Congressman Kim Co-Sponsors Bill to Restore the SALT Deduction, Help New Jersey Families

Congressman Kim Co-Sponsors Bill to Restore the SALT Deduction,

Help New Jersey Families

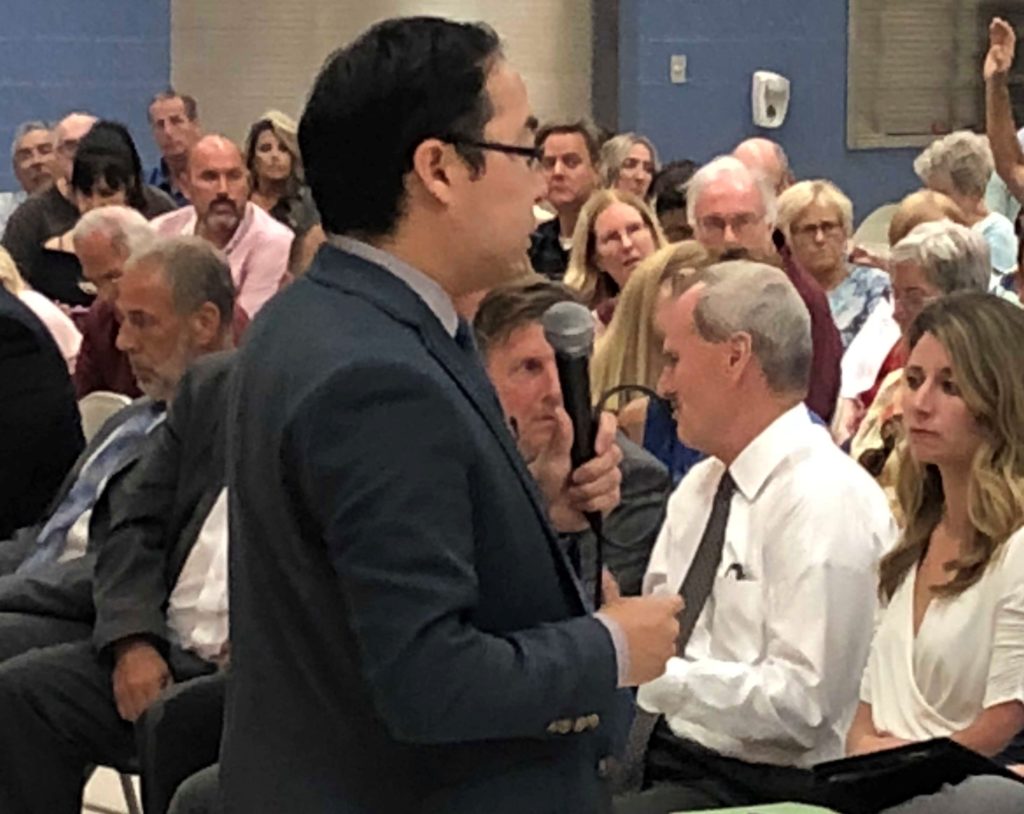

WASHINGTON, DC – Today, Congressman Andy Kim (NJ-03) co-sponsored H.R. 5377, the Restoring Tax Fairness for States and Localities Act, which would provide much needed tax relief for New Jersey families by restoring the state and local tax (SALT) deduction for 2020 and 2021.

“New Jersey taxpayers already give more than they get when it comes to our federal taxes, and the 2017 GOP tax bill only made matters worse by capping our SALT deductions,” said Congressman Kim. “My neighbors in Burlington and Ocean Counties are rightfully upset by this broken tax system and they deserve relief now from this unfair process. I’m standing up with my colleagues from New Jersey and across the country to support this bill to undo the damage and help middle class families that often had to pay thousands more in taxes.”

The bill would provide tax relief by eliminating the marriage penalty by doubling the cap to $20,000 for joint filers for 2019. The bill would also fully restore the SALT deduction for 2020 and 2021.

In a recent survey conducted by New Jersey Society of Certified Public Accountants’ (NJCPA) to more than 500 CPAs, an average of 36 percent of their clients paid more in federal taxes in 2018. The vast majority of those claiming the deduction in New Jersey and across the nation are middle-class households. In 2016, 40% of New Jersey taxpayers deducted their local property and state income taxes. Those households averaged $18,000 per deduction and over 80% of those who filed, earned less than $200,000.

Earlier this year, Congressman Kim helped introduce the SALT Act, which would restore the full deduction taxpayers previously had prior to the tax bill passed during the last Congress. Congressman Kim also testified before the House Ways & Means Committee, the House Committee responsible for tax policy, to call on Congress to act on this critical issue.

###