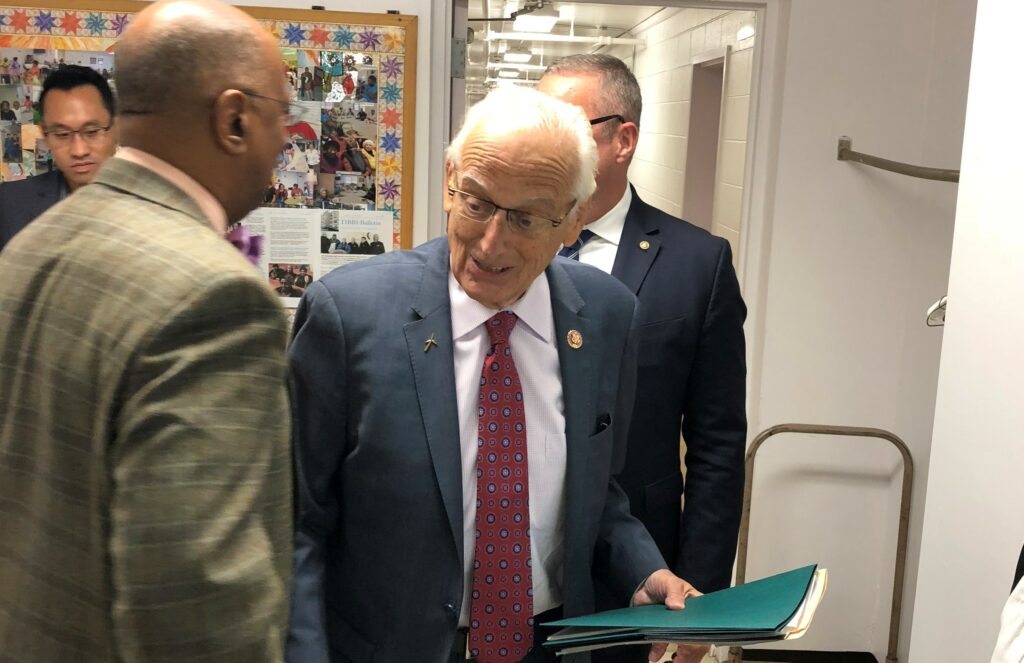

Pascrell Advocates for SALT Cap Repeal to Rules Committee

Pascrell Advocates for SALT Cap Repeal to Rules Committee

WASHINGTON, D.C. – Today, U.S. Rep. Bill Pascrell, Jr. (D-NJ-09), New Jersey’s only member of the tax-writing Ways and Means Committee, submitted a statement for the record during the House Committee on Rules’ hearing on H.R. 5377, the Restoring Tax Fairness for States and Localities Act. An original co-sponsor of the bill, Rep. Pascrell cited its ability to provide much-needed tax relief for the middle-class and restore key funding streams for local services.

Rep. Pascrell’s statement comes days after he helped pass legislation in the Ways and Means Committee to lift the SALT cap. He also held an event earlier today with Governor Phil Murphy advocating for a full restoration of the SALT deduction for New Jersey taxpayers.

Rep. Pascrell’s full statement can be read below.

STATEMENT OF REP. BILL PASCRELL, JR. (D-NJ)

FOR THE RECORD OF THE HEARING ON H.R. 5377

BEFORE THE HOUSE COMMITTEE ON RULES

DECEMBER 16, 2019

—————————————

Thank you for the opportunity to submit this statement for the record of the Rules Committee’s hearing on H.R. 5377, the Restoring Tax Fairness for States and Localities Act, of which I am an original cosponsor. I would have testified before the Committee in person, but the hearing conflicted with services for my constituent, Detective Joseph Seals, who was one of the victims of the tragic terrorist shooting in Jersey City, New Jersey last week.

I am pleased that the Rules Committee has scheduled this hearing on H.R. 5377, legislation that the Ways and Means Committee approved in a bipartisan vote last week. The legislation we are considering is the product of months of hard work by all of us in the SALT Working Group. Last Congress, the middle class was targeted by the House majority. The tax scam law of 2017 remains one of the most destructive bills we’ve ever seen because it specifically went after the middle class. The principal way it did this was by capping the state and local tax deduction and creating a double tax on many taxpayers.

Imagine that hit spread out over millions of households from coast to coast. These are families in New Jersey, Illinois, New York, Minnesota, Kentucky, and Texas – all paying through the nose to fund a tax cut for big business and its executives. And these middle-class families not only lost a deduction they relied on, but all members of their community feel the threats to services like education, infrastructure and public safety funded by SALT they depend on.

H.R. 5377 affords the middle-class three years of SALT cap tax relief: one year of relief from the marriage penalty in 2019 and two years of full repeal in 2020 and 2021. The legislation also provides additional tax relief for certain work-related expenses of first responders and teachers in recognition of the services these public servants provide to our communities. This bill is a carefully considered and balanced package of tax relief that deserves action on the House floor. I urge this Committee to approve the House’s consideration of H.R. 5377.

###