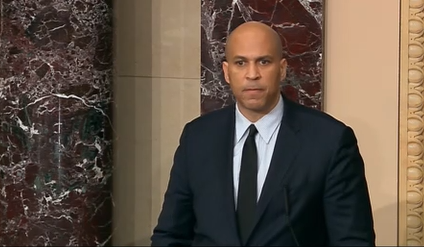

VIDEO: Booker: Making Child Tax Credit and EITC Expansion Permanent Will “Change Life Trajectories and Have a Ripple Effect for Generations to Come”

VIDEO: Booker: Making Child Tax Credit and EITC Expansion Permanent Will “Change Life Trajectories and Have a Ripple Effect for Generations to Come”

Booker and colleagues speak on the transformative impact of the expansion of the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC) included in the American Rescue Plan and the need to make expansions permanent

WASHINGTON, D.C. – Today, U.S. Senator Cory Booker (D-NJ) joined Senators Michael Bennett (D-CO), Sherrod Brown (D-OH), and Reverend Rafael Warnock (D-GA) on the Senate floor to discuss the American Rescue Plan’s expansion of the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC) and the need to make the expansions permanent.

Key Excerpts

“…the poorest age group in America is our children with one in six American kids living in poverty. It is nothing less than a moral obscenity that the richest nation in the world should have the highest rates of child poverty in the developed world for adults. Poverty has a technical definition. It’s a federally defined guideline and amount of annual income that you fall under that also takes into account how many people are in your high household for kids. Poverty is defined by what they experience every single day, what happens to them. It’s growing up, being more likely to deal with food insecurity, not knowing where your next meal will come from or when it will come. It’s facing housing insecurity….”

“We know that when a child experiences poverty, there is a life, long psychological and physiological effects they carry with them stuff. And the cruelty of this crisis is that no parent would ever choose that for their child. Poor parents do not choose for their kids to experience the daily trauma of poverty. They do not choose to condemn their kids to a life of worse education outcomes, worse health outcomes. What we must understand is that child poverty is not a choice that low income parents make. It is a failure of our country to take collective responsibility for the well-being of American children. This is a moral sin. It is not a sin to be poor, but a sin to tolerate such poverty in our communities.”

“…lifting kids out of poverty is not just about ending a crisis, but beginning a new American tradition of giving every child what every child should have in America as a birthright. It’s about creating freedom and liberty from the oppression of poverty. We have the power to do this. We — we have the tools to do it and we know it makes good economic sense to get kids and adults out of poverty.”

“Expanding the Child Tax Credit and the Earned Income Tax Credit and making them permanent are proven data driven evidence based result apparent ways to respond to some of the most morally and economically urgent challenges of the United States of America. These are the kinds of investments in our people that will change life trajectories and have a ripple effect for generations yet to come. If you give a child fertile ground in which to grow, they will blossom and reap a harvest beyond our imaginations. But if you punish them in the trauma and the violence of poverty, you decimate not just their destinies, but all of our destinies.”