Gottheimer Targets ‘Moocher States’

Just like sand in an hourglass, prospects for SALT cap relief are dwindling down.

The good news is that the infamous $10,000 cap will expire on its own after 2025. All of a sudden, that doesn’t seem all that far away. Must be something about time marching on.

Let’s go back to 2017 and the Trump Administration’s tax reform package. Among other things – a higher standard deduction, a much lower corporate tax rate – the plan imposed a $10,000 cap on deductions for state and local taxes. Previously, deductions for what has become known as SALT were unlimited. This meant nothing to most homeowners across the nation, but it meant a lot to many in New Jersey, some of whom pay much more than $10,000 in local property taxes alone.

Some New Jersey House Republicans voted against the entire tax package because of the cap.

But it was Democrats – not surprisingly – who made it a big issue in the 2018 midterms. That was a good strategy as Dems “flipped” four seats.

The sobering news was that attempts by the Democrats in the House to get rid of the cap failed. While the then-Democratic House passed multiple bills to eliminate the cap, it got nowhere in the Senate.

Admittedly, it’s hard to convince people in the south and midwest that those living in $300,000 homes in New Jersey need tax relief. We know that a $300,000 home is very much an average home, but that argument is not persuasive to representatives from such places as North Dakota and Tennessee.

Things got harder when Republicans took control of the House last fall.

There are some Republicans from New Jersey, New York and other high-cost states who would join many Democrats in eliminating the cap, but their efforts have not been rewarded.

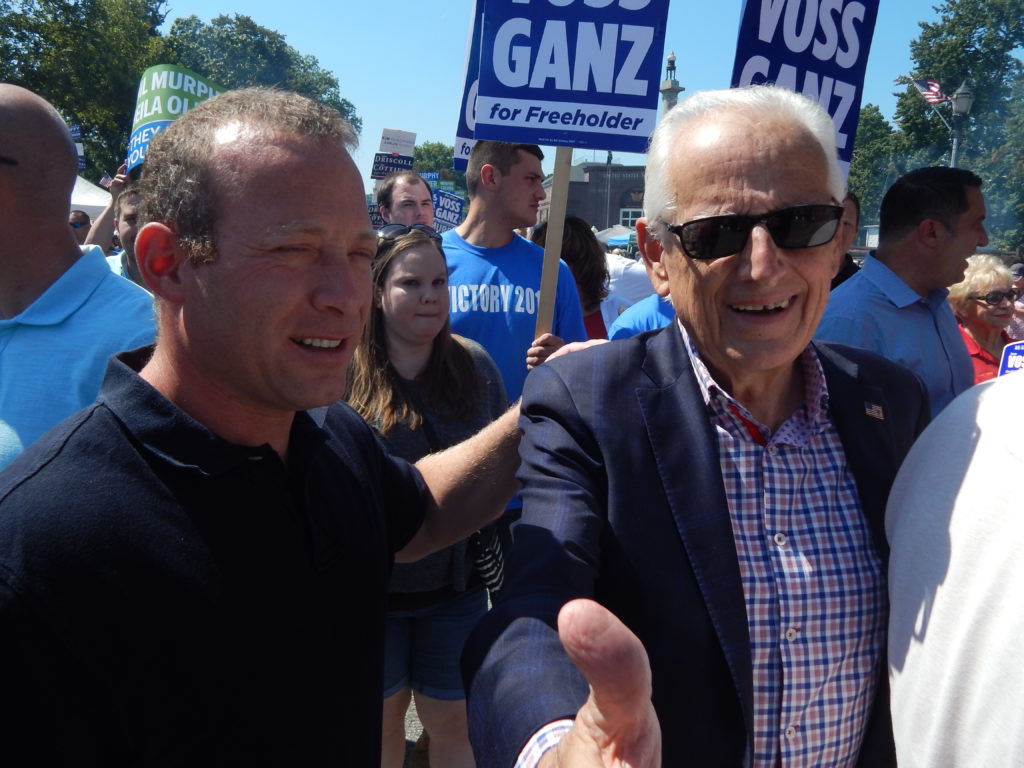

Just ask Rep. Josh Gottheimer from CD-5 after the House Ways and Means Committee refused to restore the full SALT deduction when considering tax legislation earlier this week. Here’s his not too happy take:

“The Moocher States are rising again – expecting to line their red state pockets with federal tax dollars paid by blue states. Today, extremists on the House Ways and Means Committee refused to restore the SALT deduction. That is an insult to millions of hard-working middle-class families who continue to face double taxation and higher taxes – and it’s an insult to all the Democrats and Republicans who represent blue states.

“I helped pass four bills out of the House to restore SALT and help cut property and state taxes for Jersey families. But all four times, the Senate red staters blocked the tax-cutting legislation. I’m sick and tired of these red states treating New Jersey and other blue states like their piggy bank. We’re paying everyone else’s tab for their roads, bridges and law enforcement.”

Gottheimer’s statement included comments from Janet Yellin, the U.S. Treasury Secretary, that SALT has had a “disparate impact on different states.”

One guesses the challenge now is to make sure the SALT deduction cap is not extended beyond 2025.

U.S. Rep. Bill Pascrell, Jr. (D-9), New Jersey’s only member of the tax-writing House Ways and Means Committee, offered the amendment during a committee hearing to provide relief from the burdensome state and local tax (SALT) deduction cap imposed by Republicans in 2017. The SALT amendment Pascrell offered was modeled after H.R. 3098, a bill authored by several New York and California Republican congressmembers. Ways and Means Republicans voted against their plan, blocking and killing Pascrell’s amendment.

This is no surprise. Watch how quickly Texas will be reaching out for federal assistance after their recent storms. Then remember Cancun Ted Cruz delaying Superstorm Sandy assistance to Eastern states for months. Gottheimer is right. Red states are pigs.

The Salt tax cut only benefits the upper class who are more likely to own Real Estate. A majority of low income people dont own real estate. I thought democrats were the party of the low income working man?

Maybe Josh can run for governor and fix the property tax problem when he gets to Trenton.

Moocher states are one thing, but the SALT deduction is a tax break for the rich. Most Americans do not itemize their tax returns. Most New Jersey residents pay less than $10,000 in property taxes.

The deduction could be raised to $12,000 or $15,000 if these congressional representatives want to protect ordinary people but they are really trying to help the wealthy donors who comprise the American aristocracy ~the oligarchy that runs things.

The media frenzy is not an exercise in truth.

Michael Schnackenberg must have been in the closet when they were passing out brains. He says Texas will be reaching out for federal assistance after their recent storms. I guess those people don’t count because they live in NJ. As for NJ, we got paid a lot of money not only for Superstorm Sandy, but Tropical storms like Floyd that flooded out the entire state. I find it interesting that NJ & NY (being blue states) get paid mighty fast when it comes to storm damages and flood damages, while red states in the south and midwest are slow to receive payment.

As for Superstorm Sandy a lot of the problems were caused by insurance companies playing games with payouts to people, forcing the government to delay emergency relief.

So Schnackenberg needs to shut his maw about the red states. NJ gets more than its fair share when it comes to flood and storm relief.

The SALT tax is a total joke. Why give people a deduction because their property taxes are over $10,000 annually??? It’s a simple fix. Cut the property taxes in half, stupid!!!

Oh, wait! Murphy and the Democrats are proposing to pass StayNJ to keep homeowing seniors 65 and over from leaving NJ by giving them an annual $6500 property tax cut in lieu of ANCHOR and Homestead Rebates (StayNJ was going to be a $10,000 property tax cut, but the Gov. & Democrats said it was too much because they said they don’t want to give the taxpayers a real break).