What Murphy and Guadagno Should be Telling Voters

Neither gubernatorial candidate has a plan to reduce property taxes.

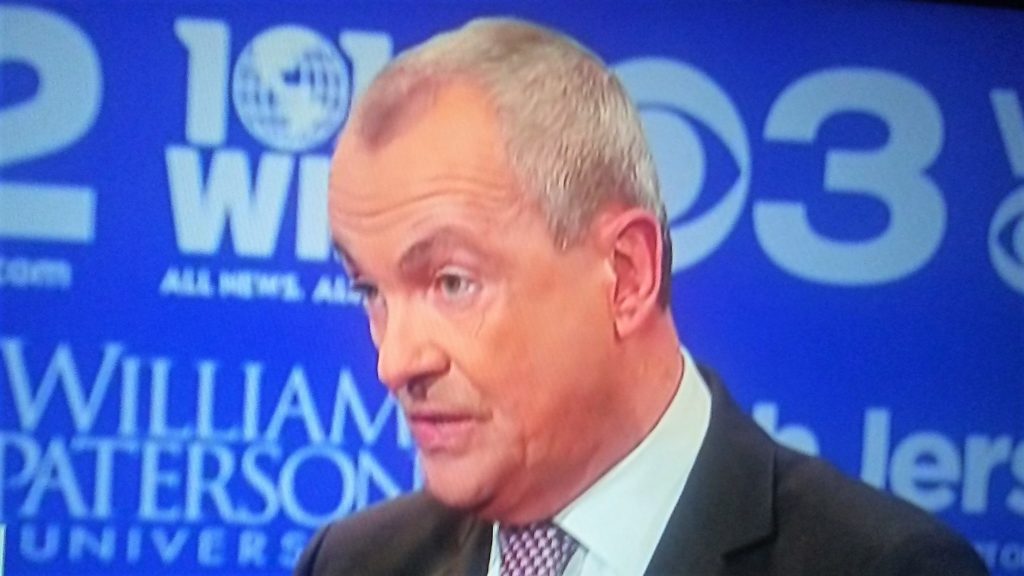

That should be pretty clear after the recent debate between Republican Kim Guadagno and Democrat Phil Murphy.

Guadagno talks about a complicated scheme to cap the school portion of property taxes for some homeowners; Murphy offers very little specifics on what he would do.

The failure of the state’s two major gubernatorial candidates to address one of the biggest issues in New Jersey seems odd.

But it really isn’t.

The public, you see, doesn’t want to cut property taxes.

Or to put that in a way that is easier to understand – the public has no appetite for the state to do what is really necessary for property taxes to decrease.

Before going further, we must again establish what property taxes support. That would be local government, which primarily consists of counties, municipalities and school districts, both local and regional. Some may think that their property taxes fund state government or even find their way to Washington, but that is not true.

That ignorance, however, helps make a solution to this perennial problem difficult.

When you strip away the political verbiage and look at the facts, there are not many ways to truly reduce property taxes.

One obvious solution is to reduce the amount of local government we have in New Jersey.

Do we truly need 565 distinct municipalities and more than 600 school districts?

Absolutely not.

Many in and outside of politics would agree. But try doing something about it.

There are occasionally consolidation and merger proposals throughout New Jersey, but most die quickly amid public opposition. It makes no difference if we are talking about sweeping plans to merge towns, or small stuff like a centralized police dispatch system.

There are a few isolated success stories. We now have one municipality in the state named Princeton rather than two. And in Morris County, the towns of Chester Borough and Chester Township (Yes, they are two separate towns) were able recently to combine police departments.

By and large, however, the state presses forward with an abundance of small towns, just about all of which have their very own police departments and school systems and a cadre of high-ranking department heads earning annual salaries much higher than $100,000.

This makes no sense. It continues because local politicians love an arrangement that allows them to lord over some very miniature fiefdoms under the mantra of “home rule.”

I long have thought that the only people devoted to home rule are the ones doing the ruling, but it may be more complicated than that.

Many members of the public also seem to like the idea of their towns having their own police, school system and DPW crew. There must be something warm and fuzzy about residents seeing their town’s seal on the side of a police car.

Such familiarity comes with a cost. The refusal of officials to merge departments and in many cases, towns themselves, drives up property taxes. And it will continue to do so unless changes are made.

Another logical way to cut property taxes is to reduce the services government provides. This is also a pretty easy concept to grasp.

If local government did less, it would need less money.

But the public is unlikely to go along.

Many people don’t go to local council meetings, but one way to get a large, angry crowd, is for a town to say it is eliminating the pick-up of recyclables. The recycling center may be merely a mile away from most residents, but doing away with pick-ups is not going to be accepted. People will complain.

But this is a big part of the problem. Services must be reduced if property taxes are going to go down.

That should be obvious.

And they can be reduced very easily. Is driving to the recycling center a hardship?

If two cops in a suburban town retire and if officials opt not to replace them to save money, is the crime rate going to skyrocket? Doubtful. Does every teacher or administrator leaving a school district need to be replaced to maintain quality education?

Residents have complained about New Jersey’s high property taxes for decades.

But if they really want property taxes to go down, residents must change their mindsets. They must accept less government, fewer services and must abandon this archaic notion of home rule.

That can be tough medicine in some cases, but that’s the reality.

And that is what Guadagno and Murphy should be telling voters.

Fred Snowflack is spot on with this article. Duplicative services need to be reduced to achieve any sort of peoperty tax reform. Perhaps we should be supporting a Snowflack for Governor campaign in 2021?

Local government could work beautifully with accountable local banking, credit, and development. We are not properly invested in our communities, literally. We are invested in the scrip of Interstate Commerce and Banking. We have stopped accounting for the real value of land in our communities. Can fix it all within three cycles during the next administration. https://twitter.com/GSITEorg

Hi Fred and congratulations on joining Max!

Yes, consolidation would save a few bucks, But take Denville for example: Saving the salaries of two cops and one school administrator cuts about $400,000 from the taxes here. That is about 2/3rds of one percent of the total taxes collected or about $25 per person. This amount would be immediately eaten up by increases in other areas so what would really happen is that the growth in property taxes would slow–but only slightly. There can be no reduction in property taxes until an alternative means of funding education is found.

I’ve heard things about it, but I’d love for someone to tell me the pros and cons about a Land Value Tax: https://www.economist.com/blogs/economist-explains/2014/11/economist-explains-0