Governor Murphy and Commissioner Caride Announce Expansion of Payment Relief for Student Loan Borrowers

Governor Murphy and Commissioner Caride Announce Expansion of Payment Relief for Student Loan Borrowers

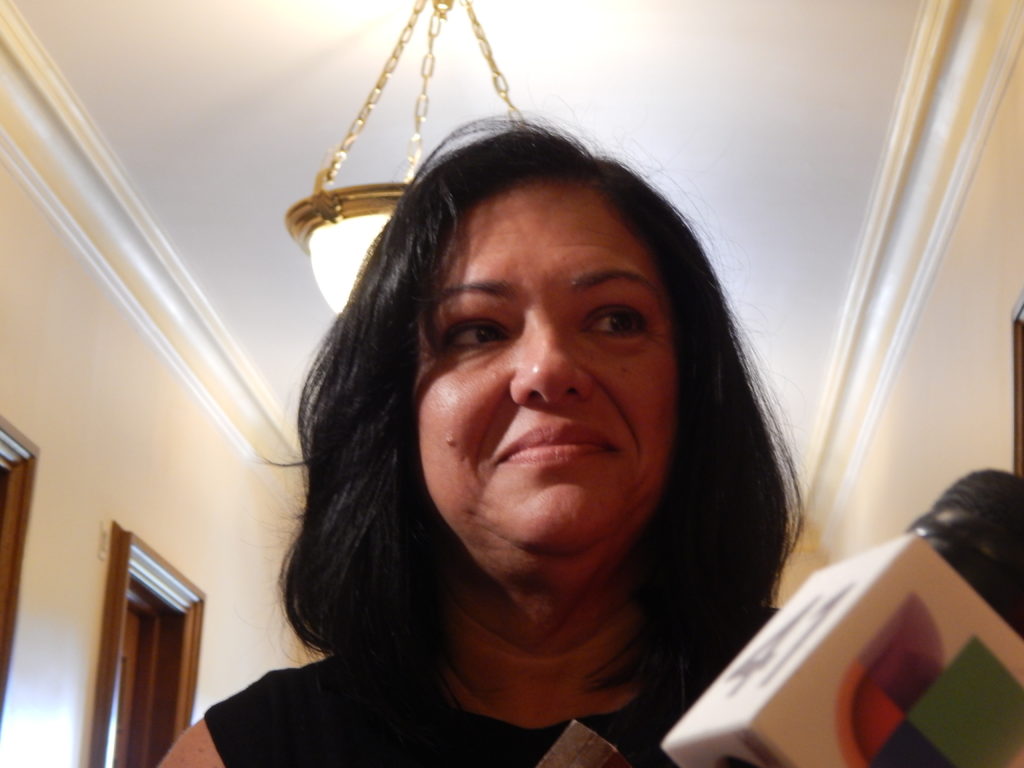

TRENTON – Governor Phil Murphy and Department of Banking and Insurance Commissioner Marlene Caride announced today that the state has secured relief options with private student loan servicers to expand on the protections the federal government granted to federal student loan borrowers. These new options stand to benefit an estimated 200,000 New Jerseyans with privately held student loans.

“Far too many New Jerseyans struggle with crushing student loan debt in good times, and our current crisis has only exacerbated the problem,” said Governor Murphy. “This initiative will provide much needed relief to New Jerseyans who are struggling with student loans and other financial obligations during this crisis. I commend the private sector servicers that joined this initiative for easing some of the affordability concerns of our student loan borrowers who have been impacted by COVID-19.”

The federal Coronavirus Aid, Relief, and Economic Security (CARES) Act provided much needed relief for students with federal loans, including the suspension of monthly payments, interest, and involuntary collection activity until September 30, 2020. However, the CARES Act does not apply to millions of student loan borrowers with federal loans that are not owned by the US Government as well as loans made by private lenders.

Under the initiative announced today, New Jersey residents with commercially-owned Federal Family Education Program Loans or privately held student loans who are struggling to make their payments due to the COVID-19 pandemic will be eligible for expanded relief. The initiative is modeled on the agreement made by the New York Department of Financial Services with commercial student loan servicers in its state.

Borrowers in need of assistance must immediately contact their student loan servicer to identify the options that are appropriate to their circumstances. Relief options offered by participating servicers include:

- Providing a minimum of 90 days of forbearance relief for borrowers;

- Waiving late payment fees for borrowers;

- Ensuring no borrower is subject to negative credit reporting;

- Ceasing debt collection lawsuits for 90 days; and

- Working with eligible borrowers to enroll them in other applicable borrower assistance programs.

“The COVID-19 pandemic has left many New Jerseyans struggling with severe financial hardship,” said Department of Banking and Insurance Commissioner Caride. “Through this effort, New Jersey residents will have payment options available as they are working to balance the financial needs of their families and obligations that include student loans, during this unprecedented time. This initiative also appropriately protects against negative credit reporting for using these payment options.”

“The unprecedented COVID-19 pandemic has posed financial hardships for many New Jerseyans, particularly those whose employment may have been impacted by this emergency. As residents navigate their ‘new normal’ and strive to protect their own health and safety during this public health crisis, borrowers should not have the added worry of how they are going to repay their student loans,” said Dr. Zakiya Smith Ellis, Secretary of Higher Education. “I am pleased to see these additional relief measures that will create greater options for repayment flexibility.”

The initiative builds upon the relief provided to student loan borrowers by New Jersey’s Higher Education Student Assistance Authority (NJ HESAA). Last month, Governor Murphy announced that borrowers with loans from the New Jersey College Loans to Assist State Students (NJCLASS) program can apply for payment relief programs that fully meet the terms of today’s agreement with other private student loan servicers.

“As New Jersey’s state financial aid agency, HESAA remains committed to supporting student loan borrowers,” said David J. Socolow, executive director of HESAA. “We are providing relief for NJCLASS borrowers experiencing illness, unemployment, or financial hardship. HESAA has never charged late fees nor will we do so during this crisis. And during the pandemic emergency, we are protecting borrowers’ credit and suspending involuntary collection activities.”

The Department notes that if regulated student loan servicers are limited in their ability to take these actions due to investor restrictions or contractual obligations, servicers should instead proactively work with loan holders whenever possible to relax those restrictions or obligations. Prudent and reasonable actions taken to support relief for borrowers during the pandemic will not be subject to examiner criticism from the Department of Banking and Insurance.

Under today’s announcement, in addition to NJ HESAA, the following are private student loan servicers providing relief:

Aspire Resources, Inc.

College Ave Student Loan Servicing, LLC

Earnest Operations, LLC

Edfinancial Services, LLC

Kentucky Higher Education Student Loan Corporation

Lendkey Technologies, Inc.

Higher Education Loan Authority of the State of Missouri (MOHELA)

Navient Corp.

Nelnet, Inc.

SoFi Lending Corp.

Tuition Options, LLC

Utah Higher Education Assistance Authority (UHEAA)

Vermont Student Assistance Corporation (VSAC)

New Jersey worked cooperatively on this initiative with California, Colorado, Connecticut, Illinois, Vermont, Virginia, and Washington. Numerous student loan servicers have been working with borrowers during this time period, and additional servicers are expected to sign onto the initiative. More information and a list of participating servicers may be found at dobi.nj.gov.

To determine the types of federal loans they have and who their servicers are, borrowers can visit the U.S. Department of Education’s National Student Loan Data System (NSLDS) at nslds.ed.gov or call the Department of Education’s Federal Student Aid Information Center at 1-800-433-3243 or 1-800-730-8913 (TDD). Borrowers with private student loans can check the contact information on their monthly billing statements.

Residents who have questions or are experiencing trouble with their student loan servicer may contact the New Jersey Department of Banking and Insurance Consumer Hotline at 1-800-446-7467 (8:30 am to 5:00 pm EST Monday-Friday), or go to the Department website and click on Consumer Assistance – Inquiries/Complaints, at https://www.dobi.nj.gov

For more information, see these COVID-19 related Questions and Answers for NJCLASS borrowers: https://www.hesaa.org/Documents/Misc/NJCLASS_Q_n_A.pdf