Pascrell Aims New Legislation to Force Wealthiest Americans to Pay Fair Share

Pascrell Aims New Legislation to Force Wealthiest Americans to Pay Fair Share

Stepped-up basis reform would help narrow equity gap

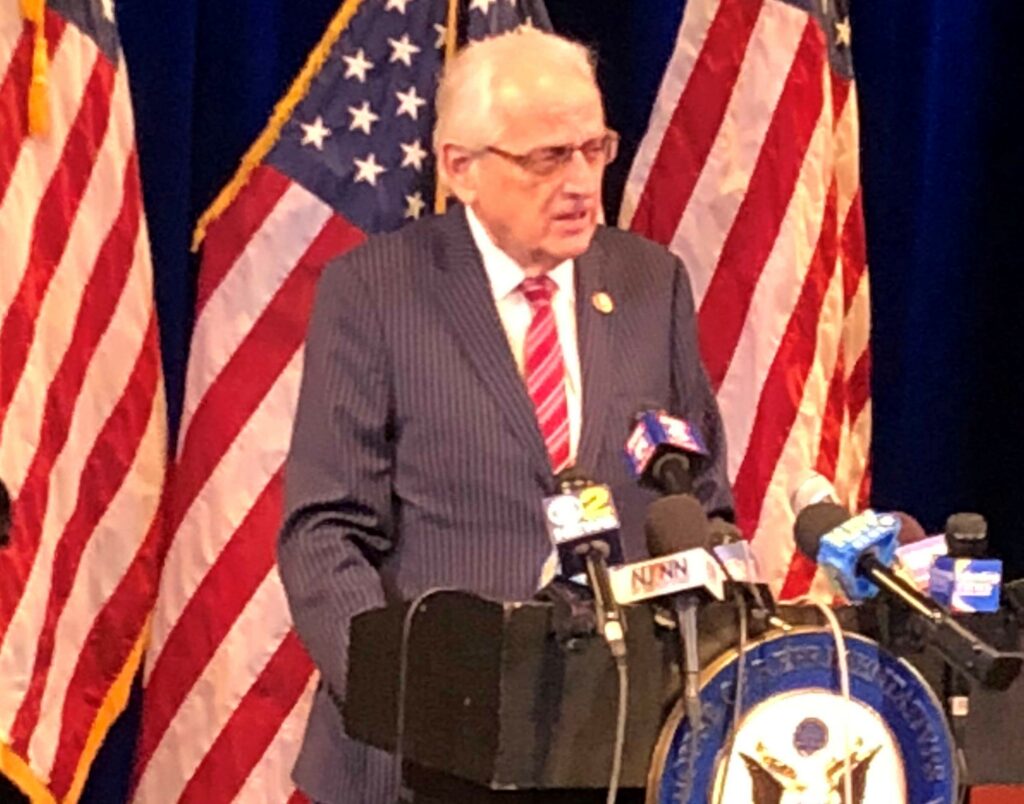

PATERSON, NJ – U.S. Rep. Bill Pascrell, Jr. (D-NJ-09), the Chairman of the House Ways and Means Subcommittee on Oversight, today introduced H.R. 2286, legislation to tax the capital gains of some of America’s wealthiest families upon certain transfers of appreciated capital assets. Long-existing tax law allows the richest American families to pass enormous wealth on to their families without paying tax on the appreciation in their assets.

“America is being ripped apart by an unfair tax system. Our two-tier tax code, with one code for working class Americans, and another full of special breaks for the people at the very top, has destroyed public confidence in our tax structure that must be fixed,” said Chairman Pascrell. “This loophole is one of the chief causes of a broken system. Allowing the richest families on earth to amass greater and greater fortunes without paying their fair share will break this country unless it is set right. As Americans are squeezed like never before and struggling to survive, they look at the widening wealth gap with desperation and anger and demand change. That change begins with closing the stepped-up basis loophole and making the wealthiest Americans pay their fair share.”

Because this legislation breaks new ground in the application of our tax laws, Chairman Pascrell welcomes comments and suggestions for clarifying or improving the provisions of this legislation.

As Chairman of the Oversight Subcommittee, Rep. Pascrell has made tax fairness one of his highest priorities. Pascrell is the main sponsor of the Carried Interest Fairness Act, legislation to close one of the most egregious loopholes in the federal tax code.

Deemed Realization legislation section-by-section.

SECTION 1: Generally treats a transfer of property by gift or bequest as a sale of the property. As a result, the donor of property realizes gain or loss at the time of a gift, and the deceased owner of property realizes gain or loss at the time the property is bequeathed to an heir. The amount realized is the excess of the fair market value of the property on the date of the gift or bequest over the donor or decedent’s basis in the property. The bill provides an exception from this deemed sale rule for gifts or bequests: (1) to a spouse who is a U.S citizen, (2) to a charity, or (3) of tangible personal property, other than property used in a business, property held for investment, and collectibles. In addition, the deemed sale rule does not apply to any gift that would qualify for the gift tax annual exclusion ($15,000 per donor, per recipient for 2021).

The bill provides that the recipient of a gift or bequest of property generally has a basis in the property equal to the fair market value of the property at the time of the gift or the decedent’s death. Additionally, the bill provides that basis may not be greater than the amount for which the property was treated as sold by the donor or decedent. In the case of a gift or bequest to a spouse, gain or loss generally is not realized until the spouse disposes of the asset or dies.

Depreciated property transferred at death and subject to the deemed sale rule is not subject to the related party loss limitations of section 267.

The bill includes special rules for transfers in trust. First, if the grantor of the trust is treated as the owner of the trust property for income tax purposes (i.e., the trust is a “grantor trust”) or if the property of the trust would be includible in the grantor’s gross estate upon death, gain or loss is recognized when the grantor ceases to be treated as owner of the trust assets under the grantor trust rules or when the assets cease to be includible in the grantor’s estate (including by reason of the grantor’s death or distribution of the assets to a beneficiary other than the grantor). Second, if a taxpayer transfers property to a trust not described above, gain or loss generally is realized and recognized at the time of the transfer to the trust. Third, in an effort to prevent the use of dynasty trusts, any property continuously held in trust without gain recognition for a period of 30 years is subject to the deemed sale rule, with gain or loss being realized and recognized, at the end of each such 30-year period.[1]

SECTION 2: Allows a taxpayer to exclude from income up to $1 million (indexed for inflation) in gain resulting from transfers at death.

SECTION 3: Generally requires information reporting relating to gifts or bequests subject to the deemed sale rule. An individual making a gift, or the executor in the case of a transfer at death, must provide a statement to the Secretary of the Treasury and to each recipient of an applicable transfer that includes the following information: (1) the name and taxpayer identification number of the person to whom the transfer was made, (2) a description of the property transferred, and (3) the fair market value of the property and the basis of the property to the transferee. Applicable transfers do not include transfers for which income is excluded under section 2 of the bill or gifts excluded from the deemed sale rule of section 1 of the bill.

SECTION 4: Allows for the payment of tax on certain gain realized and recognized at death in up to seven equal annual installments. This deferred payment option generally is available only for gain that relates to non-publicly traded assets. Interest accrues on tax payments deferred under this rule.

###

[1] This rule has exceptions for grantor trusts and certain trusts for the benefit of a spouse.