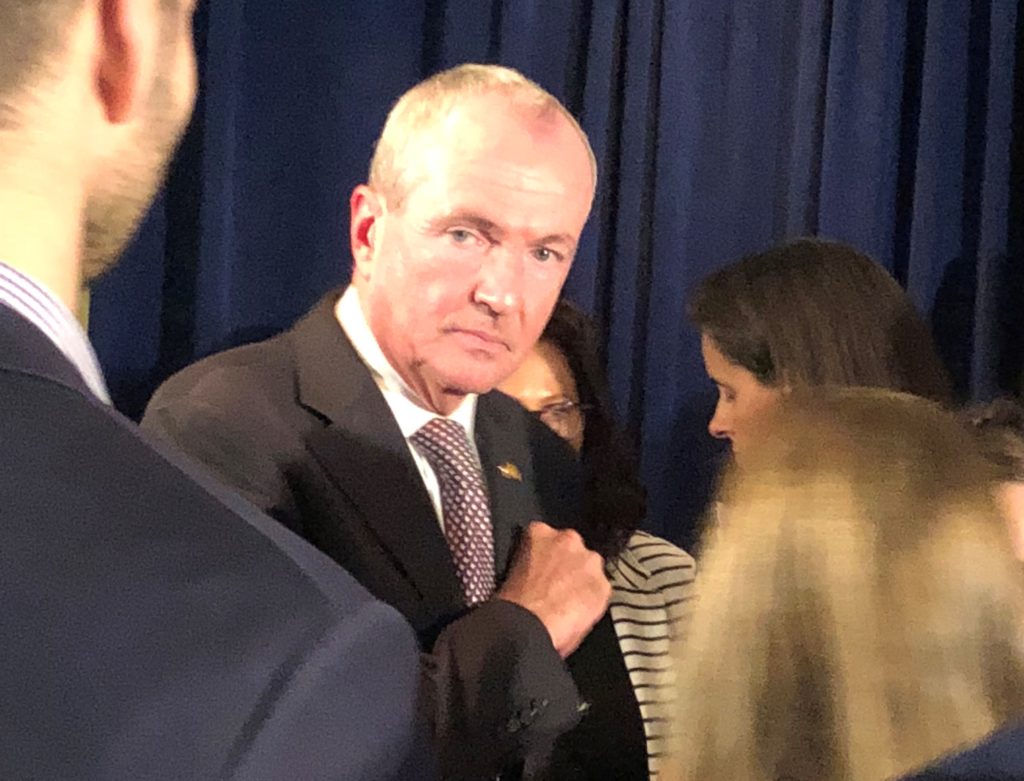

Governor Murphy Signs Fiscal Year 2020 Budget into Law and Acts on Other Legislation

Governor Murphy Signs Fiscal Year 2020 Budget into Law and Acts on Other Legislation

BILLS SIGNED:

A-5601/S-3956 (Pintor Marin, Jones, Johnson/Sarlo) – with Line Item Veto – Makes Fiscal Year 2019 State supplemental appropriations totaling $34,208,000.

Line Item Veto Message on A-5601

S-3042/A-4619 (Sarlo, Oroho/Pintor Marin, Wirths) – Creates subaccounts for SHBP and SEHBP health care services and prescription drug claims; requires procurement by State of third-party medical claims reviewer.

S-3599/A-5185 (Singleton/Wimberly, Jasey, Speight) – Revises neighborhood revitalization tax credit program to increase permitted annual tax credit allocation to $15 million.

A-5604/S-2298 (Freiman, Pinkin, Milam, DePhillips, Zwicker, Land/Corrado, Singleton) – Increases tax credit provided for qualified investments under "New Jersey Angel Investor Tax Credit Act.”

A-5609/S-3960 (Land, Freiman, Armato, Johnson, Mukherji, Milam, Mazzeo/Sarlo, Addiego) – Increases gross income tax deduction available to veterans from $3,000 to $6,000.

A-5385/S-3877 (Burzichelli, Pintor Marin, Reynolds-Jackson/Sarlo, Singleton) – Concerns sale, taxation, and forfeiture of container e-liquid.

A-5603/S-3957 (McKeon, Jones/Pou) – Increases annual assessment on net written premiums of HMOs to support charity care from two percent to three percent in FY 2020.

A-5607/S-3958 (Murphy, Johnson/Sweeney) – Provides limited period for dissolution or reinstatement of revoked or inactive business charters using expedited process, allows for payment of reduced administrative fee, and revises certain business filing fees.

S-2020/A-5600 (Sarlo/Pintor Marin, Burzichelli) – with Line Item Veto – Appropriates $38,748,610,000 in State funds and $16,748,645,972 in federal funds for the State budget for fiscal year 2019-2020.

Line Item Veto Message on S-2020

A-5610/S-3984 (McKnight, Quijano, Mosquera, Mukherji/Weinberg) – Makes FY 2020 supplemental appropriation of $12.453 million; amends appropriations for Camp Irvington and Turtle Back Zoo; adds language provision appropriating $3.1 million for immigration status-related legal assistance.

A-5611/S-3987 (Timberlake, Giblin, McKeon/Codey, Gill) – Makes Fiscal Year 2020 State supplemental appropriation of $7,500,000 for East Orange General Hospital.

BILLS VETOED:

A-5098/S-3491 (Pintor Marin, Chaparro, Jimenez/Ruiz, Codey) – CONDITIONAL – Raises, over time, hourly Medicaid reimbursement rate for personal care services to $25.