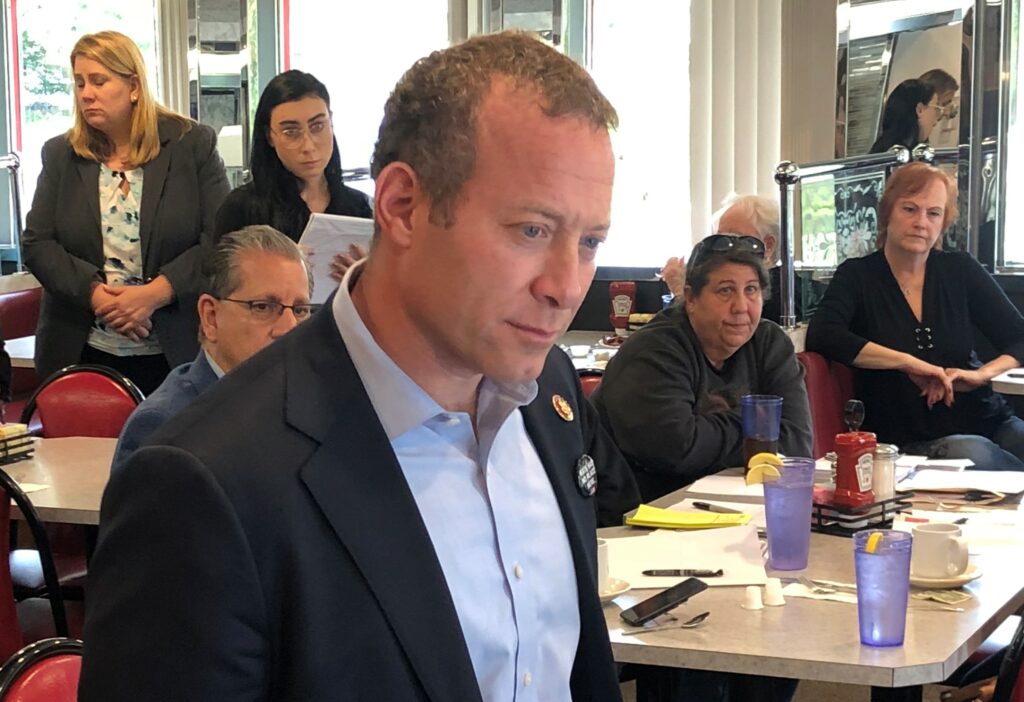

Gottheimer Urges House Leadership to Include Unemployment Tax Relief in New COVID-19 Aid Package — to Help Cut Taxes for North Jersey Families

Gottheimer Urges House Leadership to Include Unemployment Tax Relief in New COVID-19 Aid Package — to Help Cut Taxes for North Jersey Families

Urging inclusion of measure that would remove taxes on first $10,200 of unemployment payments in 2020 tax filing

Nearly 40% of Americans say they don’t know these benefits are taxed

WASHINGTON, DC — U.S. Josh Gottheimer urged House leaders to include tax relief legislation within the new COVID-19 relief package to provide tax relief for up to $10,200 in unemployment payments on a 2020 tax filing.

The letter, which was signed by 12 sponsors of the bicameral Coronavirus Unemployment Benefits Tax Relief Act, points out a recent survey which showed that almost 40% of Americans were not aware that unemployment benefits would be taxed — potentially leaving millions with a surprise tax bill this year.

New Jersey does not levy state-level taxes on unemployment benefits. This federal measure would align the federal tax code to cut taxes for thousands of North Jersey residents who are temporarily unemployed on the first $10,200 of unemployment benefits — helping residents pay their bills and protect their families during this pandemic.

“Without tax relief for these benefits…millions of workers who claimed UI last year may face an unexpected tax bill this spring,” the Members wrote. “Workers and families are still struggling with the economic pain caused by COVID-19, and we are pleased the American Rescue Plan extends unemployment benefits for workers and financial support for small businesses. However, impending tax bills on UI benefits take away vital dollars that individuals need to pay for essential expenses like housing, health care, and food.”

The letter also highlights Treasury Department data showing that federal unemployment benefits added by the CARES Act last year frequently went untaxed, despite these benefits being subject to federal income tax. Those receiving these benefits without having tax withheld will often see a major tax bill this Spring.

“Despite the Treasury Department reporting paying out $580 billion in UI benefits last year, only $22 billion was transferred to the IRS by December from state unemployment systems for withholding purposes,” the Members wrote. “Reporting from outlets nationwide has chronicled stories of workers who claimed UI benefits last year now facing surprise tax bills of over $1,000.”

The Coronavirus Unemployment Benefits Tax Relief Act was also introduced in the Senate by Senator Dick Durbin of Illinois. The tax relief provided in the bill would extend to both workers who received benefits through federal unemployment programs like Pandemic Unemployment Assistance (PUA) and Pandemic Emergency Unemployment Compensation (PEUC) as well as those who received traditional benefits through their state unemployment insurance fund.

The letter was sent to House Budget Committee Chairman John Yarmuth, House Rules Committee Chairman Jim McGovern, House Majority Leader Steny Hoyer, and Speaker of the House Nancy Pelosi.

The letter was signed by the following 12 Members: Reps. Cindy Axne, Peter DeFazio, Josh Gottheimer, Eleanor Holmes Norton, Andy Levin, Susie Lee, Chris Pappas, Jamie Raskin, Donald Payne, Jr., Scott Peters, Mark Takano, and Susan Wild.

The full text of the letter can be found below:

Dear Speaker Pelosi, Majority Leader Hoyer, Chairman Yarmuth, and Chairman McGovern,

As the House of Representatives prepares to provide additional relief to Americans struggling due to coronavirus (COVID-19), we urge you to include tax relief for Americans who lost their jobs and utilized unemployment benefits last year in the manager’s amendment to the American Rescue Plan Act of 2021.

Currently, the Department of Labor estimates that over 18 million Americans are claiming some form of unemployment benefits, and tens of millions claimed these benefits at some point over the past year. We are glad that Congress has recognized the importance of expanding unemployment insurance (UI) benefits to provide stability for workers impacted by COVID-19, including new programs like Pandemic Unemployment Assistance (PUA) and Pandemic Emergency Unemployment Compensation (PEUC) well as an additional $600 weekly benefit included in the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Without tax relief for these benefits, however, millions of workers who claimed UI last year may face an unexpected tax bill this spring.

In a survey conducted last fall by Jackson Hewitt, 39% of respondents were unaware UI benefits are taxable, with single and younger taxpayers being less aware of this issue. Those same people are more likely to have lost income during 2020 and less likely to have savings to absorb the hit. Reporting from outlets nationwide has chronicled stories of workers who claimed UI benefits last year now facing surprise tax bills of over $1,000., Treasury Department data corroborates these stories. Despite the Treasury Department reporting paying out $580 billion in UI benefits last year, only $22 billion was transferred to the IRS by December from state unemployment systems for withholding purposes – far less than the $58 billion that would have been transferred had all benefits been voluntarily withheld at the federal flat rate of 10%.

Workers and families are still struggling with the economic pain caused by COVID-19, and we are pleased the American Rescue Plan extends unemployment benefits for workers and financial support for small businesses. However, impending tax bills on UI benefits take away vital dollars that individuals need to pay for essential expenses like housing, health care, and food.

That is why we encourage you to include legislation we’ve supported, the Coronavirus Unemployment Benefits Tax Relief Act, to waive federal income taxes on the first $10,200 of unemployment benefits received in 2020. The tax relief would extend to both workers who received benefits through federal unemployment programs like PUA and PEUC as well as those who received traditional benefits through their state unemployment insurance fund. The bill currently has 30 House cosponsors, and the case has been explained thoroughly by the Century Foundation and many others.

As we work to deliver on much-needed support for families, workers, and businesses, we should not be extending benefits with one hand and taxing them with the other. We once again urge you to include this tax relief for Americans as part of the American Rescue Plan Act of 2021, and we look forward to working with you on this issue.

Sincerely,

MEMBERS OF CONGRESS

###