Pascrell Op-ed: Private Equity’s Growing Control of Health Care Endangers the Underserved

Pascrell Op-ed: Private Equity’s Growing Control of Health Care Endangers the Underserved

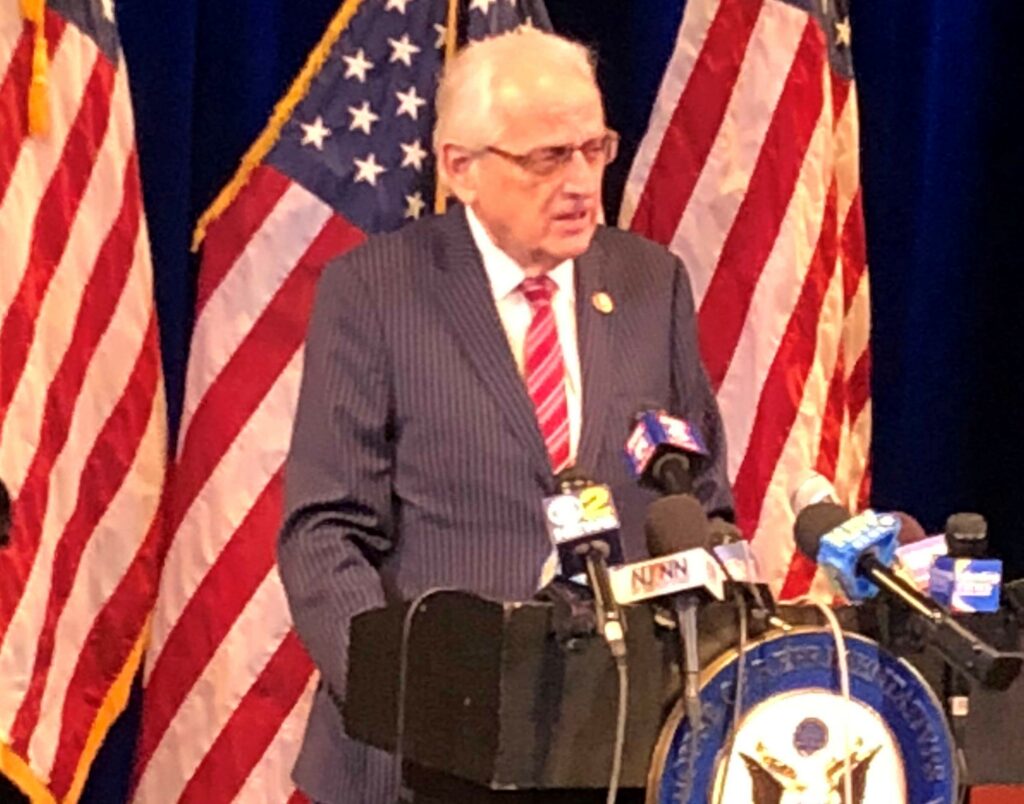

PATERSON, NJ – U.S. Rep. Bill Pascrell, Jr. (D-NJ-09), the Chairman of the House Ways and Means Subcommittee on Oversight, has an op-ed on Wall Street’s growing control of the health care industry, particularly in nursing homes and long-term care facilities. The piece in the Bergen Record of New Jersey builds on Pascrell’s March 25 oversight hearing highlighting how private equity-owned facilities are tied to higher mortality rates.

Private equity’s growing control of long-term care endangers the underserved

By Bill Pascrell Jr.

Last month, the House Oversight Subcommittee I chair held an important hearing on ominous trends in American health care. We examined the growing control of the health care system by Wall Street and private equity firms, particularly in long-term care facilities.

What we found is not pretty.

The pandemic has caused unbearable suffering, with its worst impacts borne by our seniors, who are most vulnerable to COVID-19. Nonetheless, other factors have exacerbated the catastrophic death toll, including regulatory rollback by the Trump regime and increased substandard care in nursing homes controlled by private equity.

While Wall Street’s expansion into health care sectors is not new, it has exploded in recent years. In 2020, private equity investment in the health industry topped $66 billion, a 20 percent increase in one year. Private equity influence stretches like an octopus, with tentacles in large and small hospitals, physician practices, dental practices and scores of nursing homes.

Private equity’s reach into our healthcare system is disturbing precisely because of the industry’s very nature. Private equity firms exist for one overriding purpose: to reap enormous profits for their owners. And the bulk of the funding for our health care, especially senior care, comes from federal programs like Medicare and Medicaid.

Conversely, health care providers are guided first by the Hippocratic Oath and what is best for a patient’s care. This model is in direct conflict with private equity’s quest for profits above all else.

The business model of private equity bears out this divergence. Private equity firms follow a well-worn blueprint: buying companies, saddling them with mountains of debt and then squeezing their acquisitions like oranges for every dollar before tossing the rind into the wastebasket.

In North Jersey, we know well the impact private equity greed can have on our communities.

Just a few years ago, our beloved homegrown company, Toys R Us, was permanently shuttered following years of abuse by private equity executives. After liquidating the storied chain for millions, 33,000 workers were fired. We had to fight to ensure employees received modest severance pay.

Private equity’s destructive impact on the retail industry has been well documented. Watching Wall Street move its way into more hospitals and care facilities gives me enormous trepidation.

It is no accident that private equity firms work to hide their control over hospitals. Through a dizzying web of legal transactions, private equity ownership is often shielded like a Russian nesting doll. This opacity can block proper regulatory oversight by the government – and from patients.

Imagine being a patient seeking answers about negligent care from a faceless monolith controlled by suites in some inaccessible Manhattan office building. This lack of transparency within the health industry is especially dangerous for our most vulnerable populations: communities of color, rural and underserved areas, people with disabilities and seniors.

Because tragically, research has found that nursing homes bought by private equity are linked with higher patient-to-nurse ratios, lower-quality care, declines in patient outcomes, weaker inspection performance and increased mortality rates.

Our hearing discussed a damning recent study. Using Medicare data covering 1,700 nursing homes purchased by private equity between 2000-to-2017, researchers found that patients in a private equity-owned home had a mortality rate 10% higher compared to the overall average.

In total, over 20,000 senior Americans died from lower standards of care at Wall Street-held facilities. The same study also found that private equity owners increased Medicare billing by a whopping 11%. Is this over-billing prioritizing patients, or shareholder profits?

The horror stories from the witnesses at our hearing and elsewhere are heartbreaking and powerful.

Over the last year, more than 179,000 nursing home residents have died from COVID-19, including nearly 8,000 in New Jersey. In our state, residents at private equity-owned nursing homes have experienced a disproportionate number of infections and fatalities.

Private equity played an undeniable part in our tragedy. The relationship is unmistakable. How many grandmothers and grandfathers died because profits were prized above lives? Are our taxpayer dollars funding this?

All Americans deserve answers, and they deserve action too.

Last Congress, our committee considered a bill to increase reporting requirements for private equity firms that own health care facilities — legislation we hope to ratify this session. I have introduced legislation to modernize oversight for facilities that fail to meet federal standards and a bill to codify Obama-era nursing home regulations that were dangerously repealed since 2017.

But this problem demands bold reform. To that end, I am the principal sponsor of legislation to close private equity’s favorite tax loophole, carried interest, which allows these tycoons to pay lower tax rates than their secretaries.

The time has come to shine a bright beam on how private equity ownership in our healthcare system affects patients. Private equity firms have grown too large and too far-reaching. They must face stricter accounting in their growth.