Attorney General Grewal Asks Congress Not to Gut New Jersey’s Ability to Regulate Student Loan Industry

Attorney General Grewal Asks Congress Not to Gut

New Jersey’s Ability to Regulate Student Loan Industry

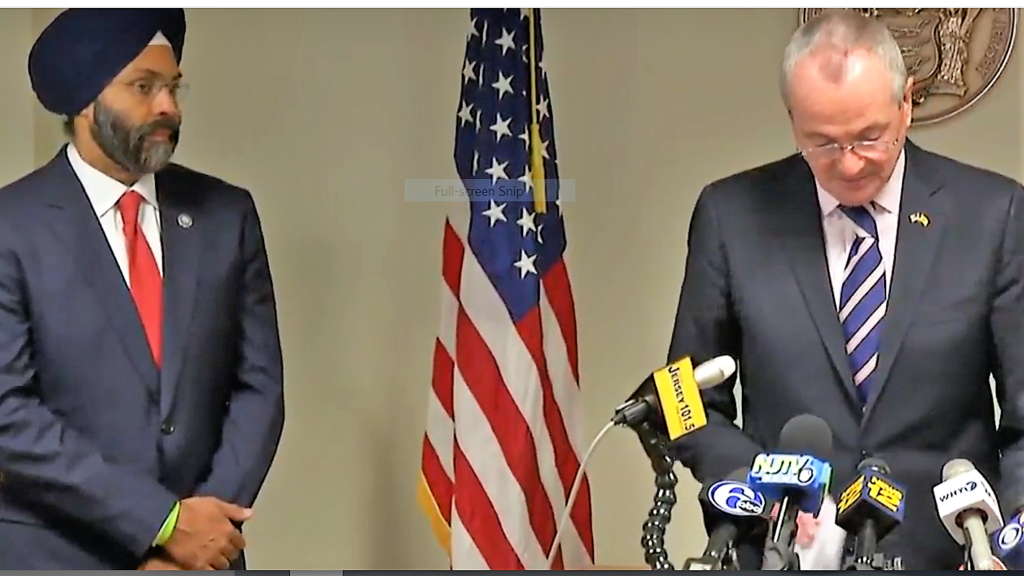

TRENTON –Attorney General Gurbir S. Grewal has joined a coalition of attorneys general in urging Congress to preserve the ability of New Jersey and other states to protect students who take out loans by rejecting a move to preempt state-level authority over the student loan industry.

“Congress is considering legislation that would gut New Jersey’s ability to regulate the student loan industry. It’s something that should concern anyone who has ever had a student loan – or anyone with a child who might one day need a student loan,” said Attorney General Grewal. “Now more than ever, as the federal government pulls back from its regulatory and enforcement obligations, it’s up to the states to fill the void. This legislation would make it more difficult for New Jersey and other states to protect our own students from unscrupulous student loan servicers.”

Grewal today joined attorneys general from around the U.S. in a letter urging Congressional leaders to reject language — included in a bill reauthorizing the federal Higher Education Act (HEA) — that would immunize student loan originators, servicers and debt collectors from state oversight.

The letter describes student loans in the U.S. as being in “crisis” – with a 12 percent delinquency and default rate – and contends that “energetic leadership and oversight at all levels of government” are needed to address abusive student loan practices that are part of the problem. The letter points to past, successful collaborations between the states and the U.S. Department of Education in protecting students from unethical or deceptive operators.

“Far from interfering with the Department (of Education) and other federal efforts to rein in abuses, the record overwhelmingly demonstrates that state laws and state enforcement complement and amplify this important work,” the letter contends.

In 2017, the New Jersey Division of Consumer Affairs settled with a Texas-based student loan servicing business known as Student Loan Resolve over unscrupulous practices. A for-profit company, Student Loan Resolve offered student loan consolidation services to New Jersey borrowers despite not being licensed by the state Department of Banking and Insurance to do so. The $119,000 settlement provided restitution for more than 90 consumers, and Student Loan Resolve agreed to stop offering its services to New Jersey students.

“Cooperation between the states and the Department of Education strengthens our enforcement efforts in this vital area of consumer protection, and it better safeguards the many students who have outstanding loans here in New Jersey and across the nation,” said Attorney General Grewal.

The multi-state letter joined by Grewal observes that the federal Government Accountability Office has identified a host of deficiencies in student loan practices including: failure to provide information to borrowers about their repayment options and difficulty in contacting servicers through designated servicer call centers.

Other trends identified by consumer protection agencies, the letter notes, include an increasing number of students and borrowers complaining of potentially unlawful practices – for example, student loan services and/or debt collectors improperly steering borrowers away from options like income-based repayment that could help them make their monthly payments.

“Instead of sidelining state partners,” the letter asserts, “now is the time to empower law enforcement at all levels of government to prevent and combat fraudulent and abusive loan originating, servicing and collection practices.”