CD12 Republican Candidate Daryl Kipnis Releases Plan To Tackle Crushing Student Debt Issue

CONGRESSIONAL CANDIDATE’S PLAN TACKLES CRUSHING STUDENT

DEBT ISSUE

Republican Daryl Kipnis’s Solution To Ease $ 1 Trillion Generational Burden

SOMERSET, NJ, March 6, 2018 – Republican congressional candidate Daryl Kipnis vows to take on the

student debt crisis head-on when he gets to Washington, D.C.

“We must act now to avert the impending cataclysm of more than $1.3 trillion in current student debt

before it destroys the financial health of an entire generation,” Kipnis, who is running in New Jersey’s

12th District against Democratic incumbent U.S. Rep. Bonnie Watson Coleman, said today. “Unless we

ease the financial burden of these loan debts for some 42 million students now, the future financial

impacts will be devastating to our overall economy.”

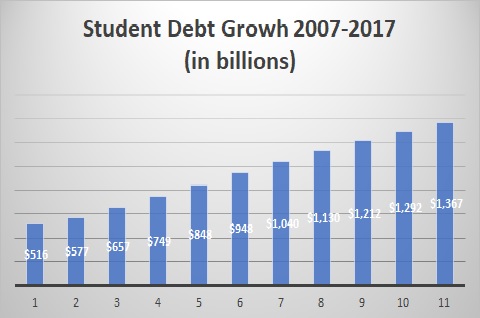

According to data from the U.S. Department of Education, student loan debt more than doubled from

2007-2017 from $516 billion to more than $1.3 trillion.

The number of students owing money increased from 28.3 million to 42.6 million during the same

period, according to the data.

“When elected, I will proudly sponsor a bill expanding loan assistance programs, refinance options,

income-based modification of loan balances, and most importantly, the ability to discharge student

loans in bankruptcy, which is greatly needed to take people who are badly struggling financially and

place them in a position where they are empowered to grow our economy and live the American

dream,” Kipnis, who owns his own law practice in Somerset, said. “For many of our youngest, and most

promising citizens, student debt has forced almost an entire generation into a form of indentured

servitude. Their debt runs in the thousands to more than $100,000, giving them the equivalent of a

mortgage payment before most of them even have a job.”

Kipnis said that he sees the economic hardship this issue causes when young people come into his office

and ask for help to ease the struggle with handling the debt.

“Many of the degrees students eventually obtain do not lead to jobs and salaries that allow them to

significantly pay the debt down to manageable levels,” he said. “I don’t imagine many of us, especially in

New Jersey, would be financially successful carrying this kind of debt right at the start of our

professional lives.”

In addition to legislation to help students with existing debt, Kipnis also wants to work on reforming the

system that causes students to borrow way beyond their means.

Those solutions include; tightening the requirements for getting student loans to align with the student

and family’s ability to pay, as well as making sure the student is getting good enough grades to

demonstrate an ability to successfully complete the degree program in a timely manner.

Kipnis also wants to see more accountability from colleges and universities that are continually hiking

tuition and related costs dramatically.

“Because these loans are, for the most part, guaranteed by the government and easy to get, the

institutions have little incentive to be competitive and run on a cost-efficient basis,” Kipnis said. “This

makes it almost impossible for free market forces to work, bringing costs down and delivering the

product of education to the masses at a reasonable cost.”

Another avenue is to fully educate students and parents about the true costs of attending college, the

alternatives and what kind of return on their investment they can realistically expect.

Kipnis said he also wants to expand availability of stackable credentialing, defined by the U.S.

Department of labor as: ‘part of a sequence of credentials that can be accumulated over time to build

up an individual’s qualifications and help them move along a career pathway or up a career ladder to

different and potentially higher paying jobs,’ as an alternative to traditional 4-year degrees, as well as

encourage enrollment in vocational and technical post-secondary education programs and create better

relationships between employers and educational institutions to fill employment needs.

By helping students with existing debt, and taking on the root causes of the problem, Kipnis wants to

ensure future generations of students have the tools to make attending college the bright gateway to

achievement and prosperity it was intended to be.

“Students should be looking to the future to pay for cars, homes, weddings, children and retirement, not

worrying each month where their student loan payment is coming from,” he said. “It may seem like a lot

of money today but easing or eliminating this indebtedness will pay big dividends in the future, allowing

the entire economy to prosper.”