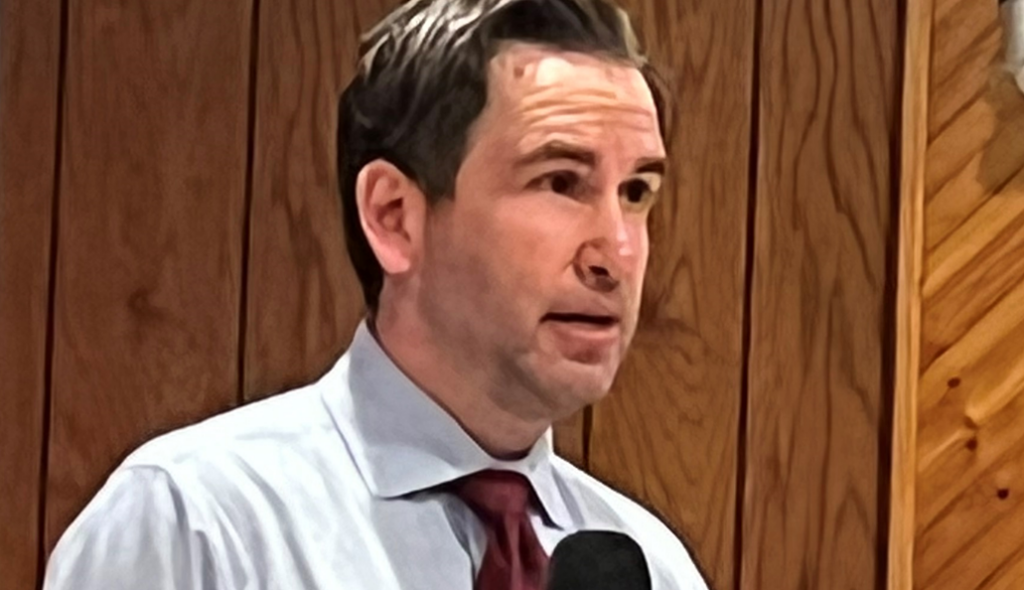

FACT CHECK: Steven Fulop Serves Real Estate Interests and His Developer Bosses — at the Expense of Jersey City Taxpayers

FACT CHECK: Steven Fulop Serves Real Estate Interests and His Developer Bosses — at the Expense of Jersey City Taxpayers

NEWARK — Mayor Steven Fulop rails against a “corruption tax,” but in reality, that’s the steep cost of doing business in Jersey City: paying dues into Fulop’s campaigns and super PACs. In return, Fulop hands out tax breaks to his developer donors at the expense of working people trying to make ends meet in Jersey City.

Here are the facts:

- As mayor, Fulop weakened Jersey City’s pay-t0-play laws in order to line his super PAC’s coffers.

- Fulop cashed nearly $7 million in campaign contributions from real estate interests and his developer donors — at the same time he gave out huge tax breaks to many of their projects.

- After Fulop gave his donors tax breaks, it was Jersey City residents who got stuck with higher property tax bills. Homeowners in less affluent Jersey City wards — A, B, C, and D — got hit with a $143 million property tax bill.

- Fulop opposed a real estate revaluation, which would have spread the property tax burden more fairly between wealthy and working families. Fulop only went along with a revaluation after wasting $4 million of taxpayer dollars on years of legal fees fighting the revaluation on behalf of his real estate and developer special interest funders.

- Fulop even got kickbacks from Dixon Advisory on his home renovations in Jersey City and in Rhode Island for his beachfront mansion.

Bottom line: Fulop has put Jersey City up for sale to the highest bidder to fund his personal political ambitions. His attempt to suddenly reinvent himself as a reformer is as laughable as it is insulting to voters.

Editor's Note: This press release is from the Mikie Sherrill for Governor Campaign.