WATCH: Assembly Committee Hearing on Horizon Restructuring

The Assembly Financial Institutions and Insurance Committee this morning will consider testimony toward legislation, which sets up a process for Horizon to apply to the Commissioner of the Department of Banking and Insurance in order to reorganize. The State Senate has also introduced a version of the bill, sponsored by Senate President Steve Sweeney and Senators Nellie Pou and Paul Sarlo.

The New Jersey Legislature is streaming the hearing here at 9:15 a.m.

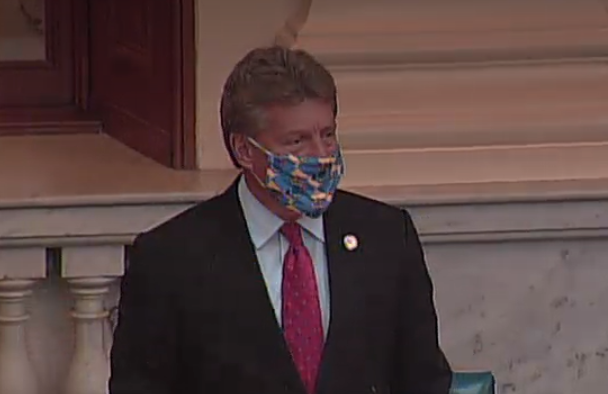

Assemblyman John McKeon (D-27) (pictured, above) today was set to introduce amendments to the bill, which the committee will vote on next week.

Amid the devastating COVID-19 pandemic, where the need for adequate and affordable health care has been amplified, Horizon may be one step closer to making the ever-evolving plan a reality. Sources say the proposals are gaining traction in both the State Assembly and Senate, as well as with Governor Phil Murphy. While the Governor has not publicly commented on the proposed law, sources say it would provide a one-time $600 million budget plug at a time when Murphy desperately seeks to offset the impact of federal denials on his COVID-19-ravaged state. The timing coincides with the lead-up to his new year budget address.

Thomas Vincz, Horizon’s Public Relations Manager, says the company’s current structure imposes restrictions and limitations that impede its ability to evolve, adapt and drive the kinds of innovations that keep health care costs under control.

“As a not-for-profit mutual, Horizon would have the flexibility to invest in new partnerships that create more connected and convenient care, provide tools for health care professionals to better coordinate care and improve quality, improve access to mental and behavioral health,” Vincz said.

Not everyone is buying Horizon’s argument. New Jersey Citizen Action Health Care Program Director Maura Collinsgru says by converting to a mutual holding company with multiple for-profit subsidiaries — the company is effectively becoming a for-profit stock company. She also says Horizon doesn’t need legislation to convert to a mutual holding company because there’s a 2001 law that clearly spells out the requirements for a conversion. One stipulation, she adds, requires Horizon to make a payment equal to the fair market value of its assets and charitable trust fund.

“Horizon, as of a 2018 end of year report filed with the DOBI, listed assets valued at approximately $7 billion,” Collinsgru said. “Horizon wants to circumvent the conversion law and instead guarantee a one-time payment of $600 million with another potential $650 million over 17 years. That money would go into the general budget and not be dedicated as required to improving the health care of New Jersey residents.

“Horizon contends they must undergo this massive ‘reorganization” in order to be competitive and innovative,” Collinsgru added. “Horizon is the largest provider of health coverage in the state. They insure and administer benefits for more than 3 million New Jersey residents, including the entire state health benefits plan. Their assertions about needing to change the law in order to buy heart monitors and other technology they can’t provide now is without merit. They can indeed provide any health service they see fit now. The only reason for legislative change is to ‘walk away’ with $7 billion.”

Leave a Reply