So…. What about this? Public/Philanthropy Partnerships

With the possible exception of Rep. Tom MacArthur, everyone in New Jersey recognizes that the Trump tax plan punishes high tax states like ours. Some will argue that we deserve a trip to the woodshed because we are a high tax state. The fact that we pay more to the feds than we get back? That, somehow, does not seem to matter to the folks in Trump country.

The real question is what can those of us in high tax states do about it? At least for the time being, the Trump folks have the votes. One proposal is to have high tax states shift their income tax to a payroll tax. This might not change the after-tax income for either corporations or individuals, it would just switch where feds get their money. Another proposal is Republican Congressman Leonard Lance’s desperate attempt to make sure everyone who ran to the tax office to pay next year’s taxes on this New Year’s Eve will actually get the disappearing tax break.

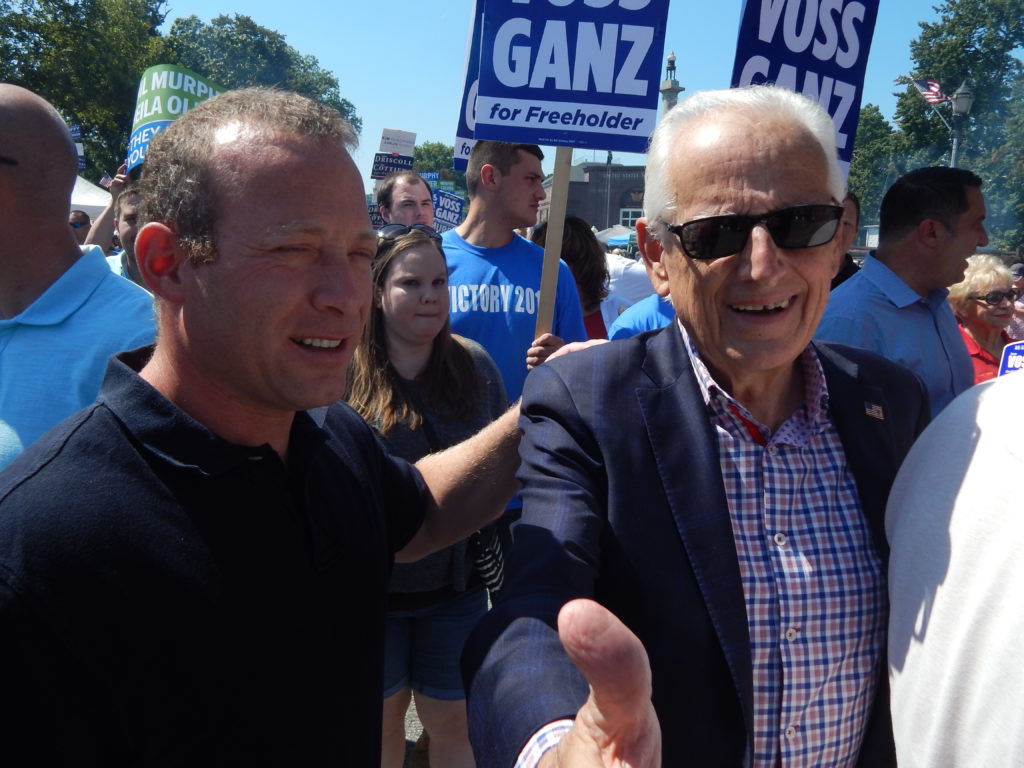

One of the most interesting and innovative proposals comes from Reps. Josh Gottheimer and Bill Pascrell, with the full support of Governor-elect Phil Murphy. Under their plan, local homeowners would pay the equivalent of their property taxes to a local community foundation. That way they would be able to take the federal tax deduction for charitable donations (which still exists in full) instead of the deduction of state and local taxes (which is now capped at $10,000). We should give these elected officials some extra points for creativity and thinking outside the box.

It is essential that this concept come with ironclad firewalls between the foundation and the political process at both the state and local level. The last thing we want is local mayors raiding the foundation for their own benefit.

It is also unclear what the IRS will say in response to this proposal, but there is legal precedent for this type of arrangement. Several states, including republican bastions like Mississippi, Alabama and South Carolina, have charitable foundations and corresponding tax credits that support local services. So while, there are clearly legal and administrative challenges coming to this idea, it is one worth exploring and perhaps expanding on.

That got me thinking of other ways we might link philanthropy and government in new and different ways. We always hear about public/private partnerships as a holy grail for making things run better. But what about public/philanthropy partnerships instead?

So… what about this? Using the endowment model for specialized government staff

Several months ago, I tilted at a windmill in this space and argued that a state windfall from the sale of two public television stations should be used to create an endowment for investigative journalists. That didn’t work, as the $300 million dollar windfall got slopped up for other things. But the nonprofit/philanthropy endowment model for specialized people and positions might be used elsewhere. Here is how.

In general, a one-time investment of about $4.5 million dollars earning a 3% return generates about $135,000 in income a year. That is a reasonable professional salary with benefits, especially if it is a short term as opposed to lifetime position. One area where this type of funding model and position might be particularly useful is in terms of professional policy and research analysis.

For a one-time investment of around $25,000,000, the state could hire five full-time professional policy research analysts. They would have fixed term contracts of 2-3 years and rotate out after that time.

Elected officials and current administrators could choose the research topics. The League of Municipalities or the Municipal Managers Association could take the lead on local government topics. The various state legislative Leaders (both majority and minority) could identify important state-level topic areas. Of course, the Governor would have an option to weigh in on topics.

The researchers themselves could be picked based on proposals they submit, previous records of accomplishment, work experience/academic expertise, etc. Ideally, a professional department director would choose them. However, because they would be paid with endowment funds and be working for a fixed time-period, they would be insulated from the political pressures and machinations faced by current commissions and boards (2% cap anyone?). That means legislators might be able to weigh in on who gets hired as long as the researchers themselves would get to decide the research approaches to the various topics.

I could see this office providing independent evidence based analysis that could form the basis for legislative and administrative policy options. Not bad for a one-time investment using a nonprofit/philanthropy endowment model.

So… What about this? Partnering to identify New Jersey nonprofit foundation capacity issues

In a recent speech to a gathering called by Investors Savings Bank, the president of the Geraldine R. Dodge Foundation (and former gubernatorial candidate) Chris Daggett pointed out that New Jersey has a small number of really big foundations (assets over $100,000,000). These are places like the Robert Wood Johnson Foundation, the Community Foundation of New Jersey and his own Dodge Foundation. However, New Jersey also has an enormous number of smaller family foundations. A quick search on the Guidestar charity navigator site using the term “foundation” in New Jersey pulled back over 6,000 examples.

What do these foundations do? What do they focus on? How much money to they have? How much money do they give?

These are all empirical and interesting questions and answering them could tell us a great deal about nonprofits and philanthropic organizations in the state. It could also highlight the areas where government needs to pay more attention, as well as places where it doesn’t. In addition, knowing the landscape of New Jersey nonprofits better might help nonprofits partner more effectively with each other. This empirical work would build on and expand the work started by the Center for Nonprofits (http://www.njnonprofits.org/2017AnnualSurveyRpt.pdf ) but in a much larger and systematic way.

This seems like a comparatively small and worthwhile investment for the state to fund. Bet the Center for Nonprofits would be happy to help.

So… What about this? Office of Social Impact Investing

One of Phil Murphy’s new and innovative ideas is the creation of a State Bank of New Jersey. Doing that is obviously a long-term play and doing it right will take years of planning. In the meantime, there are a number of innovative ideas around social impact investment strategies. These bring public agencies philanthropic foundation underwriters and nonprofit service delivery agencies together for the common good. New Jersey’s combination of private wealth, small to medium size philanthropies, finance experts, large number of nonprofit delivery agencies, and (to be honest) high taxes means New Jersey could become a national leader in the development of social impact bond strategies, for-benefit corporations and other innovative strategies for partnerships between government, philanthropies, and the emerging “fourth” sector.

To take advantage of this opportunity requires commitment and coordination from both investors and the government to the idea and concepts of social impact investing. This might be a working group or commission; it might be a small part of the State’s economic development authority, it could be a conference or symposium. However, there is a real opportunity for New Jersey to lead in this area and we should take it.

They say that nothing concentrates the mind like a noose around the neck. The proposal for using charitable foundations in lieu of SALT taxes by Rep. Gottheimer and Pascrell might be a perfect example of that. Regardless, it is one worth building and expanding on. Creative philanthropy/public sector partnerships like this one will help us survive the Trump onslaught until it passes.

Matt Hale is a professor of political science at Seton Hall University.

Leave a Reply