Treasurer Muoio Testifies Before Assembly Budget Committee on Proposed FY 2023 Budget

Treasurer Muoio Testifies Before Assembly Budget Committee on Proposed FY 2023 Budget

Robust Growth Expected to Continue through Fiscal Year 2022 While Revenues Are Expected to Moderate for Fiscal Year 2023

Key Investments in Gov. Murphy’s Proposed Budget Will Build Upon the Progress that has Led to Two Recent Credit Rating Upgrades

(TRENTON) – State Treasurer Elizabeth Maher Muoio testified before the Assembly Budget Committee at the State House today, providing a detailed update on revenue projections for the remainder of Fiscal Year 2022 through Fiscal Year 2023 as the economy is expected to right-size after two years of surging revenue increases.

Treasurer Muoio also outlined some of the strategic investments Governor Phil Murphy has proposed for Fiscal Year 2023 to bolster New Jersey’s economy, strengthen the State’s fiscal foundation, and make New Jersey more affordable for working and middle-income families – building upon the progress of the last four years, which has led to two credit rating upgrades in the past month.

The following is a copy of her full testimony, as prepared for delivery:

ASSEMBLY BUDGET COMMITTEE HEARING

State Treasurer Elizabeth Maher Muoio

Testimony as Prepared for Delivery

April 4, 2022

Good morning, Chairwoman Pintor Marin, Vice Chair Wimberly, and members of the committee.

Thank you for the opportunity to come before you today to discuss Governor Murphy’s proposed budget for Fiscal Year 2023 (FY23).

As always, I’d like to start off by introducing my colleagues here at the table with me – Deputy Treasurer Aaron Binder, who is no stranger to most of you, the Acting Director of the Office of Management and Budget (OMB) Lynn Azarchi, Deputy Director of OMB Tariq Shabazz, and Martin Poethke, the Director of our Office of Revenue and Economic Analysis (OREA). I’d like to personally thank each of them, as well as my front office, and the staff of OMB, OREA, and a number of our other divisions, many of whom have joined us here today or are listening in remotely, for their tireless dedication and professionalism in putting this budget together.

Just over two years ago we were in the midst of quarantine as the COVID-19 pandemic firmly gripped the world, sending many of us home to work remotely for what we thought would only be a short period. Our lives have changed in countless ways since, in some instances irreparably, and in some instances for the better. We’ve learned to do certain things more efficiently by employing technology and we’ve learned to be more nimble in adapting to continually changing circumstances.

As the State, national, and world economies hunkered down in the face of a growing pandemic, the economic outlook tumbled. Hospitals were overflowing, unemployment in New Jersey soared to a modern peak of 15.8%, employment dropped by an unprecedented 732,600 jobs in just March and April, and State GDP plummeted by a stunning 39.1% in the second quarter of 2020.

I don’t mean to needlessly rehash what we’ve all lived through, but these circumstances have a direct bearing on our fiscal situation.

Consequently, our budget took a hit, too, as revenues at the end of FY20 dropped $1.45 billion below our targets in just a few short months. The economic forecasting consensus agreed that recovery would take several years. It took State finances seven long years after the 2008-2009 Great Recession to bring revenues back to pre-recession levels.

But not this time.

This time New Jersey rallied. America rallied. Individuals and business rallied. And yes, even the government rallied. Vaccines were developed in record time and distributed quickly. Unprecedented federal support helped the unemployed pay bills and feed families. Loans and grants kept businesses afloat. In New Jersey, federal aid sent over $25 billion to the unemployed, $25.8 billion went to businesses under the Paycheck Protection Program, and another $19.9 billion in Economic Impact Payments were delivered directly to taxpayers. Stimulus checks put thousands of dollars into household pockets, boosting consumer spending and our recovery, which accelerated as a result.

New Jersey’s labor market had a record year in 2021 as 212,400 jobs were restored and created. Through the end of February 2022, the State has recovered 89.9% of jobs lost at the beginning of the pandemic, ahead of most of our regional neighbors, and the unemployment rate has fallen back to 4.6%. In 2021, wages and salaries rose 8.4% while retail sales soared 20.5% according to Moody’s. State GDP climbed to record levels. New Jersey’s hot housing market continued to grow with single family home prices rising 14.4%. Nationally, corporate profits jumped an estimated 25% and the S&P 500 Index rose 26.9% in 2021.

The impact on State revenue collections has been remarkable.

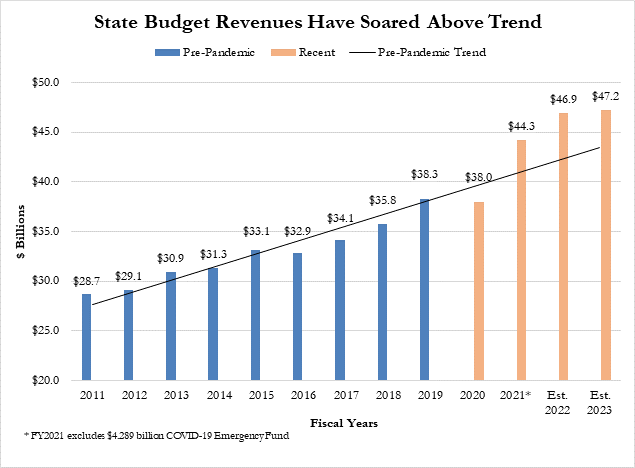

Rather than taking seven years to recover, like the Great Recession, State revenues returned to and then surpassed the pre-pandemic peak after only one down year in FY20. As you can see from the graph below, FY21 baseline budget revenues jumped well above FY19. And that revenue surge has continued. The black line shows the steady trajectory that State revenue growth typically follows going back more than 10 years – proving that growth over the last few years has been truly remarkable AND anomalous.

This brings us to the present. Our revised FY22 revenue forecast at the time of the Governor’s budget message totals $46.9 billion, reflecting robust year-to-date collections trends.

We were very happy to hear that OLS sees even brighter news in terms of forecast revenues.

Having had the opportunity to see the incredible March revenue numbers that have come in since we finalized our forecasts more than a month ago for the GBM, it is understandable that OLS’ forecast is higher.

Those March numbers are even higher than our increased March forecast made for the GBM. For instance, we forecasted March sales tax revenue to rise 11% and it looks like it may end up closer to 17%, and PTBAIT is running more than $400 million above expectations – including $250 million in new final payments from taxpayers who had never before paid PTBAIT. We are looking forward to the all-important month of April which will provide our best insight yet into current taxpayer behavior and where it may be trending.

However, while we recognize and understand additional growth in the forecast, it is important to note that the majority of the difference between our forecast and OLS’s forecast is represented by the CBT and PTBAIT, which are two of the State’s most volatile and unpredictable revenues. That, together with international and national economic concerns for FY 23, regarding interest rates and supply chain issues, would suggest a more cautious approach should be taken.

And as both Moody’s and S&P have noted, our cautious revenue estimations provide us with greater protection against future downturns, and contributed to the first two credit rating upgrades the state has seen in decades.

Erring on the side of caution is not just wise, it’s warranted on the heels of a historically volatile time for revenues, coupled with an entirely new revenue stream that no one fully understands yet – in the form of the Pass-Through Business Alternative Income Tax.

As you can clearly see from the graph, revenue collections in the last three years are unusually strong. The nine-year pre-pandemic revenue pattern averaged about 3.6% growth annually, while recent growth has jumped well above that pre-pandemic trend.

To help provide clarity, I’d like to turn to some of the details underlying the revenue forecasts.

FY22 is the second consecutive year of strong revenue growth. Our $46.9 billion revised forecast is $4.6 billion above the level certified in the Appropriations Act last June. Clearly this performance has outpaced everyone’s predictions as OLS’ June forecast was actually $212 million lower than the Executive’s revenue certification.

We have increased the FY22 forecasts for most of the major revenues.

All of these increases reflect the strong economy – jobs growth, wage and salary increases, consumer spending, the hot housing market, rising stock markets, and elevated corporate profits.

Our forecast for the Gross Income Tax (GIT) – the State’s largest revenue stream – has increased by $489.0 million for a total of $17.4 billion. Collections are up 16.3% through the end of February, driven by strong growth in wage withholding and quarterly estimated payments. However, we expect overall GIT collections growth will slow substantially for the remainder of FY22 due to the impact of several State and federal tax cuts enacted last year, worth just over an estimated $300 million, and an estimated $1.4 billion jump in tax credit claims for the Pass-Through Business Alternative Income Tax (PTBAIT).

It’s important to underscore that the GIT and the PTBAIT are closely linked together. As you know, the PTBAIT functions as an alternative to the federally capped SALT deduction for State and Local Taxes. Corporate pass-through entities pay the PTBAIT and then distribute those amounts as credits to their members who subsequently claim those credits when they file their personal income tax returns. Roughly 97% of these credits are taken through the GIT. PTBAIT payments soared in December and January, as many taxpayers took advantage of this relatively new program for the first time. New PTBAIT taxpayers contributed about $700 million, while returning taxpayers also increased their payments substantially. As a result, the FY22 PTBAIT revised forecast of $3.1 billion is $1.7 billion higher than certified last June.

However, it’s equally important to note that the billions of dollars collected under the PTBAIT will ultimately reduce GIT liabilities and effectively mask the strong GIT collections growth we have seen. So for every dollar we account for in PTBAIT, we need to be prepared for a dollar to go out in the GIT or CBT.

Moving on to the Sales Tax, the State’s second largest revenue source is up a remarkable 12.6% through the end of February. Our revised forecast is now $789.6 million above the certified level. As we’ve noted, strong consumer spending is driven by the substantial federal stimulus payments, high wage growth, and a shift in spending away from non-taxable services towards durable goods that are taxable, has driven this revenue stream. With the regional Consumer Price Index up 5.1%, inflation is also a contributing factor in rising Sales Tax collections, since the tax is applied to the price of goods.

Moving on to the Corporation Business Tax (CBT), collections are up 28.4% so far this fiscal year. As I already noted, U.S. corporate profits grew 25% last year. When we certified revenue last June our forecast assumed there would be a large impact from the claiming of PTBAIT tax credits. However, newer data that we have from the first year of the PTBAIT program indicate that very little of the PTBAIT tax credits are claimed through the CBT. Instead, as I noted, 97% are being claimed through the GIT. As a result, we have increased the FY22 revised forecast by $1.2 billion.

As I’m sure you’re aware, New Jersey’s real estate market has been hot for more than a year, and revenue collections are up 43.1% through the end of February. While sales volume has eased off recently, home prices continue to rise as demand remains strong. The revised forecasts for both the Realty Transfer Fee and the Assessment on Real Property Greater Than $1 Million are increased by a combined $230.2 million in FY22.

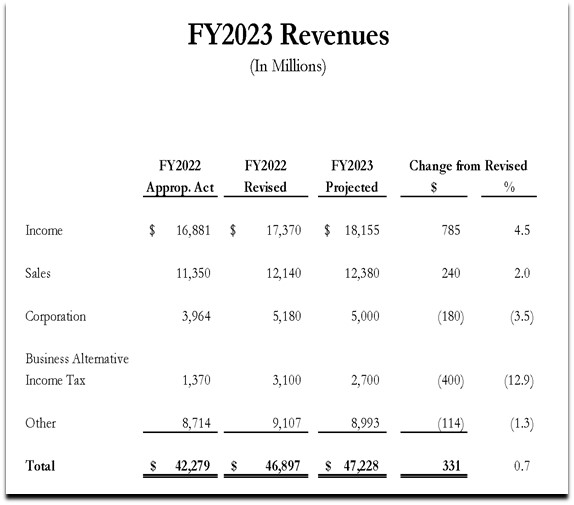

Now turning to the upcoming fiscal year, the FY23 revenue forecast assumes a moderation in growth from the recent robust performance. As is customary, we will have a newly revised forecast for you in May after the all-important income tax filing season has concluded. The overall total of $47.2 million is up only $330.9 million, or 0.7% over FY22. Some revenues are expected to grow at rates closer to historical norms, such as the GIT and the Sales Tax, while others are expected to decline, such as the CBT, the PTBAIT, and the realty fees.

You don’t have to be an economist to know that these remarkable surges will not continue unabated in light of disappearing federal stimulus aid, looming PTBAIT credits, and rising inflation and interest rates. To be clear, the low-growth forecast for next year does not suggest a declining economy. These forecasts assume that economic expansion endures, employment growth continues, inflation moderates – as Moody’ and others are predicting – and stability returns. The FY23 forecast should be seen as more of a right-sizing after two years of surging revenue increases.

I’d just like to quickly run through some key points for the FY23 revenue forecast:

· The GIT estimate of $18.2 billion assumes growth of $785.0 million or 4.5% from FY22. This is in line with long-run average growth for the GIT.

· The Sales Tax estimate of $12.4 billion assumes growth of $240.3 million or 2.0%. This is slightly below the long-run average Sales Tax growth, because households will have spent most of their federal stimulus money. Also, we anticipate that consumers will shift away from pandemic-driven durable goods purchases back toward more spending on services, which are less frequently subject to the Sales Tax.

· The CBT estimate of $5.0 billion, a decline of $180.0 million or 3.5%. This is the second highest level ever for the CBT, but down year-to-year as corporate profits are expected to recede from historically high levels.

· The PTBAIT estimate of $2.7 billion, a decline of $400.0 million or 12.9%. A third year of a substantial influx of December payments from entirely new taxpayers is not expected, so that the payment patterns for this revenue should begin to stabilize below the elevated FY22 level.

· The Realty Transfer Fee collection of $532.1 million is down by $93.9 million, and the Assessment on Real Property Greater Than $1 Million of $211.0 million is down by $37.2 million. Coming off the elevated levels of FY22, these realty revenues are forecasted to decline by 15%. Interest rates are expected to rise, weakening demand and moderating the pace of price increases.

Like I said, all of this suggests moderate growth after a truly remarkable surge.

I think we can all agree the past two years have been a rollercoaster – physically, emotionally, and fiscally – prompted by an unprecedented pandemic, unprecedented federal stimulus, and unprecedented behavior changes as the world adjusted to these seismic shifts.

Through it all, we continue to enjoy a close working relationship with OLS who we were nearly in lock step with last June – with only roughly $200 million separating our revenue estimates across a roughly $46 billion budget.

Working together with the Legislature, we have been committed to ensuring our economy is one that buoys everyone – through tax fairness, targeted tax incentives, investments in workforce development, and in education.

The Administration’s focus on strategic investments have helped bolster our economy, make good on many promises, strengthen our fiscal foundation, and provide even greater relief for working and middle-income families.

And the result, as the Governor noted in his budget address, is that we’ve gone from the fourth slowest-growing state economy to one of the fastest-growing state economies in just four years. In fact, the latest numbers just released last week show that New Jersey’s GDP grew 7.4% in the fourth quarter of 2021, notably above the national average of 6.9%.

Moody’s delivered proof that we are headed in the right direction shortly before we introduced our new budget, issuing New Jersey’s first credit rating upgrade in more than 45 years. In doing so, Moody’s cited our steps to more aggressively address liability burdens, including the completion of debt defeasance along with our increased pension contributions, which they noted are consistent with improving governance and fiscal management.

And just days ago, S&P issued their first credit rating upgrade in 17 years, providing further validation, in the wake of our new budget proposal, that the course we are on is the right one. S&P’s decision was based in part on our efforts to reduce debt by roughly 10 percent, along with our prudent revenue estimates, which they noted will better position us to weather any future economic slowdowns or downturns.

Doubling our proposed surplus this year to prepare for a rainy day, making the full pension payment once again, retiring more debt, reducing our reliance on borrowing, and cutting taxes for seniors, middle class and working families while asking a little more from the most fortunate – all of this has placed us on unequivocally sounder footing than we were when I first appeared before you four years ago.

As the Governor noted in his budget address, these credit upgrades are “clear proof that social responsibility and fiscal responsibility are not mutually exclusive. It is clear proof that when you invest in people, invest in growing the middle class and growing the economy, and invest in our future, it all pays off.”

Which is why the Governor’s newly proposed budget continues to build on this progress.

We are including another $1.3 billion to reduce debt – for a total of $5 billion over the last year – saving the state over $600 million through defeasement and countless more dollars through ongoing debt avoidance – making New Jersey more affordable for this generation and the next.

And I would just like to note that should we continue to see additional revenue growth, the administration would like to devote even further dollars towards debt reduction as well. That’s a conversation we welcome with the Legislature.

We are also proposing a nearly $900 million investment to replace the Homestead Benefit program with the new ANCHOR program – to make living in New Jersey more affordable for twice as many homeowners and now renters as well.

We are proposing more than $700 million in new funding for another record investment in pre-K through grade 12 education – to make attaining a quality, public education more affordable for everyone.

We are proposing the second consecutive full pension payment for the first time in more than a quarter of a century – to secure a more affordable retirement for hardworking public employees.

The Governor is also proposing the use of over $300 million in American Rescue Plan funds to create the Affordable Housing Production Fund, which will make home ownership more affordable and attainable for an estimated 3,300 families.

And, not only does this budget contain no new taxes or fees – a promise the Governor has made and kept – it also proposes a year of “fee holidays” for drivers renewing their licenses, certain health care professionals applying for or renewing their licenses, couples getting married, and residents visiting State parks – all of this to make living and working in this State a little more affordable.

In fact, more than 70 percent of our total budget is redirected back out each year in the form of grants-in-aid for property tax relief, social services, and higher education, as well as State aid to schools, community colleges, municipalities, and counties.

So the vast majority of our budget is used to help those most in need, to offset property taxes by supporting schools and local governments, and to invest in a brighter future for every New Jerseyan.

I think we can all agree that is the number one reason why we are all here.

On that note, I want to thank you for your time and we look forward to taking your questions.