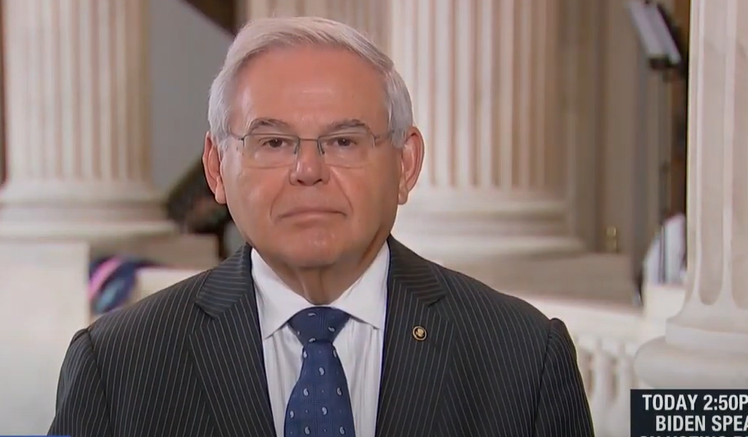

Menendez Leads Push for Greater Transparency on IRS Continued Engagement with ID.me

Menendez Leads Push for Greater Transparency on IRS Continued Engagement with ID.me

WASHINGTON, D.C. – U.S. Senator Bob Menendez (D-N.J.), a senior member of the Senate Finance Committee that oversees the Internal Revenue Service (IRS), today led a group of colleagues in urging the agency to address concerns about any continued involvement between the IRS and ID.me, an online identity network that taxpayers can use to access government services. The senators are particularly concerned by the disproportionate harm such facial recognition technology can have on minority and low-income communities.

“Congress has repeatedly expressed concern with the development of an unconstrained and pervasive surveillance infrastructure, fueled by systems like ID.me,” wrote the senators to IRS Commissioner Charles Rettig. “The Project on Government Oversight (POGO), a leading oversight watchdog, has cautioned that the use of this type of technology often plays an outsized role in law enforcement investigations, despite serious flaws that can lead to wrongful arrests and civil rights violations.”

The senators expressed particular concern about how ID.me will manage the vast amount of government documents provided by American taxpayers since the IRS started using the platform last summer. They also highlighted how this type of technology has been used to selectively target individuals in some of the country’s most vulnerable demographic groups.

“Despite well-documented concerns with this technology—especially for individuals who have poor internet service at home, rely on computers in public libraries, use older phones, or for whom English is not their first language—the IRS required the use of this technology to access and review advanced child tax credit (CTC) payment information,” the senators added. “Nearly 35 million families received the advanced Child Tax Credit last year, including numerous Black, Hispanic, Asian, and Native American families,[1] and many immigrant families using an Individual Taxpayer Identification Number.”

Sen. Menendez has long been sounding the alarm about the IRS’ reliance on ID.me, as well as the agency’s massive processing backlogs. Last month, he led more than 200 colleagues in a bipartisan and bicameral call for the IRS to provide penalty relief for taxpayers. This spurred the agency to address some of the most painful issues facing taxpayers by temporarily halting a slew of penalty notifications. Sen. Menendez also urged IRS Commissioner Rettig last year to keep phone lines open while addressing the unprecedented backlog of unprocessed returns and to take concrete steps that will allow the agency to return back to basics such as answering phones, providing quality online and in-person services, and processing returns in a timely manner.

Joining Menendez in signing the letter were Sens. Cory Booker (D-N.J.), Alex Padilla (D-Calif.), and Catherine Cortez Masto (D-Nev.).

The full letter can be found below and HERE.

Dear Commissioner Rettig,

We appreciate the Internal Revenue Service’s (IRS) announcement earlier last week that the agency will be transitioning away from ID.me’s facial recognition technology.[1] However, we remain concerned about any continued engagement between the IRS and ID.me and the use of facial recognition technology during this transition. Specifically, we are concerned about whether taxpayers will be offered a meaningful choice to protect their biometric data, whether ID.me will properly manage the vast amount of biometric data provided by taxpayers, and whether there has been substantial oversight of this facial recognition technology since the launch of ID.me verification at the IRS last summer. Given the gravity of the threat to civil rights and civil liberties by this technology, especially against persons of color and immigrants, we ask that:

· The IRS and ID.me clarify whether facial recognition will remain an option for verification during the 2022 filing season. If it will remain an option, we request the IRS clarify how it will ensure taxpayers using ID.me—especially last-minute filers—are not forced to rely on facial recognition technology as their only practical option to avoid long wait times for live-video verification.

· The IRS and ID.me provide a list of all federal, state, or local law enforcement agencies that would have been provided access—or may have access in the future—to biometric data provided through the IRS’ ID.me verification system, no later than Friday, February 25, 2022.

· The IRS and ID.me contact taxpayers who have uploaded biometric information to ID.me to inform them of their ability to delete their selfie or photo account immediately after the service is available, and provide them with plain language instructions—in multiple languages—on how to complete the process.

Congress has repeatedly expressed concern with the development of an unconstrained and pervasive surveillance infrastructure, fueled by systems like ID.me.[2] The Project on Government Oversight (POGO), a leading oversight watchdog, has cautioned that the use of this type of technology often plays an outsized role in law enforcement investigations, despite serious flaws that can lead to wrongful arrests and civil rights violations.[3] POGO notes that there have already been three documented cases where individuals were wrongfully arrested—with two instances where individuals were wrongfully imprisoned—based on facial recognition technology.[4] Moreover, a study by the National Institute of Standards and Technology (NIST) in 2019 found that Asian American and Black individuals were up to 100 times more likely to be misidentified than white men.[5]

Facial recognition technology has also been used by DHS, ICE, and CBP to surveil, target, arrest, and detain immigrants.[6] The ACLU points out that in 2017, for example, DHS and ICE used this type of technology to tag, track, locate, and arrest 400 people in an operation to target the family members and caregivers of unaccompanied minor children.[7]

Despite well-documented concerns with this technology—especially for individuals who have poor internet service at home, rely on computers in public libraries, use older phones, or for whom English is not their first language[8]—the IRS required the use of this technology to access and review advanced child tax credit (CTC) payment information.[9] Nearly 35 million families received the advanced Child Tax Credit last year, including numerous Black, Hispanic, Asian, and Native American families,[10] and many immigrant families using an Individual Taxpayer Identification Number (ITIN).[11]

We look forward to receiving a timely response to our requests and will continue to closely monitor the IRS’ use of ID.me technology—or any identification verification technology.

Sincerely,