AG Grewal, Division of Consumer Affairs Announce New Donor Reporting Requirement for 501(c)(4) Organizations, Other Charities

AG Grewal, Division of Consumer Affairs Announce New Donor

Reporting Requirement for 501(c)(4) Organizations, Other Charities

New Rule Follows Two Lawsuits on IRS Weakening of Federal Reporting Rule

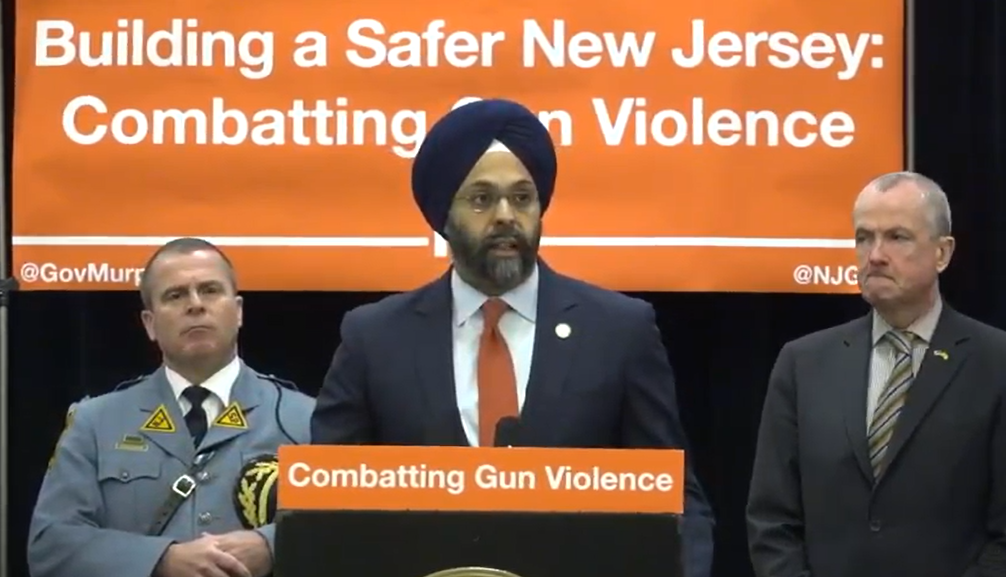

TRENTON – Attorney General Gurbir S. Grewal and the Division of Consumer Affairs today announced a new rule adopted in response to the federal government’s elimination last year of a requirement that so-called “social welfare organizations” annually report their substantial donors to the Internal Revenue Service.

The new rule requires social welfare organizations and other charitable organizations to identify significant contributors – those who have donated $5,000 or more – in their annual reports to the Division’s Charities Registration Section.

Charitable organizations have been required to report this information to the Division in the past. The new rule clarifies that they must continue to do so even though the federal government has changed its own reporting requirements.

In a related action, Attorney General Grewal last week joined New York Attorney General Letitia James in suing the U.S. Department of the Treasury and the IRS for failing to comply with Freedom of Information Act (FOIA) requests submitted jointly by the States in 2018. The States’ FOIA requests seek information regarding the federal decision to stop requiring significant contributor information from tax-exempt organizations.

The new rule and FOIA lawsuit follow a separate lawsuit that New Jersey filed in March, along with Montana Governor Stephen C. Bullock and the Montana Department of Revenue, to challenge the federal government’s repeal of its donor reporting rule. That lawsuit is still pending.

“The new rule we are announcing today shows that we don’t just push back when the federal government adopts policies that harm New Jersey,” said Attorney General Grewal. “We also move forward. I applaud the Division of Consumer Affairs for taking affirmative steps to ensure that it receives the information it needs to enforce our laws protecting the integrity and accountability of social welfare groups and other charitable organizations.”

“This rule will enhance our ability to effectively regulate charitable fund-raising organizations and other tax-exempt non-profits by ensuring that we continue to receive relevant information,” said Division of Consumer Affairs Acting Director Paul R. Rodríguez. “We take seriously our duty to make sure charitable organizations are who they say they are, do what they say they do and act in compliance with New Jersey laws.”

Previously, certain charitable organizations that were tax exempt under Section 501(c)(4) were required by the IRS to submit a list of substantial contributors who, during the prior year, gave the organization money, securities or any other type of property totaling $5,000 or more. The Division of Consumer Affairs required such organizations to provide its Charities Registration Section with a copy of their IRS filings and, as a result, the Division could obtain significant contributor information from those IRS filings.

With the IRS now abandoning its requirement that many Section 501 organizations provide a significant contributors list along with their annual filings, the New Jersey rule announced today fills a void.

Under the new rule, which was published in the New Jersey register on May 6, charitable organizations exempt from taxes under Section 501 must continue to provide a list of significant contributors to the Division of Consumer Affairs, regardless of whether the federal government’s new policy excuses them from doing so for the IRS.

The related FOIA lawsuit, filed last week in the U.S. District Court for the Southern District of New York, concerns requests submitted in October 2018 to the U.S. Department of the Treasury and the IRS, seeking internal records about the roots of their decision to stop requiring significant contributor reporting, along with other information.

To date the Treasury Department has not responded at all, while IRS has made a single, partial production of records containing fewer than 400 pages from one of seven categories of requested material.

Deputy Attorney General Katherine A. Gregory and Assistant Attorney General Glenn J. Moramarco are representing the State of New Jersey in the FOIA lawsuit.