Gottheimer Helps Unveil New Bipartisan Legislation to Fully Restore the SALT Deduction, Provide New Jersey Families a Tax Cut

Gottheimer Helps Unveil New Bipartisan Legislation to Fully Restore the SALT Deduction, Provide New Jersey Families a Tax Cut

Bill to repeal the SALT cap supported by the U.S. Conference of Mayors, and police, firefighter, & teacher organizations throughout the nation

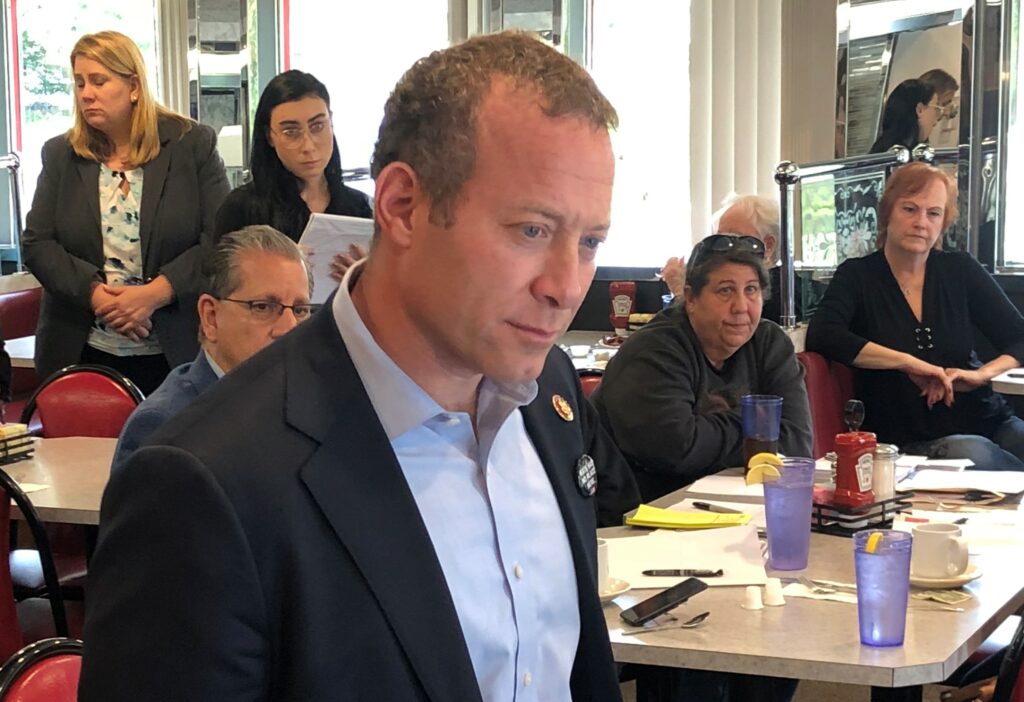

WASHINGTON, D.C. — Today, U.S. Congressman Josh Gottheimer (NJ-5) joined a bipartisan group of six other Members in the House to introduce the SALT Deductibility Act, a bipartisan bill to fully restore the full State and Local Tax (SALT) deduction. The proposal would allow taxpayers to fully deduct their state and local taxes on their federal income returns, end double taxation, and give families in Northern New Jersey a tax cut. In 2017, the deduction was gutted and capped at $10,000 by the Moocher States and resulted in a tax hike for many middle-class families.

Capping the SALT deduction resulted in double taxation by imposing a tax on taxes already paid. In high cost of living areas, the cap has continued to accelerate a race to the bottom that drives families to other states, often subsidized by the very states their new residents have left. This leaves middle-and lower-income taxpayers holding the bag to pay for school, police, fire, and other essential state and local services.

The repeal of the $10,000 cap on the SALT deduction has bipartisan support in the House of Representatives. The legislation is led by Congressman Tom Suozzi (D-NY) and original co-sponsors of the legislation include Congressman Brad Schneider (D-IL), Congresswoman Young Kim (R-CA), Congressman Josh Gottheimer (D-NJ), Congressman Chris Smith (R-NJ), Congressman Andrew Garbarino (R-NY), and Congressman Mondaire Jones (D-NY).

“Ever since New Jersey got absolutely whacked by the 2017 Tax Hike Bill, I’ve been fighting to fully reinstate our SALT deduction and to finally cut taxes for North Jersey families,” said Congressman Josh Gottheimer. “With this new bipartisan legislation, both sides of the aisle are coming together to help reinstate a tax break for our hardworking, middle-class families, helping more Jersey residents through this pandemic. It’s time to finally get this done.”

“The cap on SALT deductions has been a body blow to New York families,” said Congressman Tom Suozzi. “The full SALT deduction must be restored. Without the full SALT deduction, families will leave New York and the last thing we need in the midst of the health and economic devastation of COVID-19 is to lose our residents and taxpayers. Congress must act immediately.”

“The cap on the SALT deductions has hurt Illinois families and local communities. Forcing Americans to pay federal tax on taxes they already paid to state and local governments is double taxation and it’s wrong. In my Illinois district, approximately 42 percent of filers use the SALT deduction, and the average deduction is significantly higher – nearly double – the new cap. The SALT cap is not fair to America’s middle class, and I’m proud to be leading the way with Rep. Suozzi,” said Congressman Brad Schneider.

“The cap on SALT deductions has burdened our California workers, families, and businesses as our state continues to have some of the highest taxes in the nation. This bill simply repeals this SALT deductions cap, so Californians can keep more of their hard-earned dollars and make life more affordable,” said Congresswoman Young Kim. “I came to Congress to create commonsense policies and get things done in a bipartisan way. I’m proud to keep my promise to my constituents by introducing the bipartisan SALT Deductibility Act today, and I’ll continue to do all I can to improve the lives of my community in the 39th District of California.”

“The arbitrary, unfair SALT caps place an unacceptable added burden on New Jersey taxpayers,” said Congressman Chris Smith. “Compared to what we get back, New Jersey already pays more than our fair share to the federal government. New Jersey residents—who have suffered so much, who have paid so much in taxes—both need and deserve this relief.”

“Donald Trump cut taxes for billionaires and corporations and paid for it on the backs of hardworking families in Westchester and Rockland Counties, where we pay the highest property taxes in the nation,” said Congressman Mondaire Jones. “That ends today. Restoring the SALT deduction is a necessary first step to creating an equitable tax system – one where we put money back in the pockets of working people.”

“The SALT cap unfairly penalizes Long Islanders and has left a devastating effect on New York. Not being able to deduct state and local income taxes is a case of double taxation, which is the last thing my constituents need during a global pandemic,” said Congressman Andrew Garbarino. “I’m pushing for a full restoration of the SALT deduction – Long Islanders deserve to be treated fairly and similarly to the rest of the country.”

“In the middle of a pandemic and an economic crisis that demands genuine relief and reform, I encourage Congress to address the Trump administration’s arcane cap on state and local tax deductions that harms those living in high cost of living areas,” said Illinois Governor JB Pritzker. “The Trump SALT Cap overturned a century-old relationship between federal and state and local taxes, and restoring that balance – thereby protecting taxpayers from having to pay taxes on their taxes – is a critical aspect of the economic relief and revitalization package this nation so desperately needs.”

In addition to bipartisan support in the House of Representatives, a repeal of the SALT deduction is supported by state leaders and several national leaders including:

- US Conference of Mayors

- National Association of Counties

- National League of Cities

- International Association of Firefighters

- National Association of Realtors

- American Federation of Teachers

- National Education Association

- National Association of Police Organizations

“On behalf of the nation’s mayors, I want to express our strong support for the Securing Access to Lower Taxes by Ensuring Deductibility Act (SALT Deductibility Act). This bipartisan proposal would repeal the $10,000 cap on federal income tax deductions for state and local taxes. Before the enactment of the cap in the 2017 Tax Cuts and Jobs Act, all state and local taxes were deductible, which recognized the autonomy of state and local tax systems and helped taxpayers avoid double taxation. Since its enactment, the cap has been harmful to moderate-income taxpayers in many states. And, during a time when the COVID-19 pandemic has imposed enormous hardship on state and local budgets, it is further undermining the ability of state and local governments to raise the revenue they need to support critical public services,” said Tom Cochran, CEO and Executive Director of the United States Conference of Mayors.

“Counties are on the front lines of the COVID-19 pandemic, supporting nearly 1,000 hospitals, more than 1,900 public health authorities and other services essential to residents’ safety and well-being. The human and financial impacts of addressing this health and economic emergency are staggering,” said National Association of Counties Executive Director Matthew Chase. “Repealing the state and local tax deduction cap would strengthen the ability of our counties and local communities to deliver essential public services, such as emergency response, public health, and infrastructure. We applaud Representatives Suozzi, Garbarino, M. Jones, C. Smith, Gottheimer, Y. Kim and urge bipartisan passage of this important legislation.”

“Cities, towns and villages are encouraged by the introduction of the Securing Access to Lower Taxes by ensuring Deductibility Act, which bolsters a crucial local finance tool: State and Local Tax Deduction (SALT),” said Clarence Anthony, CEO and Executive Director, the National League of Cities. “The SALT deduction is critical for local governments, preventing additional strain on millions of middle-class families and helping cities raise revenues needed to make investments in infrastructure, public safety, and education. Especially now during the COVID-19 pandemic, the proposed repealing of the SALT deduction cap of $10,000 will help communities continue to support America’s economic recovery efforts.”

“Repealing the cap on state and local tax deductions will allow fire departments to have more budgetary freedom to focus on public safety needs. Current restrictions on SALT deductions have the potential to result in significant service reductions and negatively impact public safety in communities across America,” said Harold Schaitberger, General President, International Association of Fire Fighters. “I thank Representatives Suozzi and Schneider for their leadership on this important issue and look forward to the full repeal of the SALT cap.”

“The 1.4 million members of the National Association of REALTORS®, thank you for introducing the “SALT Deductibility Act,” a bill to eliminate the limitation on the deduction for state and local taxes (SALT),” said Charlie Oppler, president of the National Association of Realtors. “This legislation would significantly increase the tax incentives for purchasing and owning a home for millions of Americans.

“Too many working families are hurting. The COVID-19 pandemic has exacerbated the glaring inequities in our economy – from housing and food insecurity to access to healthcare — and state and local governments are struggling because of a fallout of revenues to maintain the services & support on which many of our communities rely. The Trump-era eviscerations on state and local income tax deductions is another hit on these families that are already struggling, and I applaud Rep. Suozzi for leading efforts to repeal the SALT cap and for introducing the SALT Deductibility Act. Families living in states and localities that invest in public services—including education, health care, and public safety should not be subject to unfair federal tax penalties. It’s long past time to repeal the SALT cap and end the financial pain it causes working families,” said AFT President Randi Weingarten.

NEA On behalf of our 3 million members and the 50 million students they serve, the National Education Association offers its strong support for the SALT Deductibility Act. This legislation repeals the damaging cap on the SALT deduction that was included in the Tax Cuts and Jobs Act of 2017 that threatened states’ and local communities’ ability to fund essential public services, including schools. We applaud the efforts of Reps. Suozzi and Schneider to ensure that all students have the opportunity they deserve for a well-rounded curriculum and support services that will cultivate their success and we urge Congress to approve the SALT Deductibility Act,” said Marc Egan, Director of Government Relations, National Education Association.

“Throughout this country, law enforcement officers go to work every day with one goal in mind: to keep their communities safe. To achieve this mission, they receive support from the communities they serve, as public safety budgets across the country are largely drawn from state and local property, sales, and income taxes – essential investments that give our first responders the tools they need to get the job done. The state and local tax (SALT) deduction has helped support these vital investments at the state and local level. Further, our members are not just first responders; they are also citizens of the communities in which they work. The fact is that the capping of the SALT deduction is a significant tax increase for many homeowners, including law enforcement officers. The cap must be repealed – for homeowners, for our communities, and for the first responders who work every day to keep those communities safe. NAPO thanks Representatives Suozzi, Schneider, Garbarino, Gotthiemer, Mondaire Jones, Christopher Smith, and Young Kim for their leadership and we look forward to working with them to see the cap repealed,” said Bill Johnson, Executive Director, National Association of Police Organizations.

“Counties have worked hard to maintain essential services while also protecting local taxpayers, but that work was undercut by the disastrous federal repeal of the State and Local Tax deduction,” said NYSAC President Jack Marren. “Counties stand in full support of this legislations and applaud Congressman Suozzi and members of the New York Delegation for leading the effort to restore fairness in the tax code and provide needed relief to the hardworking families in New York State who already send far more in taxes to the federal government than we get back.”