Majority of CPAs Do Not Favor Having a Public Bank in New Jersey, says NJCPA Survey

Majority of CPAs Do Not Favor Having a Public Bank in New Jersey, says NJCPA Survey

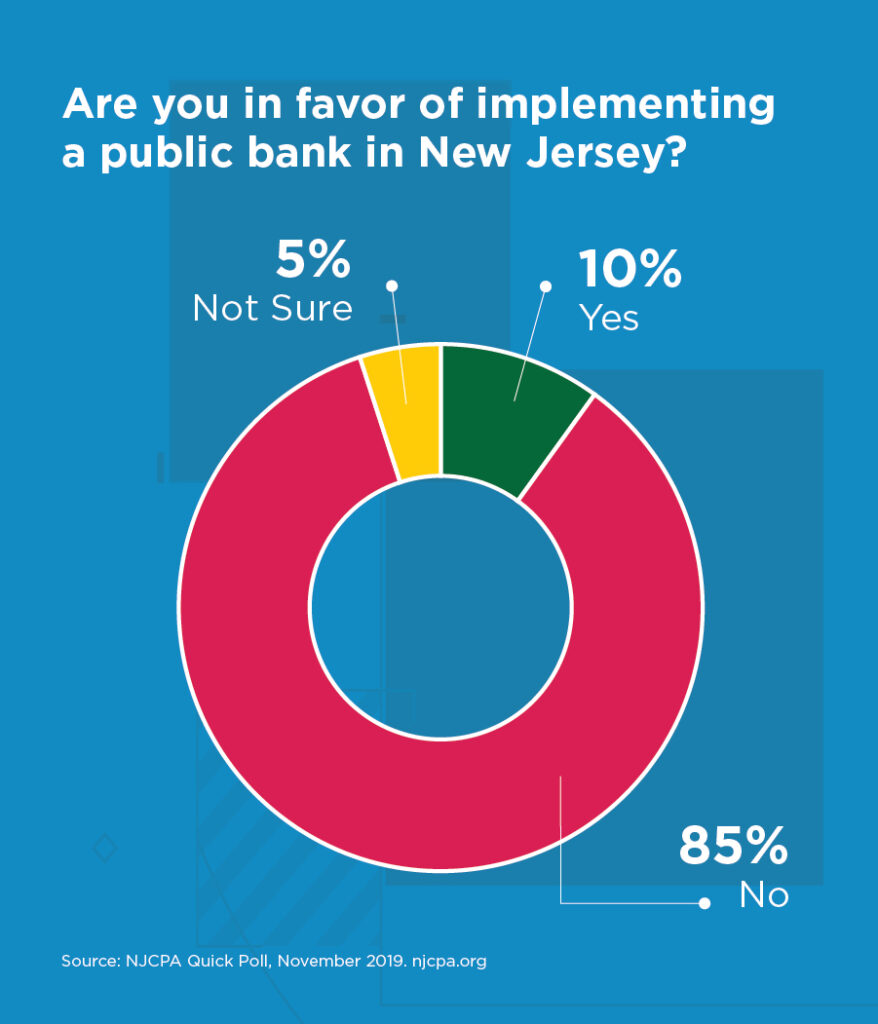

ROSELAND, N.J. — The majority of certified public accountants (CPAs) in a New Jersey Society of CPAs (NJCPA) survey in November, or 85 percent of the 489 members who responded, do not like the idea of having a public bank in New Jersey. The survey was conducted in response to Governor Murphy setting up a 14-member Public Bank Implementation Board (Executive Order No. 91) to develop a plan for such an endeavor within one year.

The public bank, which would be funded by taxpayers, would lend to small businesses, students and municipalities looking to improve infrastructure or build affordable housing in New Jersey. Any profit from such a bank would funnel back into the state’s funds. Governor Murphy plans to have the Board conduct public meetings to discuss the project.

Survey respondents who opposed the concept noted that credit unions, which provide similar borrowing opportunities, are already available throughout the state. They also cited their distaste for having state government in the banking industry, where taxpayers could be forced to subsidize such an enterprise. Respondents also believed the state government’s full attention needs to focus on fixing the pension and health benefit obligations that plague the state currently.

Those in favor of the idea (10 percent) noted that perhaps it could attract younger people into the state to start businesses, noting such a bank could assist both millennials and Generation Z in obtaining loans for businesses or housing.

“Surveys like these are a good indicator of what CPAs and their clients — who are often small business owners — believe will impact the economic landscape of the state,” said Ralph Albert Thomas, CPA (DC), CGMA, CEO and executive director at the NJCPA. “While better borrowing opportunities are always in demand, the survey shows some concerns exist for safeguarding the funds.”

# # #