Federal Revenue Sharing: A Proposal Phil Murphy Can Effectively Champion

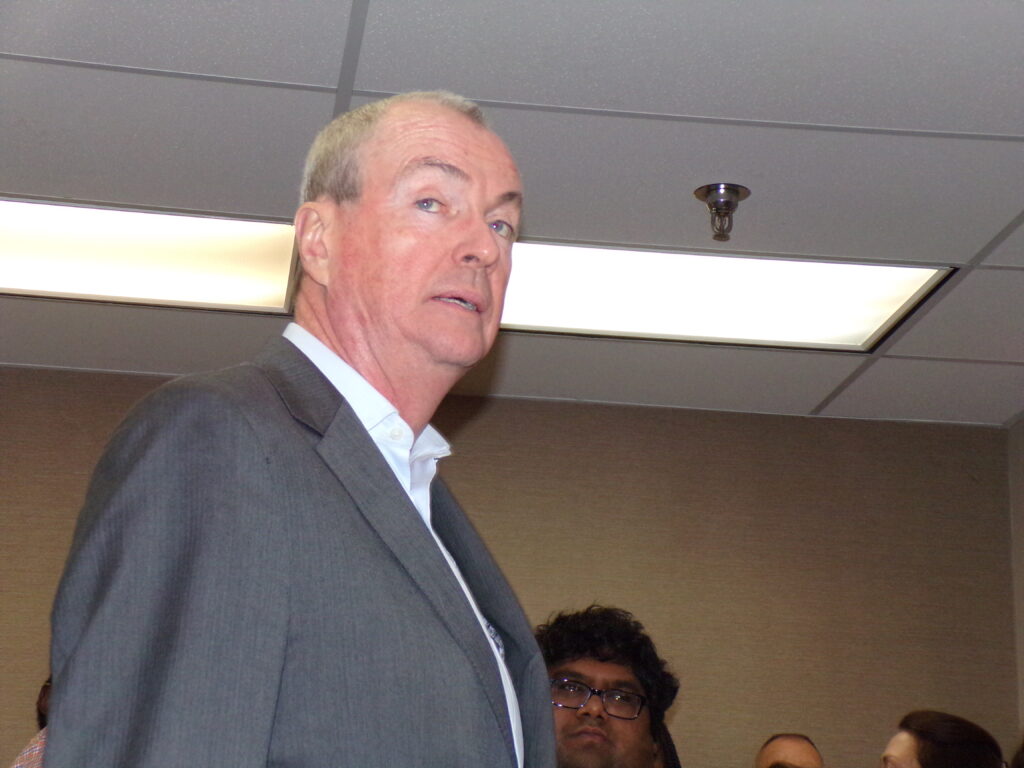

The Monmouth Poll published on Tuesday contained landmark news: Governor Phil Murphy has now attained a job approval from the New Jersey electorate of 71 percent. This high rating and the responses to the underlying questions in the poll signify overwhelming approval of the style and substance of the governor’s leadership during the Coronavirus crisis.

Murphy’s crisis leadership basically involves five characteristics:

- Unwavering dedication and energy, exemplified by his emergence from a hospital bed after life-saving cancer surgery to devote round-the-clock attention to the crisis.

- Totally transparent communication with the media and general public, characterized by a tone of candor yet hope.

- Excellent policy judgment, establishing health as the predominant priority over the political temptation to prematurely reopen the New Jersey economy. He has also accurately emphasized the need for expanded testing prior to any economy reopening.

- Strict avoidance of political partisanship, both in public communication and in dealing with the Trump administration.

- Adherence to principle and avoidance of political concerns.

There are likely to be two immediate results from the Monmouth Poll, one political and one governmental.

The likely political result is that barring an unforeseen scandal, Democrat incumbent Phil Murphy will henceforth be viewed as a prohibitive favorite for reelection as governor in 2021, regardless of the identity of his GOP opponent. In addition to Murphy’s popularity, his reelection prospects are enhanced by the massive Democratic registration advantage over the Republicans and the damage inflicted on the Republican brand by the deep and widespread unpopularity of Donald Trump in the Garden State.

The likely governmental result is that at long last, Governor Murphy will prevail upon the Democratic leadership of the Assembly and Senate to pass the Millionaire’s Tax. Murphy has sought enactment of this measure since the outset of his administration in order to meet the revenue needs of the state, which have been rapidly increasing over the past decade.

Like all other northeastern states, especially New York, the revenue needs of New Jersey now have become much more dire, due to the damage inflicted by the Coronavirus on New Jersey’s healthcare and economic infrastructure. With the passage of the Millionaire’s Tax, New Jersey will have no other palatable tax increase options. The Garden State’s only option is to seek additional federal aid.

Democratic US Senators Cory Booker and Robert Menendez are highly regarded by their fellow senators, and they will make every possible effort to obtain for New Jersey the requisite federal aid. Unfortunately, their efforts will almost certainly be thwarted by the combination of Donald Trump and Senate Republican Leader Mitch McConnell, who oppose virtually all federal financial assistance to the impacted states.

McConnell has gone so far as to propose that states with major budget deficits be forced to file bankruptcy. States are not authorized to file for bankruptcy under the Federal Bankruptcy Code. Accordingly, he has proposed that the Federal Bankruptcy Code be amended to give states this option.

The very passage of such a statute would result in a major national financial panic, as the value of many state bonds would be reduced to junk. By making such a proposal, McConnell has exhibited economic illiteracy. To use a Phil Murphy term, Mitch McConnell is a first-class knucklehead.

Fortunately for New Jersey, the prospects for the election of a Democratic President Joe Biden and Senate increase every day, and New Jersey is likely to have a much more favorable and receptive audience for federal aid after January 20, 2021. States like New Jersey and New York, however, will require more than a one-time injection of aid in order to resolve their long-range revenue shortfalls.

The best solution for New York and New Jersey would be the enactment of a permanent Federal Revenue Sharing Program. Revenue sharing is a type of fiscal federalism whereby the federal government allocates revenue to state and local governments with little or no strings attached.

A formula can be established to ascertain the amount of revenue sharing funds each state would receive every year. It would be essential for New Jersey that the formula for such a program reflect the total amount of federal taxes paid by New Jersey individuals and businesses.

There was a federal revenue sharing program in effect from 1972 until 1986, when it was unfortunately eliminated during a budget crunch. The following is a link to an October 10, 1986 New York Times column, “Federal Revenue Sharing -Born, 1972. Died 1986. R.I.P.” by James Cannon describing the history of the program:

https://www.nytimes.com/1986/10/10/opinion/federal-revenue-sharing-born-1972-died-1986-rip.html

The basic philosophy behind federal revenue sharing is as follows: The federal government is the most effective collector of taxes, but state governments, which are closer to the people, are the most efficient administrators of services and programs. Accordingly, revenue sharing furthers the interests of good government.

The author of the concept of revenue sharing was Walter Heller, Chair of the Council of Economic Advisors under President John F. Kennedy. The first president to introduce this concept in legislative form was Richard Nixon in 1969, but it was not enacted into law until 1972. And the person who played the most effective role in persuading the Congress to enact the program was the then governor of New York, Nelson A. Rockefeller.

Rockefeller was motivated by his situation in New York at that time. As Cannon put it, Nelson was facing a huge deficit, and he did not want to cut services or raise taxes again.

This is the exact situation Phil Murphy will face in the years ahead. Like Rockefeller in 1972, Murphy does not want to enact any further tax increases or program and/or service cuts. And federal revenue sharing can resolve for Phil Murphy New Jersey’s forthcoming deficits in the same way that it enabled New York to close its deficits in the 1970s.

In seeking Congressional approval for a Federal Revenue Sharing proposal, Murphy‘s effort would be enhanced if he had a Republican partner. He can have an ideal GOP ally in Maryland’s governor, Larry Hogan.

Phil Murphy and Larry Hogan have emerged on the national stage during the Coronavirus crisis as gubernatorial models of crisis leadership. They will now be in a position to work with a President Biden to remedy the wreckage of federal-state relations resulting from the vindictiveness and incompetence of the Trump years. The enactment of a new Federal Revenue Sharing program can mark an auspicious beginning for the governmental reform trio of Joe Biden, Phil Murphy, and Larry Hogan.

Alan J. Steinberg served as Regional Administrator of Region 2 EPA during the administration of former President George W. Bush and as Executive Director of the New Jersey Meadowlands Commission.

Leave a Reply