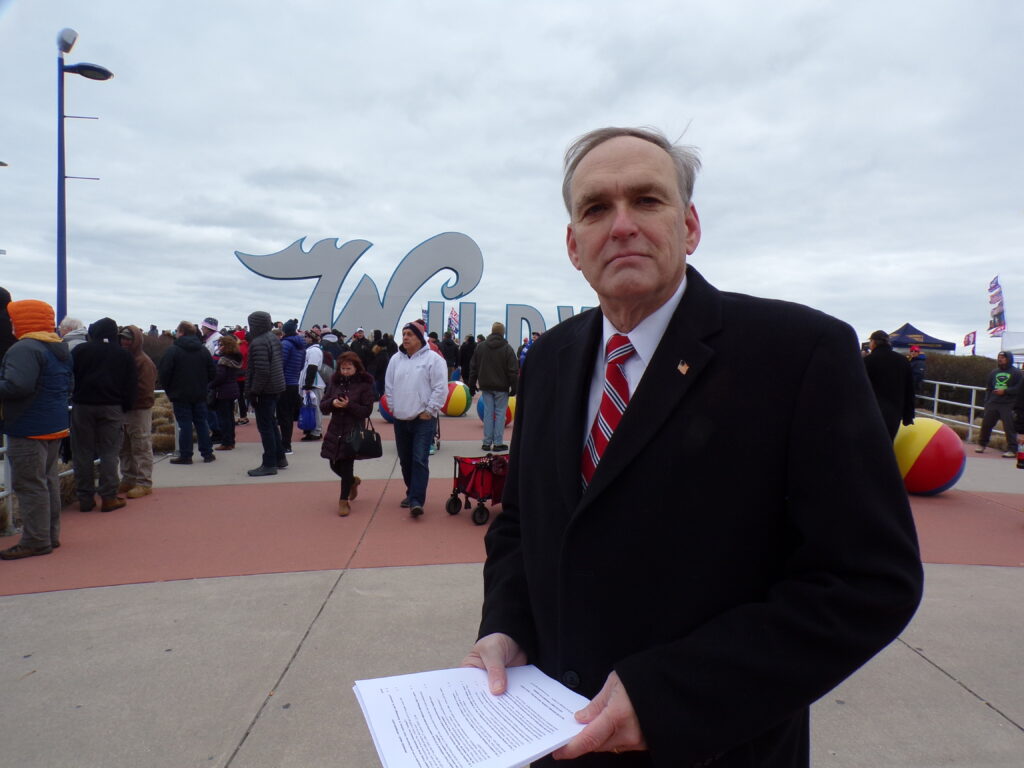

DEMOCRATIC CONGRESSIONAL CANDIDATE ROBERT TURKAVAGE OFFERS PROPOSAL TO RAISE THE STATE AND LOCAL INCOME TAX (SALT) DEDUCTION CAP FROM $10,000 TO $40,000, AND MAKE OTHER MODIFICATIONS TO THE 2017 TAX CUT LAW.

DEMOCRATIC CONGRESSIONAL CANDIDATE ROBERT TURKAVAGE OFFERS PROPOSAL TO RAISE THE STATE AND LOCAL INCOME TAX (SALT) DEDUCTION CAP FROM $10,000 TO $40,000, AND MAKE OTHER MODIFICATIONS TO THE 2017 TAX CUT LAW.

Today, I, Robert Turkavage offer a proposal to raise the Tax Cuts and Jobs Act of 2017 (TCJA) $10,000 SALT Deduction cap to $40,000. I propose to pay for this increase through certain income tax rate changes, and by eliminating certain corporate tax loopholes.

BACKGROUND

On 12/22/2017, the TCJA was signed into law by President Trump. TCJA, among other things, reduced individual and corporate income tax rates, and limited the state and local income tax deduction for taxpayers to $10,000. This $10,000 “cap” meant that any state and local income, property, and sales taxes paid in excess of $10,000 were not deductible for federal income tax purposes. TCJA was lauded as the “signature legislative achievement” of the Trump Administration.

TCJA did not deliver what was promised

Unfortunately, the TCJA did not live up to the promises of the Trump Administration. First, on 12/16/2017, President Trump proclaimed, “The economy is now at 3% (Gross Domestic Product (GDP) growth) …I think it could go to 4, 5 maybe even 6% annually”. On 12/20/2019, however, the Bureau of Economic Analysis (BEA) reported that GDP growth for the third quarter of 2019 was estimated at 2.1%. BEA earlier reported GDP growth for the first and second quarters of 2019 at 3.1% and 2.0 %, respectively. Second, Treasury Secretary Steve Mnuchin stated in 2017, “Not only will this tax plan pay for itself, but it will pay down debt”. In large part due to the TCJA, the national debt has increased over $3.4 trillion since President Trump assumed office.

TCJA proved harmful to certain taxpayers; disproportionately benefited wealthier taxpayers, and in some cases, conferred multiple benefits on corporations.

Millions of Americans who purchased homes prior to the passage of the TCJA have been financially harmed by the law. Operating under the assumption that their state and local income and property taxes would be fully deductible for federal income tax purposes, these individuals made decisions as to where to live, the home purchase price they were willing to pay, and the amount of a home down payment they could afford. With few public hearings on the effect the SALT cap would have on individual taxpayers, TCJA became law, effectively “boxing in” these Americans to severe reductions in their disposable income due to the SALT deduction cap.

TCJA also conferred a greater financial benefit, both in dollar and percentage terms, to wealthier taxpayers. The Tax Policy Center examined the tax benefits in 2018 accruing to five different income groups. Taxpayers in the middle-income group, those with an average income of $65,640, saw a 1.6% benefit as a result of TCJA. Taxpayers in the top income group, those with an average income of $347,940, saw a 2.9% benefit as a result of TCJA.

It is widely known that corporation tax rates were reduced from 35% to 21% under TCJA. What is not widely known is that many multinational corporations received additional benefits or “carve outs”, as a result of lobbying efforts on their behalf with the government. Here are two examples: TCJA ultimately included two taxes that corporations had to pay. The first was a 10% tax (termed the “BEAT” tax) aimed mostly at foreign corporations with major operations in the US. The second was a tax up to 10.6% (termed the GILTI tax) targeting offshore earnings of corporations. After TCJA was passed, the Department of Treasury began writing the federal regulations implementing the hastily approved law. Many multinational corporations soon realized that they would have to pay the BEAT and GILTI taxes. Lobbyists for these corporations then began extensive lobbying efforts with the Treasury officials writing the regulations, in order to have the regulations written in such a way so as to exempt the corporations from the BEAT and GILTI taxes. These lobbying efforts were largely successful, and the government will now realize a small fraction of the $262 billion in BEAT and GILTI tax revenue it had originally anticipated receiving over the ensuing ten years.

INCREASING AND PAYING FOR THE SALT DEDUCTION CAP

To remedy the adverse financial consequences to the millions of homeowners impacted by the SALT Deduction cap, I would support an expansion of the cap from $10,000 to $40,000. Such an expansion would mitigate, if not eliminate, the negative financial consequences to many middle-income taxpayers which resulted from the $10,000 cap. At the same time, the effect on deficits would be restrained as the benefit to more affluent taxpayers would not exceed $40,000.

To further reduce the effect expansion of the cap would have on deficits, I would support certain modifications to the tax code. I would, for example, support applying the tax rates which were in effect prior to the passage of the TCJA, for those “Single” filing status taxpayers whose taxable income was greater than $175,000. Similarly, I would support applying the pre-TCJA tax rates to those “Married Filing Joint” taxpayers whose taxable income was greater than $350,000.

Finally, I would support a review by the Government Accountability Office of the regulations promulgated by the United States Department of the Treasury implementing the TCJA. This review should be conducted to determine if the regulations ultimately approved by the Secretary of the Treasury as they pertained to items such as the BEAT and GILTI taxes, were consistent with the intent of Congress at the time the law was passed by them. Regulations not found to be in conformity, which could be considered “loopholes”, should be referred back to Congress for possible reversal. Loopholes ultimately reversed will provide additional tax revenue to the government that could serve to further mitigate the cost of the SALT expansion cap.