Madden, Moriarty Introduce Bill to Establish Annual Back-to-School Sales Tax Holiday

Madden, Moriarty Introduce Bill to Establish Annual Back-to-School Sales Tax Holiday

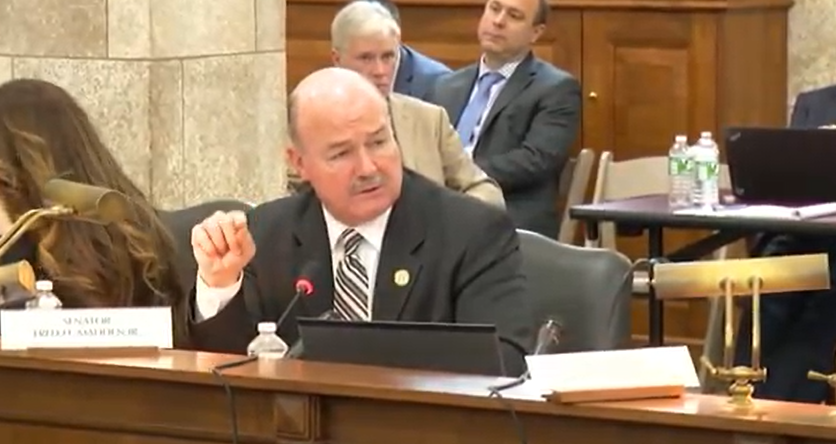

(TRENTON) – Senator Fred Madden and Assemblyman Paul Moriarty (Both D-Camden, Gloucester) introduced legislation providing an annual tax break on back-to-school supplies to help parents and teachers as they prepare students for the new school year.

The proposed bill establishes an annual “back-to-school” 10-day sales tax holiday to commence the week before the first Monday in September. During the holiday, certain retail sales of school supplies, school instructional materials, and sports or recreational equipment sold to an individual purchaser for non-business use are exempt from the sales and use tax.

“The purpose of this legislation is to assist both families and teachers during the busy and potentially expensive back-to-school season. As we’ve seen a collective rise in inflation and the cost of living, it would be a preventative measure, to ensure that students are not left without the very essential school supplies they’ll need for the upcoming school year,” said Senator Madden (D- Gloucester/Camden). “This proposed tax holiday will save parents and teachers funds that they should not have to compromise in order to provide for their children and students.”

“Every year, the average family spends upwards of $250 per child on school supplies alone and teachers spend around $600 of their own money on classroom supplies for their students. These are significant, yet necessary expenses for an important reason— ensuring students and teachers have what they need for a successful school year,” said Assemblyman Paul Moriarty. “Prices are rising with inflation showing no signs of letting up. Now more than ever, it is critical to help families cut costs where they can. A tax holiday right before school begins each year will be something parents and teachers can count on while back-to-school shopping.”

Under the bill, tax-exempt school supplies and equipment during the holiday include:

(1) school supplies, such as pens and pencils, notebooks, and binders;

(2) school art supplies, such as paints and paintbrushes, clay and glazers;

(3) school instructional materials, such as maps, globes, reference books, and workbooks;

(4) computers with a sale price less than $3000 per item; and

(5) school computer supplies, such as computer storage equipment, printers, and personal digital assistant, with a sales price of less than $1,000 per item.

The measure will also exempt sports or recreational equipment. These products would include, but are not limited to, ballet and tap shoes, baseball and hockey gloves, cleated or spiked athletic shoes, mouth guards, roller and ice skates, and sports and motorcycle helmets.

This legislation is part of the proposed FY’23 budget affordability agenda, which aims to help provide tax relief for New Jersey families.