Unpacking the Murphy Millionaire’s Tax

The dog overtook the car….Ahab slew the white whale…Wile E Coyote devoured the roadrunner….Tom cornered Jerry….Gov. Phil Murphy got the millionaire’s tax.

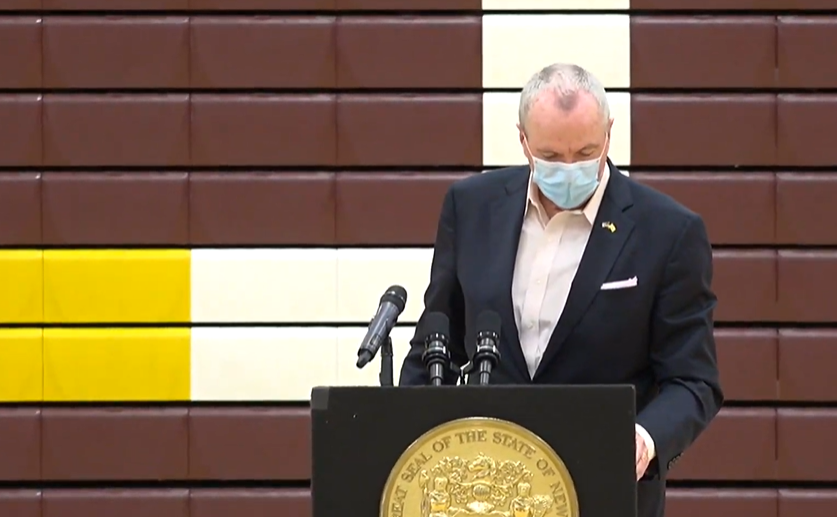

It took nearly three years and the onslaught of an unprecedented public health crisis that shredded the state’s economy and drove the budget into the red, but Murphy persevered.

And, within the next two weeks, he’ll put pen to paper and sign into law increases in the tax on incomes in excess of one million dollars.

Senate President Steve Sweeney (D-Gloucester) and Assembly Speaker Craig Coughlin (D-Middlesex), who joined forces to block the tax proposal increase in 2018 and 2019 dropped their objections and struck a compromise with the governor — the increase on the wealthy in return for a tax break for the middle class.

Compromise — give something to get something — is the adhesive which binds together the lawmaking process and enables it to move forward, albeit creakily in many cases but forward, nevertheless.

The hackneyed metaphor about sausage making and lawmaking still applies, but it’s important to understand that sausage is comprised of many different ingredients which, taken alone aren’t very mouthwatering but blended together becomes a palatable dish to place on the family dining room table.

Murphy, Sweeney and Coughlin cooked up their palatable dish with an increase from 8.97 percent to 10.7 percent on incomes between $1 million and $5 million and a $500 rebate sent to families with incomes below $150,000.

Neither legislator was struck by a bolt of lightning epiphany that opened their yes to the need for a millionaire’s tax. Rather, the reversal of their two-year-long opposition position was a clear-eyed political acknowledgment that the budget was a train wreck caused by the COVID-19 pandemic and that refusing to ask the wealthy for more while unemployment hit record levels, businesses closed and property taxes fell under upward pressures was no longer tenable.

All that remained was settling on an agreement with Murphy to recognize that the millions of middle class taxpayers deserved attention from government, an idea modeled on the Federal governments’ stimulus check program on a more modest scale.

For Murphy, it was an easy call — he won his millionaire’s tax and avoided inflicting any harm on his solid base of support among public employee unions who feared a deal with Sweeney would involve layoffs or substantive changes in the public pension and benefits system.

A $500 check to middle class taxpayers was a small price to pay. It is, moreover, of no small moment that the check will show up in taxpayers’ mailboxes in 2021, a reminder that the governor and 120-member Legislature will appear on the ballot in November.

Who among us has forgotten the homestead rebate check signed by Brendan Byrne arriving two weeks before his re-election in 1977? (The more things change, etc., etc.)

With the agreement, other potential obstacles to delivering a balanced budget to the governor by Oct. 1 collapsed.

There will be changes in the governor’s overall budget recommendations —most notably rejecting his “baby bonds” proposal — but with the millionaire’s tax issue resolved, the remaining issues will fall neatly into place. To the relief of all involved, there will be no brinksmanship involving a potential government shutdown, a politically disastrous turn of events at a time of great public anxiety over dealing day in and day out with a lethal virus for which there is as yet no cure.

Republicans, already unhappy over the Administration plan to issue some $4 billion in bonded debt to cover lost tax revenue, are unanimous in opposition to the tax increase but the Democratic majorities are lined up solidly in support of the leadership deal.

Whatever residual support existed for a primary challenge to Murphy next year — admittedly not particularly strong — has vanished entirely.

He has emerged as the chief executive who led the state through a horrific public health emergency, acted decisively (not without controversy) to upend everyday life in the higher interest of public safety, and managed a fiscal upheaval unlike any before.

For someone who endured months of criticism and a barrage of questions about his political skills and his seeming inability to deal with the political crosscurrents which roil the Legislature, he has attained a position of enhanced strength, sufficient to strike a deal to raise taxes heading into an election year.

He’s already made it clear he intends to remain for a second term, ending for the moment speculation about his joining a Joe Biden Administration should there be one.

He’s already accomplished more than the dog, Ahab, the coyote and Tom.

Carl Golden is a senior contributing analyst with the William J. Hughes Center for Public Policy at Stockton University.

Leave a Reply