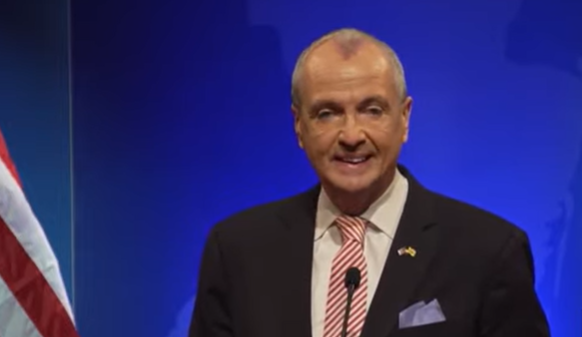

Governor Murphy Presents Fiscal Year 2023 Budget

Governor Murphy Presents Fiscal Year 2023 Budget – “The Opportunity State: Stronger, Fairer, More Affordable”

Budget Provides Robust Property Tax Relief, Record Level of School Funding, and One-Year Moratorium on Certain Fees

Increased Investments in Affordable Housing, Higher Education, and Economic Growth

Continues Path of Fiscal Responsibility with Another Full Pension Payment of $6.82 Billion, Additional $1.3 Billion to Reduce Debt

Record Surplus of $4.2 Billion – Nearly Twice the Size of Last Year’s Proposed Surplus

TRENTON – Governor Phil Murphy delivered his fifth annual budget address on Tuesday, outlining a spending proposal for Fiscal Year 2023 (FY2023) that builds on the historic progress made over the last four years with new investments that will make New Jersey stronger, fairer, and more affordable by delivering substantially more property tax relief to many more families, providing the highest level of school funding in history, making a second consecutive full pension payment for the first time in more than a quarter century, and supporting significant investments in the economy.

“The budget I propose today continues the work of the past four years – restoring fiscal responsibility, promoting economic growth, and making New Jersey stronger, fairer, and more affordable for our families and seniors,” said Governor Murphy. “I am proud that, across our first four years working together, we cut taxes for our middle-class and working families and seniors 14 times.”

“With a focus on fostering an innovation-driven economy that grows new industries, restores our environment, and drives investment into our communities, this budget will support the careers of tomorrow,” continued Governor Murphy. “Last week’s credit upgrade is clear proof that social responsibility and fiscal responsibility are not mutually exclusive. It is clear proof that when you invest in people, invest in growing the middle class and growing the economy, and invest in our future, it all pays off. This is what happens when you use the budget not just to muddle through today, but to build a State of Opportunity for tomorrow.”

“The Governor’s proposed budget makes good use of increased revenues by striking a strong balance between investing in the economy, delivering substantial tax relief, and supporting fiscal responsibility by paying down debt and shoring up our reserves,” said State Treasurer Elizabeth Maher Muoio. “Our record pension contributions, which are reducing our unfunded liability, have been made possible by the Governor’s resolve. While others have made a commitment to fully fund it, he is the first to keep it and maintain it.”

The Governor’s first proposed budget of his second term builds on the significant progress made over the last four years, which just last week led to New Jersey’s first credit rating upgrade in nearly 20 years, helping to reduce future costs to the State.

Fiscal Responsibility

The $48.9 billion spending plan includes a record proposed surplus of $4.2 billion, nearly twice the size of the surplus proposed in last year’s budget, while redirecting more than 70 percent of the total budget back out in the form of grants-in-aid for property tax relief, social services, and higher education, as well as State aid to schools, community colleges, municipalities, and counties.

The Governor continues to deliver on his promise to public employees by proposing a $6.82 billion pension payment, including contributions from the State lottery, which marks the second consecutive year that the State will meet 100 percent of the Actuarially Determined Contribution (ADC). With the proposed FY2023 payment, the Murphy Administration will be responsible for nearly 68 percent of State pension contributions since FY1995.

Continuing his commitment to fiscal responsibility, the Governor is also proposing to make an additional $1.3 billion deposit in the Debt Defeasance and Prevention Fund for FY2022, in addition to the $3.7 billion that was appropriated last June, bringing the total set aside for reducing the State’s debt load to $5 billion. To date, the State has retired more than $3 billion in debt principal and interest, saving taxpayers over $600 million, and reducing the State’s overall debt load since the Governor took office. The State also expects to save roughly $2.2 billion by using debt prevention funds to support capital construction on a pay-as-you-go basis, rather than borrowing at current interest rates to fund capital construction.

The Governor’s ambitious budget proposal centers on making New Jersey more affordable, creating economic opportunity, protecting health and safety, and planning for New Jersey’s future.

Making New Jersey More Affordable

With a focus on affordability, the proposed FY2023 budget expands upon the 14 tax cuts the Murphy Administration has delivered for working families by dramatically increasing direct property tax relief, continuing the Governor’s historic funding of pre-K and K-12 education, and bringing down the costs of higher education and housing.

As unveiled last week, the Governor is proposing to replace the Homestead Benefit program with the creation of a new nearly $900 million program known as ANCHOR – the Affordable New Jersey Communities for Homeowners and Renters (ANCHOR) Property Tax Relief Program. ANCHOR will benefit more than 1.15 million homeowners – double the amount under the Homestead Benefit – and more than 600,000 renters, all of whom are currently excluded from the Homestead Benefit.

Under the Governor’s proposal, the benefit amount would increase over next three years and is based on income level – targeting relief to those who need it most. Homeowners earning up to $250,000 a year will receive an average benefit of nearly $700 in FY2023, growing to $1,150 by FY2025. Renters earning up to $100,000 will receive a yearly benefit up to $250.

Furthering his commitment to affordability, the Governor’s proposed budget contains no new taxes or fees and proposes a year of “fee holidays” for drivers renewing their licenses, certain health care professionals applying for or renewing their licenses, couples getting married, and residents visiting State Parks.

The budget proposal maintains the Governor’s commitment to fully funding our school funding formula with an additional $650 million in K-12 formula aid. Since 2018, the State has increased K-12 formula aid by almost $1.8 billion, far outpacing investments by any other administration. The budget also advances the Governor’s goal of universal pre-K with an additional $68 million for Preschool Education Aid, $40 million of which will go towards new districts, creating almost 3,000 more seats for three- and four-year-olds. Since 2018, the Murphy Administration has already increased pre-K spending by over $240 million and created nearly 9,000 new seats.

The proposed budget also continues building on the Governor’s commitment to improve higher education access and affordability. Due to a $94 million increase in direct aid to higher education institutions through the Outcomes-Based Allocation since FY2021, tens of thousands of eligible students will receive free tuition this fall at public four-year colleges through the Garden State Guarantee. The Governor is also proposing increased support for the Educational Opportunity Fund, a higher income threshold for Community College Opportunity Grants to match the Garden State Guarantee’s limits, and the creation of the Some College, No Degree program to encourage college completion.

The Governor also plans to propose the use of over $300 million in American Rescue Plan (ARP) funds to create the Affordable Housing Production Fund, which will help complete all viable 100 percent affordable housing projects identified in Mount Laurel settlements and create an estimated 3,300 new units. The Governor is also proposing a $5 million increase for the successful Down Payment Assistance Program to help more first-time homebuyers purchase houses in New Jersey. These programs build on the over $1 billion in short-term relief that the Administration will start distributing this year through the Eviction Prevention Program and Homeowner Assistance Fund.

Creating Economic Opportunity

The proposed budget also includes comprehensive investments to continue spurring economic growth and support New Jersey’s ongoing recovery from the pandemic by creating new opportunities for job seekers, small businesses, and entrepreneurs, making critical investments in infrastructure, and providing access to capital for diverse businesses, including:

- Investments in programs that will continue expanding the State’s workforce development pipeline – such as UpSkill, the Pay it Forward Fund, and the New Jersey Apprenticeship Network, which has helped nearly double the number of registered apprenticeship programs statewide since 2019;

- Investments to further the Governor’s climate goals, including initiatives developed by the Green Jobs Council as well as the New Jersey Wind Institute for Innovation and Training;

- Maintaining the Governor’s previous investments in the Main Street Recovery Fund, which includes the Small Business Lease Grant, Small Business Improvement Grant, Main Street Micro-business Loans, and Main Street Lenders Grant;

- $10 million for the Black and Latino Seed Fund to ensure all New Jersey businesses are lifted by economic recovery;

- A $65 million investment in new real estate project initiatives, which include the creation of a Diverse Developer Fund to ensure that new construction reflects more communities; and

- Critical support for the innovation economy:

- Up to $60 million in tax credits this year to support the launch of the $300 million Innovation Evergreen Fund to further entrepreneurship and attract venture capital;

- Continued investments in Strategic Innovation Centers, which are strengthening New Jersey’s advanced manufacturing, life sciences, and logistics industries; and

- Funding for the first recipients of the STEM Loan Redemption program that Governor Murphy created in 2018, which is operated by the NJ Higher Education Student Assistance Authority.

The Governor’s proposed budget also builds on last year’s largest ever transportation capital construction program by supporting critical investments in the State’s transportation infrastructure and NJ TRANSIT with plans to use debt avoidance funds for additional game-changing capital improvement projects, including the restoration of Newark Penn Station.

Under the Governor’s proposal, NJ TRANSIT’s operating budget is its highest ever, increasing by $106 million in FY2023, for a total increase of $450.4 million since the Governor’s first budget, helping to support continued improvements to the commuter experience. NJ TRANSIT’s new agreement with the Turnpike Authority will also provide a dedicated funding stream. Additionally, the Governor just announced last week that there will be no fare hikes on riders for the fifth consecutive year.

Protecting Health and Safety

The Governor’s budget proposal includes a wide-ranging effort to address health issues exacerbated by the pandemic and to expand social service programs while making critical care more affordable. The investments outlined in the budget will strengthen health and safety support for both communities of color and lower income New Jerseyans, all of whom have been disproportionately impacted by the pandemic.

The budget proposal also includes nearly $20 million in State and federal funds to implement the landmark Statewide Universal Newborn Home Nurse Visitation program that the Governor enacted in July. As part of the First Lady’s Nurture NJ initiative, the budget also includes $15 million in State funding to raise Medicaid rates for maternity care providers, as well as funds for midwifery education and Central Intake Hubs to support families with young children.

The Administration will continue to prioritize health care affordability by implementing new efforts to benchmark health care cost growth while working with the Legislature to make prescription drugs more affordable. The budget proposal includes funding for the second year of the Cover All Kids initiative and increases State subsidies for Get Covered NJ, the state’s official health insurance marketplace, which contributed to record enrollment for 2022.

In FY2023, the Administration will continue implementing the Child Care Revitalization Fund and develop new initiatives to encourage small businesses to provide child care benefits to employees.

The Governor also plans to work with the Legislature to utilize American Rescue Plan funds to develop student mental health and success initiatives that will help students of all ages who have been impacted by the pandemic. The budget also maintains funding for the Governor’s suite of substance use disorder programs, which will be supplemented by more than $640 million over the next 18 years through settlement funds from opioid manufacturers and wholesalers.

The budget proposal maintains the Governor’s historic commitment to Community-Based Violence Intervention grants as part of a multi-faceted approach to combat gun violence.

Additionally, the Governor is proposing a one-time fund for ITIN holders who did not receive federal stimulus aid, building upon the Governor’s previous work to support communities in need of assistance.

Planning for the Future

In addition to fiscal responsibility, the Governor will also work with the Legislature to make transformative, one-time investments with federal funds and responsibly allocate new revenues from adult-use marijuana to benefit the communities that have been most impacted by the War on Drugs.

The budget proposal includes $430 million for the Schools Development Authority (SDA) and the Department of Education to award funding to districts for capital maintenance and emergent needs, as well as to support the SDA’s current school construction projects, which will reduce borrowing and ensure all students can learn in safe facilities.

The Governor is also proposing new funding to continue improving Motor Vehicle Commission services and overhauling the State’s Unemployment Insurance system.

The Governor is committed to ensuring that New Jersey remains a leader in combating climate change, preparing for its impact, and mitigating environmental harms. To that end, the Governor is proposing a nearly $30 million investment to meet the Electric Vehicle Act’s mandate of a 100 percent electric State fleet by 2035.

The budget proposal also supports the implementation of the country’s first-in-the-nation climate change education standards through a new grant program. The Administration will also work with the Legislature to develop plans to use federal funds to eliminate lead hazards in thousands of housing units and make investments in clean water and flood resistance. These investments will keep residents safe, reduce utility rate increases, and protect environmental justice communities.

As New Jersey begins sales of adult-use recreational marijuana, the Administration is preparing to distribute revenues to Impact Zones, or communities disproportionately affected by previous drug policies. The Governor hopes to see tens of millions of dollars invested in new opportunities for aspiring cannabis entrepreneurs and workers, as well as programs that spur economic development, support re-entry, reduce gun violence, improve public health, and advance environmental justice.

For more information on the Governor’s proposed FY2023 budget and policies, check out the Budget in Brief online.

An additional one-page policy paper on the central commitments underpinning Governor Murphy’s budget proposal can be found online here.