has no income tax and balmier weather. Among the major investment firms moving key activities to Florida are 1) Paul Singer’s Elliott Management Corp. moving its headquarters to West Palm Beach from midtown Manhattan; and 2) leading firms like Blackstone Group Inc. and Citadel increasing their presence in the Sunshine State.

I am not saying that Wall Street is about to become a ghost town. The move of Elliott and the possibility of the Goldman asset management exodus to Florida are giving rise, however, to increased discussion of the Miami-to-West Palm Beach corridor becoming the new Wall Street South.

The New York City economy and municipal budget are being ravaged during the Pandemic by this real estate meltdown, rising unemployment, and massive small business closures. Perhaps the most damaged Manhattan small business sector has been the restaurant trade, which historically has been highly successful in attracting business meetings and tourism. It will take at least five years for the restaurant trade to even begin a recovery.

Had New York City landed the planned second national headquarters of Amazon (HQ2) in Long Island City in Queens, literally adjacent to Manhattan, this would have created tens of thousands of jobs, largely offsetting the Pandemic impact of corporate departures from Manhattan. This would have enabled New York to largely avoid the catastrophic economic and budgetary problems which now imperil the city’s future.

The New York City political Left, led by Congresswoman Alexandria Ocasio-Cortez (AOC), in 2019 succeeded in blocking the implementation of the Amazon incentive package offered by New York Governor Andrew Cuomo and New York City Mayor Bill DeBlasio. The success of AOC in this regard is a tribute both to her political acumen and economic illiteracy.

https://www.foxnews.com/politics/nyc-amazon-catastrophic-job-losses

And if the Goldman Sachs Asset Management unit moves to Florida, it will have a palpable impact on New Jersey as well. To begin with, the departure to Florida of highly paid Manhattan-based executives residing in North Jersey will have an effect on high end Jersey real estate, however marginal.

Yet the most significant issue regarding New Jersey will be that of back offices for financial firms headquartered in Manhattan. Many of these firms no longer desire to have their back offices located in Manhattan with its prohibitive real estate costs, and they are being approached by Florida to locate these facilities in the Sunshine State.

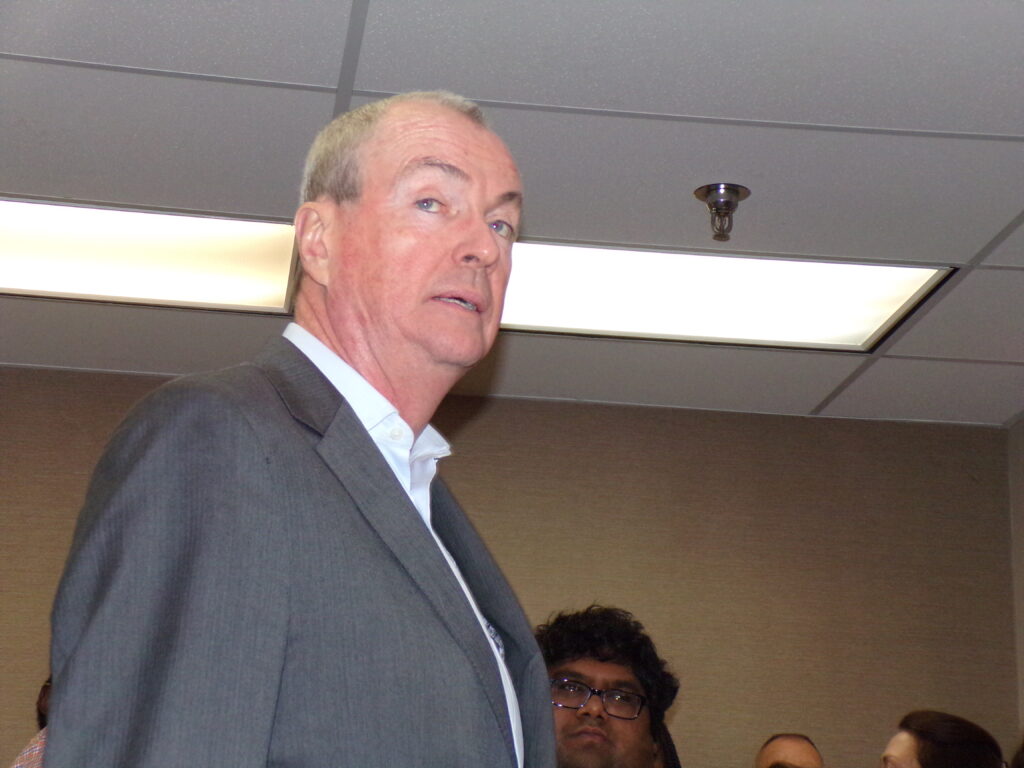

As a location for back office facilities, however, New Jersey may be preferable to Florida for these firms, given the Garden State proximity to Manhattan. The new tax incentive package agreed to by Governor Phil Murphy and legislative leadership this past week gives New Jersey a fighting chance to compete with Florida. https://www.insidernj.com/governor-murphy-lawmakers-announce-agreement-comprehensive-economic-recovery-plan-tax-incentives-reform-legislation/

And while New Jersey and New York have a mutual non-poaching policy to not attempt to relocate each other’s businesses, New York certainly would not object to New Jersey utilizing its incentives to keep a New York-based business in the New York Metropolitan Area when the choice is limited to New Jersey or the Sunbelt.

Special congratulations are due to certain individuals regarding this historic incentive agreement.

First, Phil Murphy once again has proven himself to be a model for other Democratic governors – a non-Socialist progressive with political and economic reality. He has the compassion of a progressive for middle class families struggling to cope with higher education, housing, and healthcare costs. Yet his sense of economic and political reality has guided him in negotiating a compromise on the incentives that was both economically beneficial and politically achievable. And he is no Socialist believer in government control of all business – Phil Murphy did not achieve his success on Wall Street by espousing the tractates of Marx and Engels.

Second is my former boss, Gil Medina, who served during the Whitman administration as the Commissioner of the former New Jersey Department of Commerce and Economic Development. Gil was successful in 1996 in formulating and obtaining legislative passage of New Jersey’s first business incentives, the Business Employment and Incentive Program, and other administrations since have built on his success. He was also a superb salesman for New Jersey in attracting new businesses.

Third are two outstanding former New Jersey State Senators, Republican Joe Kyrillos and Democrat Ray Lesniak. These two legislators created an historic legacy in sponsoring and championing incentive packages over the last three decades, and in working together and with others for the enactment of incentive legislation.

Indeed, it must be said that the latest incentive legislation has arrived just in time for New Jersey to be competitive in the post-Pandemic world.

Alan Steinberg served as Regional Administrator of Region 2 EPA during the administration of former President George W. Bush and as Executive Director of the New Jersey Meadowlands Commission.

Dear Mr. Steinberg, The NJ Machine Democrats must have written this column and signed your name to it! I thought you should know. No independent Republican would write such nonsense.

Ray Lesniak an outstanding former State Senator?! LOL! Has everyone forgotten about Lesniak’s stint at First BankAmericano and the insider loans he received before the bank failed? Oh and then there is the Lesniak Institute for American leadership. It’s at Kean University, which until recently was run by Dawood Farahi. Farahi blamed all the embellishments on his cv on a low level employee (yeah right) and he also purchased a conference table from China for $219,000. Lesniak always stood by him. Ol’ Ray stands out alright but not in a good way.

And now another big fat round round of tax breaks that, according to WNYC, will go to help poor old George Norcross. And if that’s not bad enough there is absolute no transparency at all, the bill to be heard and acted on over the holidays and on a schedule that will make it impossible for the public to digest it.

INTERESTING COMMENT!

NJBlech for a user name…….NO…….I have lived in New Jersey

for 90 years, love it, and am very loyal to my state.

Therefore, I would advise you to change your user name to a more

positive name in regard to NJ or use your name.

I know very little about Mr. Steinberg…..but…..Independent Republican,

at this point, I would remove the Republican, perhaps I am wrong.

He might long for the old/ former Republican Party.

Ray Lesniak, let’s give him some credit. He is interested in stopping

Bear Hunting, and you can’t find fault with that.

Research InsiderNJ October 11, 2020

“Hunters Put Down Your Guns, Go Back to Your Families”

As for George Norcross…..bring on Sue Altman.

………BEWARE……LOUD SCREAMING AHEAD,!

Very little experience regarding financial institutions and compensation.

If I were the CEO and interested in cost cutting, I would eliminate all bonuses

and keep Goldman Sachs in NYC. South Florida pales in comparison to

Manhattan. Balmy weather means extremely hot. Besides Trump might

live in Florida. Matt Gaetz ilives there already.

It is just a suggestion, stop the screaming, The head of compensation

might read the column, but I seriously doubt he will read this comment.

Anyway, Alan Steinberg, I enjoyed your column as always, learned

new info. Thank you.