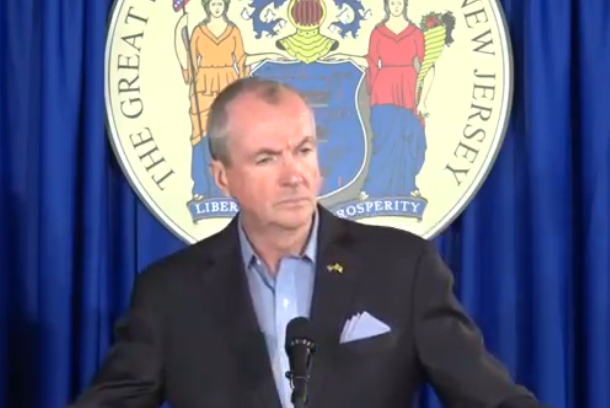

Governor Murphy Underscores the Need for Responsible Budget Practices Lacking in Legislature’s Spending Bill

Governor Murphy Underscores the Need for Responsible Budget Practices Lacking in Legislature’s Spending Bill

“The budget I proposed is a forward-thinking, honest budget that has been embraced by policy experts because it breaks from the bad habits of the past that led to a record 11 credit downgrades,” said Governor Murphy. “The budget the Legislature has sent us is short-sighted, foregoing our rainy day fund deposit and leaning heavily on both questionable and one-time funding sources instead of including reliable, recurring revenue. In the coming days, we will be reviewing all of our options to make sure the budget we enact lives up to our original goal of protecting the middle class through responsible and fair fiscal policies.”

Last month, the Governor announced that New Jersey would be closing out the current fiscal year by making a $317 million deposit into the Surplus Revenue Fund, the first such deposit in more than a decade since the Great Recession forced it to run dry. The budget the Legislature sent the Governor yesterday shifts those reserves into the General Fund where they can be spent more freely.

The Surplus Revenue Fund, more commonly known as the rainy day fund, is distinct from the surplus revenue carried in the state’s General Fund. The fund was created by the Legislature in the early 1990’s to serve as a lock box for fiscal emergencies and deposits into it are dictated by a statutory formula when revenues come in above the certified forecast.

A recent study by The Pew Charitable Trusts noted that New Jersey is one of only three states that currently has nothing in its rainy day fund, stating unequivocally that “the clock is ticking on their chances to use the economic expansion to rebuild reserves.” Just last week, a Duke University survey indicated that nearly half of the nation’s chief financial officers predict the U.S. economy will be in a recession by the middle of next year.

“The drumbeat warning of an economic downturn has been growing progressively louder by the day,” said State Treasurer Elizabeth Maher Muoio. “If a recession hits, and revenues plummet while safety net needs like Medicaid rise, we will need real surplus revenues to weather the storm. Governor Murphy’s proposed budget was built with a keen eye to the future, centered around savings, surplus, and sustainable revenue – three key pillars encouraged by ratings agencies and embraced by good government advocates.”

While the Legislature’s budget embraces many of the Murphy administration’s shared priorities, it rejects the responsible revenue solutions included in the Governor’s proposed budget – such as the millionaire’s tax – while ignoring the statutorily-required rainy day fund deposit, adding $387 million in “Christmas Tree” spending on pet projects, and relying on indefensible revenue projections and unachievable savings assumptions that threaten the state’s fiscal stability.

The Governor’s proposed Fiscal Year 2020 budget included an estimated $536 million that would have been generated by raising the income tax on those earning more than $1 million. All revenue from the Gross Income Tax is constitutionally dedicated to the Property Tax Relief Fund (PTRF), which represents roughly 45 percent of the state budget, and is used to fund critical needs such as school funding, municipal aid, and direct property tax relief programs like the Homestead Benefit and Senior Freeze programs. All other major revenue sources support the General Fund, which is used to pay for the bulk of state operations, including vital services like NJ TRANSIT.

Because the Legislature did not include the Governor’s proposed millionaire’s tax, the budget they passed yesterday relies on $268 million in General Fund revenue to support the increased appropriation for school funding under the new formula they enacted last year. In future years, the flexibility to lean on General Fund revenues will disappear as the increased Corporation Business Tax (CBT) surcharge winds down and sunsets over the next three years, one-time revenue sources disappear, and the state’s pension contribution continues to ramp up.

The Governor also questioned the revenue estimates that the Legislature’s budget is built on, most notably the CBT and cigarette tax, which are far rosier than the estimates of either Treasury or the Office of Legislative Services. The Treasurer noted that relying on overinflated revenue projections would leave New Jersey further in the lurch if another recession hits, given that revenues fell more than 10 percent below certified forecasts during the last two recessions.

In FY2001, New Jersey’s total reserves were at $1.3 billion, which was six percent of total expenditures at the time. The Dot-Com recession that ensued caused a sudden $2 billion revenue shock. In 2008, New Jersey had a much healthier $2.6 billion in reserves when revenues plunged by nearly $5 billion over two years during the Great Recession.

In light of these scenarios, those who joined the Governor today stressed the need to bolster the state’s rainy day fund and manage the state’s finances responsibly.

“We have seen 25 years of governors and legislative leaders of both parties not make the investments required to recover from a recession, or bring talented people to the state, but only to get by year by year,” said Gordon MacInnes, New Jersey Policy Perspective Senior Fellow and former legislator. “Investments in the assets that make New Jersey a terrific place to live and do business have stopped, and we need to be able to make those investments again.”

“It is precisely because the investments made in the Legislature’s budget are so critical that we bemoan the lack of consistent, sustainable revenues,” said Brandon McKoy, President of New Jersey Policy Perspective. “The country is experiencing a period of record growth that is expected to end soon. Making significant investments in our empty rainy day fund is a basic, good budget maneuver to prepare for tough times, and would be a signal to ratings agencies that we are beginning to manage our finances in a more responsible manner.”