Pascrell SALT Relief Bill Passes

Pascrell SALT Relief Bill Passes

Legislation to revive full state and local tax deduction heads to House floor

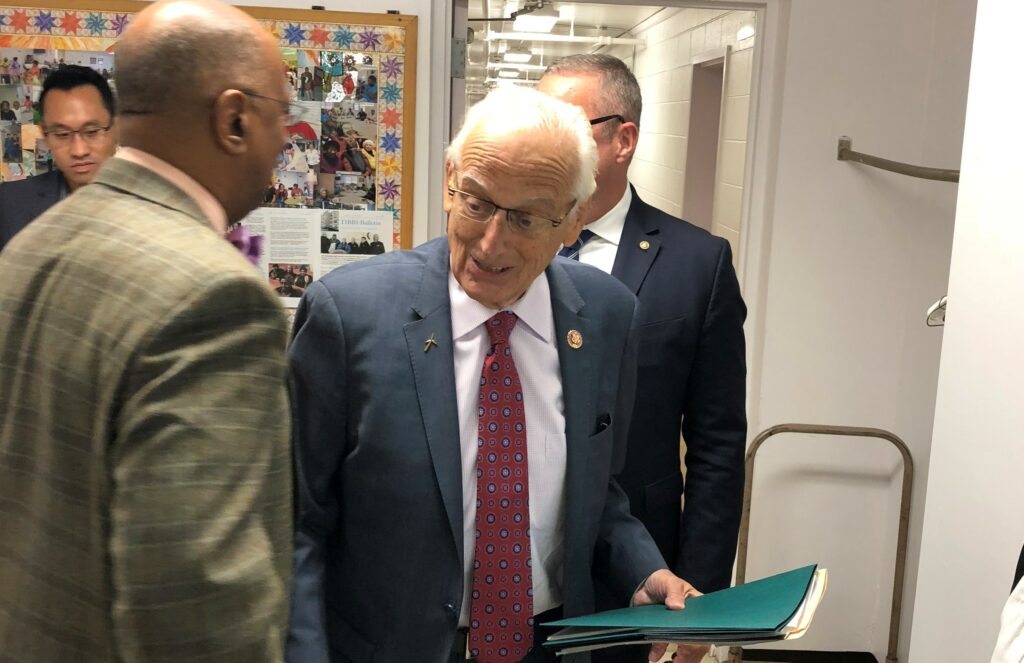

WASHINGTON, DC – Overarching legislation cosponsored by Rep. Bill Pascrell, Jr. (NJ-09) and based on his bipartisan SALT Act to repeal the destructive capping of the federal state and local tax deduction and undo the damage of the 2017 Republican tax scam today was approved in a bipartisan vote by the House Ways and Means Committee. The next step for the measure, H.R. 5377, would be consideration on the House floor.

“Today the Ways and Means Committee voted to provide tax relief to millions of middle-class Americans,” said Rep. Pascrell, a senior member of the Ways and Means Committee. “In 2017, Republicans passed an irresponsible millionaires’ tax cut that my constituents in New Jersey paid for. We have promised to undo the destruction on the middle class rendered by the Republican tax scam law and today we began to fulfill that promise. New Jersey homeowners will get their federal tax deduction back and local communities will no longer be pressed to cut important services like education, public safety, and infrastructure. I urge for swift consideration on the House floor and then the Senate so we can provide real tax relief to the people who deserve it most.”

“I am proud to stand beside Congressmen Pascrell and Suozzi as they continue to fight back against President Trump’s unfair attack on the hardworking residents of New Jersey,” said New Jersey Governor Phil Murphy. “We remain committed to finding solutions for homeowners, and I thank the Congressmen and their allies in the House for continuing this fight. Until Congress passes legislation to reverse the Trump Administration’s assault on the middle class, our Administration will continue to explore all possible avenues to restore full deductibility for our residents.”

The legislation approved today, H.R. 5377, would (1) eliminate the cap’s marriage penalty for 2019, enabling married taxpayers filing jointly to claim up to $20,000; (2) repeal the cap entirely for 2020 and 2021; and (3) pay for the tax relief by restoring the top income tax rate of 39.6 percent that was in effect prior to the 2017 tax scam.

Rep. Pascrell has been a leading a critic in Congress of the Republican tax scam and has repeatedly assailed the capping of the SALT deduction. Pascrell is the lead sponsor of H.R. 1142, the bipartisan Stop the Attack on Local Taxpayers Act of 2019, which would remove the cap on federal SALT deduction and also raise the top personal income tax rate to where it was before the 2017 Republican tax scam. The bill is currently cosponsored by 47 House members. Companion Senate legislation, S. 437, is sponsored by Sen. Robert Menendez (D-NJ) and currently cosponsored by 13 senators. Pascrell first authored legislation addressing importance of the state and local tax deduction in 2012. He recently offered several amendments on SALT fairness, including the amendment to eliminate the cap during Ways and Means Committee consideration of the 2017 tax bill.

###