Murphy Staggers into another Millionaire’s Tax Rundown with Plucky Sweeney

Listen to audio version of this article

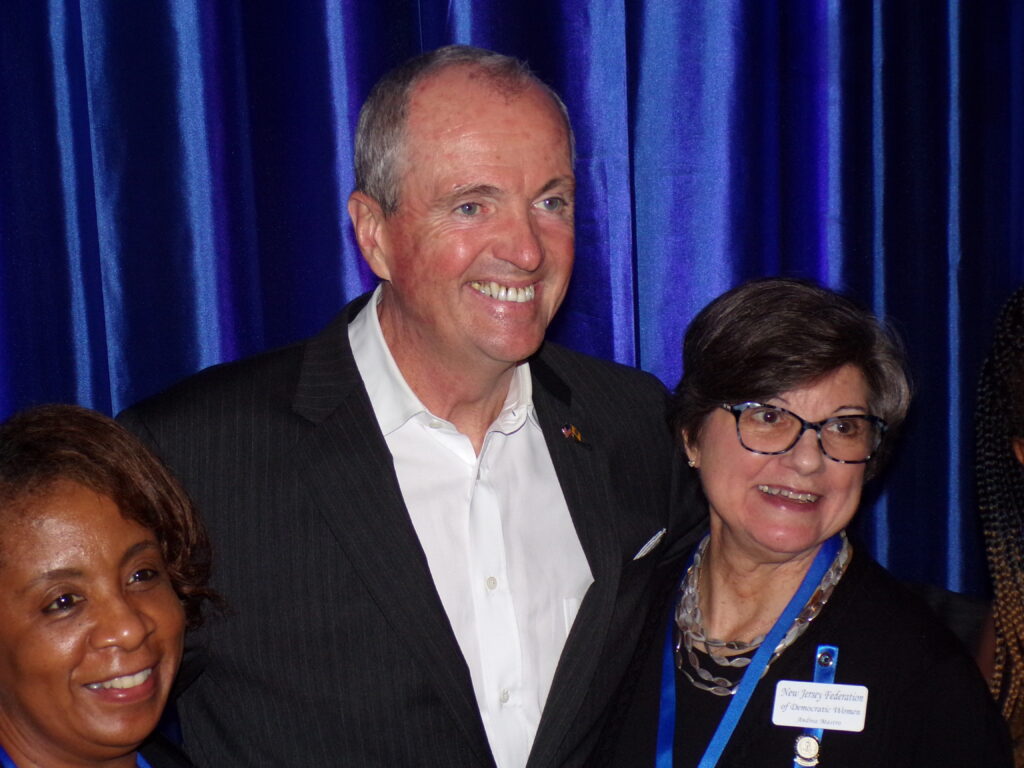

Gov. Phil Murphy won’t deliver his proposed state budget to the Legislature for another six months, but in his recent comments, he’s made it clear that for the third consecutive year he’ll ask for an increase in the tax on incomes above $1 million.

And, if history is any guide, for the third consecutive year the Legislature won’t accede.

Murphy’s pounded the drum for the millionaire’s tax since his 2017 campaign, driving the point that wealthy New Jerseyans are escaping paying their fair share and that his demand for an increase in their taxes enjoys upwards of 70 per cent public support.

None of it mattered, though, as Senate President Steve Sweeney (D-Gloucester), and Assembly Speaker

Craig Coughlin (D-Middlesex) both warned the governor that the tax increase was dead on arrival and no amount of lobbying or waving favorable public opinion polls around would change the outcome.

The confrontations in 2018 and in this year’s budget cycle drove the state to the brink of a shutdown, an embarrassing turn of events for a rookie governor who rode a landslide victory into office and enjoyed handsome partisan majorities in both houses of the Legislature.

The most he came away with was an increase in the tax on individuals earning in excess of $5 million, a rate which applied to fewer than 3,000 taxpayers. His victory was spelled with a lower case v and in quotation marks.

While it is early in the process, the outlook for the fiscal 2020-21 budget is equally dim.

In several public appearances, Murphy has pointed to his Administration’s accomplishments as the halfway point of his first term approaches and has included a strong pitch for the millionaire’s tax.

As he has frequently done, though, he undercut his own message with a remarkably tone deaf and divorced from reality comment at a public forum: “If you’re a one issue voter and tax rate is your issue, either a family or a business, if that’s the only basis upon which you’re going to make a decision, we’re probably not your state.”

In a state whose average property tax has closed in on $9,000 and in hundreds of communities falls between $10,000 and $20,000, his remarks ranged from cold indifference to a if-you-don’t-like-it-here- move” dismissal of those struggling to keep up with property tax increases and others forced to re-locate because they could no longer afford to remain.

While it may have been an attempt by Murphy to focus on other attributes and advantages the state offers (outstanding public schools, skilled workforce, access to major markets, etc.), it fell horribly flat and was soundly criticized, including a response by Sweeney that the governor had “waved the white flag” on taxes and given up on trying to control them, opting instead for increasing them.

Murphy, inadvertently or clumsily, handed Sweeney a gift with his “we’re probably not your state” remark, one that the Senate President will likely use with considerable frequency in any debate over a proposed budget and the millionaire’s tax in particular.

Sweeney, whose recent activity resembles the feeling out process which precedes a statewide political campaign —- from a new boardwalk for Wildwood to a commission to revitalize New Jersey Transit, etc. — isn’t likely to waver on a millionaire’s tax proposal, understanding that he, not Murphy, possesses the greater leverage.

He’ll undoubtedly reiterate his “Path to Progress” report which is based on the view that the state already collects sufficient tax revenue and there exists a compelling need to dramatically alter how it is spent that must be addressed.

The only path to fiscal stability, according to Sweeney, is acknowledging that, left unresolved, the state is on an unsustainable course that will lead inevitably to jeopardizing such vital programs as the public pension and benefits system and aid to public education.

Sweeney understands as well that if Murphy’s insistence on greater taxation on millionaires produces yet a third consecutive shutdown threat, the bulk of the blame will fall on the governor.

The public perception (driven by Sweeney) will be that Murphy is more than willing to deny essential state services to taxpayers out of personal pique over a failure to raise taxes.

The argument worked before, forcing the governor to capitulate, and will likely work again next year should it come to that.

The last two budget standoffs should have convinced Murphy that, in this state, the governor is the face of government, that it is the chief executive —- the only statewide elected state official — who receives the bestowal of praise when things go right and the torrent of abuse when they don’t.

(See: Photos of former Gov. Chris Christie, surrounded by family and friends, sunning himself on the beach in the midst of a July 4 holiday shutdown of all other state parks and public beaches).

For better or worse, the Legislature is too vague a target for public outrage in these circumstances.

While it appears that Murphy, at this preliminary stage, appears committed to the millionaire’s tax, he would be better served to moderate his stance rather than dig in his heels.

Continuing to insist upon the tax increase rather than seek some compromise common ground will produce a re-run of the last two budget cycles.

What’s that old canard about ignoring the past and being condemned to repeat it?

Carl Golden is a senior contributing analyst with the William J. Hughes Center for Public Policy at Stockton University.

Leave a Reply