Gottheimer Fights to Repeal Harmful Medical Device Tax and to Lower Health Care Costs, Protect R&D for North Jersey Families, Businesses

Gottheimer Fights to Repeal Harmful Medical Device Tax and to Lower Health Care Costs, Protect R&D for North Jersey Families, Businesses

Medical device tax suspension expires December 31, 2019

New Jersey’s Life Sciences supports 65,000+ jobs in the Garden State

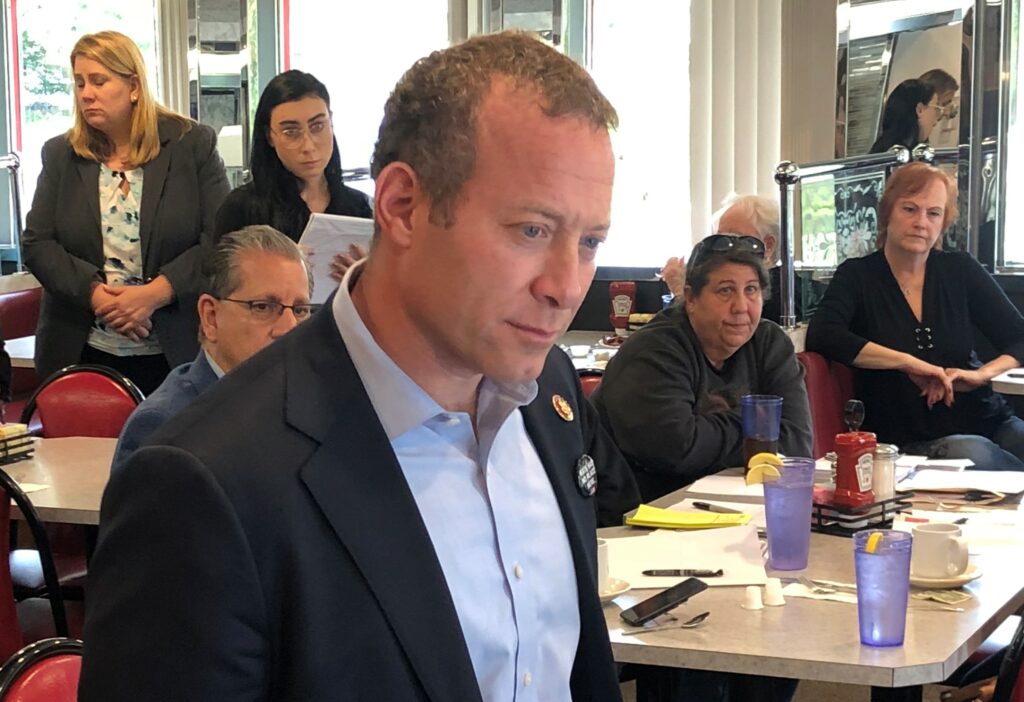

WASHINGTON – On Monday, December 9, 2019, U.S. Congressman Josh Gottheimer (NJ-5) joined a group of Members of Congress in a letter to Speaker of the House Nancy Pelosi, House Minority Leader Kevin McCarthy, Senate Majority Leader McConnell, and Senate Minority Leader Schumer calling for a repeal of the medical device tax before year’s end. The medical device tax is a 2.3% tax on the price of taxable medical devices sold in the United States, including X-ray machines, hospital beds, and MRI machines.

The medical device space supports more than 65,000 jobs in New Jersey alone, and invests nearly $10 billion annually in research and development.

“New Jersey’s Fifth District is counting on tax cuts to keep jobs in North Jersey and bring much-needed health care savings to local families and businesses. I’m fighting to repeal the medical device tax so that we can boost the quality of health care across all the counties I represent, increase innovation, and continue to grow our local economy,” said Congressman Josh Gottheimer (NJ-5). “That’s why I’m calling on both Democrats and Republicans in Congress to repeal this excise tax that’s hurting our medical community, our patients, and raising health care costs across the board. I’m also going to keep working across the aisle to get North Jersey families and businesses the common-sense tax cuts we need.”

The medical device tax, which was implemented as part of the Affordable Care Act, has been suspended since 2016 and the current suspension expires on December 31, 2019. If re-imposed, the tax would result in a decline of 21,390 full-time equivalent jobs in the medical device industry and a reduction in gross domestic product (GDP) of $1.7 billion. The tax also deters innovation, keeping the industry from developing new devices to improve the quality of care for patients.

In the letter sent to congressional leadership this week, the members wrote, “We support repeal of the medical device tax because Americans and patients everywhere who rely upon these innovative technologies will ultimately suffer the burdens if this tax goes back into effect. The House and Senate must act as soon as possible. We owe it to our constituents to act, and we look forward to working with you to accomplish this goal.”

The letter was signed by Representatives Lizzie Fletcher (TX-07), Cindy Axne (IA-03), Anthony Brindisi (NY-22), Angie Craig (MN-02), Joe Cunningham (SC-01), Madeleine Dean (PA-04), Josh Gottheimer (NJ-05), Kendra Horn (OK-05), Ann Kirkpatrick (AZ-02), Susie Lee (NV-03), Tom Malinowski (NJ-07), Ben McAdams (UT-04), Lucy McBath (GA-06), Chris Pappas (NH-01), Dean Phillips (MN-03), Katie Porter (CA-45), Harley Rouda (CA-48), Kim Schrier (WA-08), Lori Trahan (MA-03), and Jeff Van Drew (NJ-02).

Read the full letter HERE.

###