New Jersey Restaurant Operators Endure Weaker Business Conditions as Economic Pessimism Grows

New Jersey Restaurant Operators Endure Weaker Business Conditions as Economic Pessimism Grows

NJRHA survey finds economy is disrupting service across the industry

FOR IMMEDIATE RELEASE

August 29, 2022

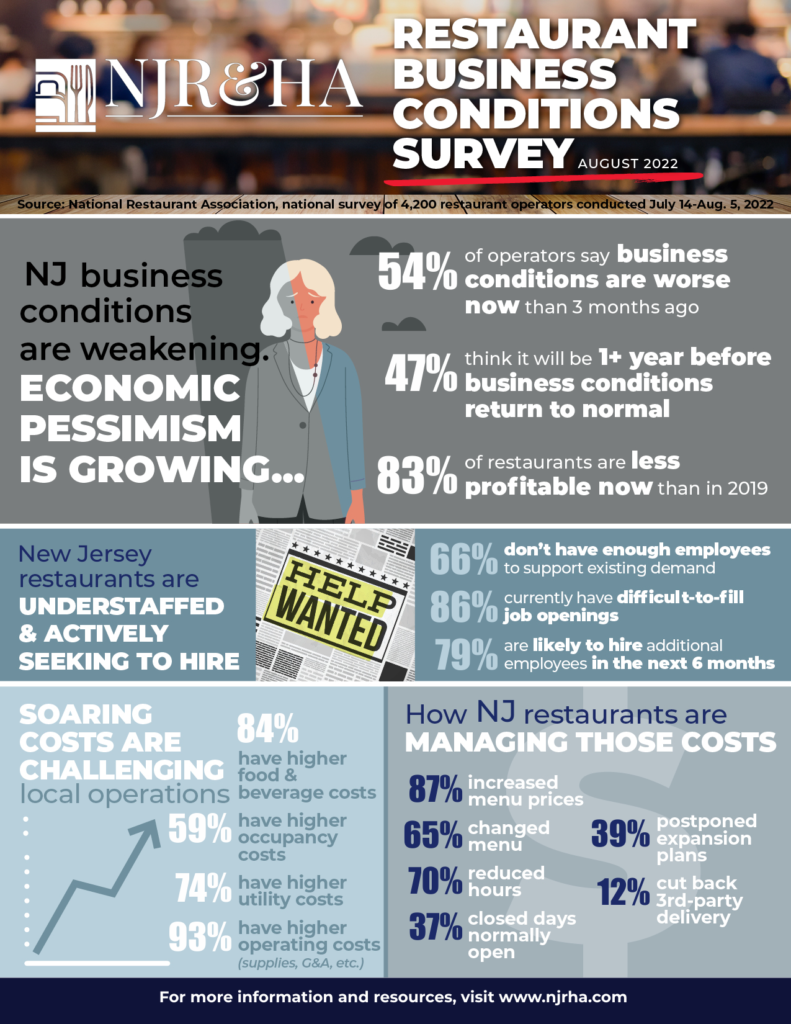

TRENTON – Soaring costs of food and utilities coupled with an ongoing hiring crisis are among the key issues impacting the industry that is still recovering from shutdowns and guest capacity limitations during the Covid-19 pandemic, according to a new survey released today by the New Jersey Restaurant and Hospitality Association (NJRHA).

These challenges, among others, are why 54% of New Jersey restaurant operators say business conditions are worse now than they were three months ago. This finding follows a June National Restaurant Association survey in which 43% of operators across the country said they think conditions will worsen in the next six months, which was the highest level of pessimism since 2008.

NJRHA President Dana Lancellotti said despite the economy’s impact on the industry as a whole, operators are still providing the best service possible to their patrons.

“Restaurant operators are masters at balancing adaptation and innovation to provide amazing service for their customers,” said Lancellotti. “While operators are more pessimistic about the economy, they aren’t letting that get in the way of serving great food, providing exceptional service, and creating a memorable experience.”

Approximately 95% of a restaurant’s sales dollars go to food, labor, and operating costs. While wholesale food prices have increased 16.3% in the last 12 months, menu prices have only risen 7.6%, according to the U.S. Bureau of Labor Statistics. As a result, profits are suffering.

According to the NRJHA survey, 83% of New Jersey restaurant operators say their restaurant is less profitable than it was in 2019.

- In the new survey, 84% of operators said their total food and beverage costs are higher than they were 2019 and many other expenses are up.

-

- 59% of operators say their total occupancy costs are higher than 2019

- 74% of operators say their total utility costs are higher than 2019

- 93% of operators say their other operating costs (supplies, G&A, etc.) are higher than 2019

“Consumers are watching prices rise faster in grocery stores than in restaurants, therefore see an increased value in spending their food budget in restaurants. However, inflation is still impacting the industry and is forcing operators to cut hours, change their menus, postpone expansions, and reduce third-party delivery,” said Lancellotti.

Pandemic debt has come due, and operators can’t pay

During the first two years of the pandemic, 65% of restaurants took on new loan debt to adjust business models and continue operating. According to new national data from the National Restaurant Association, the loans were a mix of forgivable government loans, government disaster loans, and private-sector loans.

- Paycheck Protection Program (PPP) loans were the most common — taken on by 59% of operators.

- 48% of operators took on an Economic Injury Disaster Loan (EIDL) issued by the U.S. Small Business Administration or lending partner.

- 31% took on a private-sector loan from a bank, credit card or other entity.

“For many operators who received EIDL loans, the deferment period for payment will soon end and it will be an overwhelming challenge for a majority of them to begin repayment right now,” said Lancellotti. “The National Restaurant Association data shows that, of the operators who have not begun loan repayment, only 23% say they will be able to make principal and interest payments. Another 46% expect to be able to pay the principal, but not 30 months of accrued interest.”

Restaurants are slowly adding jobs to get back to pre-pandemic employment levels

A strong majority of restaurants are still actively seeking staff — even as they face the struggles of a slowing economy. Despite the industrywide increase of 74,000 jobs in July, 66% of New Jersey operators report not having enough employees to support customer demand, and 79% of operators say they will likely hire additional employees during the next six months, according to the survey.

- 63% of operators say their restaurant is currently more than 10% below necessary staffing levels.

- 86% of operators say their restaurant currently has job openings that are difficult to fill.

“We face the unique issue that hospitality is an in-person job,” Lancellotti said. “Unfortunately, our industry cannot take advantage of the growing work-from-home trend that other industries offer. Hospitality is a face-to-face business.”

However, Lancellotti remains optimistic the industry will recoup its workforce.

“The restaurant industry is built on hospitality, and to ensure we can provide the highest levels of service, we hire talented people,” Lancellotti said. “We know that many people have been reconsidering their careers recently, and we hope that they will look seriously at this industry. Restaurants have good-paying jobs available at every experience level for people from every background. And these jobs provide the skills necessary to be successful in any career, and in life.”

The National Restaurant Association Research Group conducted a survey of 4,200 restaurant operators July 14- Aug. 5, 2022. New Jersey responses were compiled to produce the state findings. Find a report of key New Jersey findings here and national findings here.

###

Restaurant Business Conditions Survey – August 2022

New Jersey

Restaurant operators expect business conditions to remain challenging

- Business conditions deteriorated in recent months, according to many restaurant operators. 54% of New Jersey operators say business conditions for their restaurant are worse now than they were 3 months ago. Only 14% say business conditions improved during the last 3 months.

- Looking forward, most New Jersey restaurant operators do not expect a return to normal business conditions any time soon. 10% of operators think it will be 7-12 months before business conditions return to normal for their restaurant, while 47% think it will be more than a year. An additional 20% of operators say business conditions will never return to normal for their restaurant.

Soaring costs across all parts of the business are creating challenges for restaurant operators

- A majority of New Jersey operators say their costs are higher now than they were before the pandemic:

- 84% of operators say their total food and beverages costs are higher than 2019

- 86% of operators say their total labor costs are higher than 2019

- 59% of operators say their total occupancy costs are higher than 2019

- 74% of operators say their total utility costs are higher than 2019

- 93% of operators say their other operating costs (supplies, G&A, etc.) are higher than 2019

- New Jersey restaurants took a number of actions in recent months as a result of higher costs:

- 87% of restaurants increased menu prices, while 65% changed the food and beverage items that it offered on the menu

- 70% of restaurants reduced hours of operation on days that it is open, while 37% closed on days that it would normally be open

- 39% of operators say they postponed plans for expansion

- 48% of operators say they stopped operating at full capacity

- 36% of restaurants cut staffing levels, while 27% postponed plans for new hiring

- 25% of operators say they incorporated more technology into their restaurant

- 12% of operators say they eliminated third-party delivery

Profitability is down from pre-pandemic levels

- Despite the wide variety of mitigating actions taken to address higher costs, the vast majority of New Jersey restaurants are less profitable now than they were before the pandemic.

- 83% of New Jersey operators say their restaurant is less profitable now than it was in 2019 before the pandemic. Only 4% of operators say their restaurant is more profitable, while 13% say their profitability has remained about the same.

Majority of New Jersey restaurants are understaffed and actively seeking to fill positions

- Although the industry added back many of the jobs lost during the pandemic, a majority of New Jersey restaurants remain understaffed. 66% of operators say their restaurant currently does not have enough employees to support its existing customer demand.

- For most New Jersey restaurants, staffing is significantly below necessary levels. Among restaurants that are currently understaffed, 63% of operators say their restaurant is more than 10% below necessary staffing levels. 11% of operators are currently more than 20% below necessary staffing levels.

- 86% of New Jersey operators say their restaurant currently has job openings that are difficult to fill.

- 79% of New Jersey restaurant operators say they will likely hire additional employees during the next 6 months if there are qualified applicants available.

Source: National Restaurant Association, national survey of 4,200 restaurant operators conducted between July 14 and August 5, 2022

About the National Restaurant Association

Founded in 1919, the National Restaurant Association is the leading business association for the restaurant industry, which comprises nearly 1 million restaurant and foodservice outlets and a workforce of 14.5 million employees. Together with 52 State Associations, we are a network of professional organizations dedicated to serving every restaurant through advocacy, education, and food safety. We sponsor the industry’s largest trade show (National Restaurant Association Show); leading food safety training and certification program (ServSafe); unique career-building high school program (the NRAEF’s ProStart). For more information, visit Restaurant.org and find @WeRRestaurants on Twitter, Facebook and YouTube.