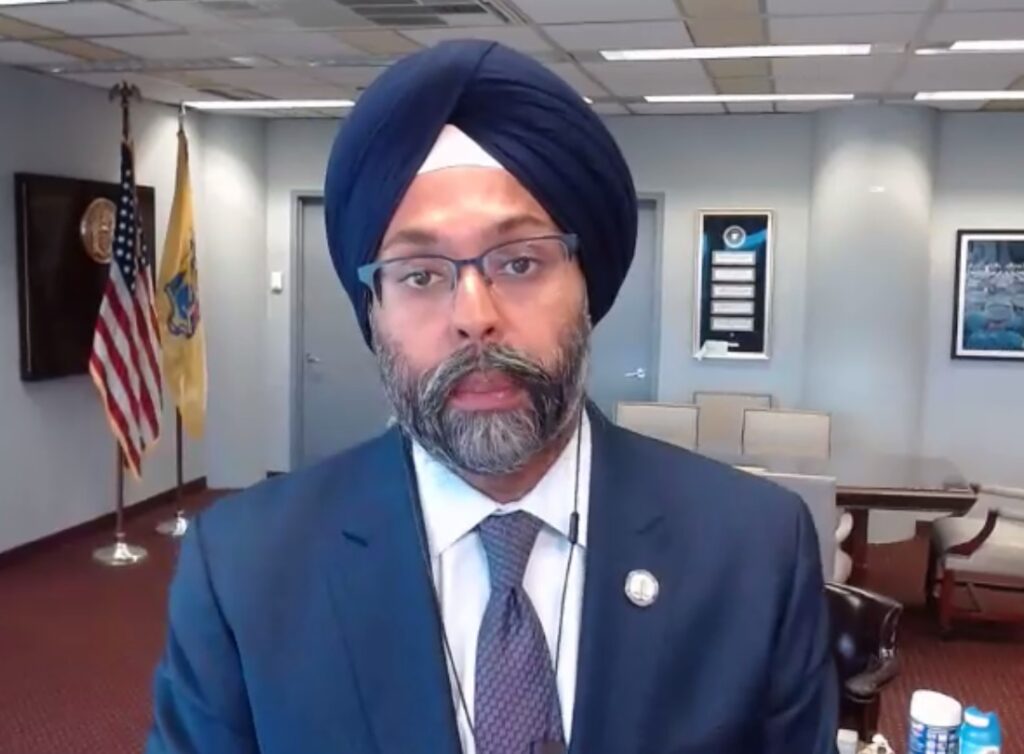

AG Grewal Secures $1.1 Million in Relief for NJ Consumers in Settlement with Citibank over Credit Card Overcharges

TRENTON — Attorney General Gurbir S. Grewal announced today that Citibank will pay a total of $4.2 million to eligible consumers in New Jersey and four other States to resolve allegations the company overcharged credit card interest for tens of thousands of consumers.

As a result of the settlement, Citibank will refund a total of approximately $1.13 million to more than 7,000 eligible New Jersey consumers. Eligible consumers in New Jersey will receive between $55.93 and $2,256.76 each, with an average refund per consumer of about $159.

North Carolina, Pennsylvania, Iowa, and Massachusetts are also participating in the Citibank settlement include. Overall, approximately 25,000 current and former Citibank customers will receive refund checks as a result of the agreement.

The multi-state investigation that led to today’s settlement was triggered by Citibank’s failure to properly reevaluate and reduce the annual percentage rate (APR) for certain consumer credit card accounts as required by the federal Credit Card Accountability Responsibility and Disclosure Act of 2009 (CARD Act), as well as by States consumer protection laws.

The CARD Act requires credit card issuing banks to perform a “look back” at least every six months to review whether, for accounts where the bank has increased the APR due to credit risk or other factors, the factors that prompted the increase have changed. When the look back review yields information that calls for it, the law requires banks to reduce the account’s APR. The States’ joint investigation found that for a period of nearly seven years beginning in early 2011, Citibank failed to properly lower credit card interest rates for consumers who were entitled to reductions in their APR.

“We’re committed to ensuring that New Jersey consumers are treated fairly by credit card companies and financial institutions,” said Attorney General Grewal. “Today, we’re happy to be putting more than a million dollars back in the pockets of New Jersey residents.”

“Through this settlement we are holding Citibank accountable for its failure to treat credit cardholders fairly, and at the same time providing important relief to those consumers,” said Acting Division of Consumer Affairs Director Kaitlin Caruso. “I’m certain affected Citibank cardholders in New Jersey and across the country could have used the extra dollars they were charged in interest for other purposes, and we’re pleased to have obtained refunds for the thousands of New Jersey consumers who were harmed.”

New Jersey and the other participating States will be distributing settlement refunds to eligible consumers through Epiq Systems Inc., a settlement administrator. Consumers need not take any action to receive their funds, which will be sent as checks to eligible consumers in the middle of 2021.

Only those Citibank credit card customers who meet certain eligibility criteria will receive a refund check. Consumers who have questions regarding the refund distribution can contact Epiq at (855) 914-4657.

Citibank previously entered into a separate settlement with the federal Consumer Financial Protection Bureau (CFPB) that resolved that agency’s own investigation into allegations Citibank failed to reevaluate and reduce APRs for 1.75 million consumer credit accounts. The CFPB settlement required Citibank to pay a total of $335 million in restitution to affected consumers. Today’s settlement provides additional relief for consumers in New Jersey and four other States.

Deputy Attorney General and Section Chief Patricia Schiripo, of the Consumer Fraud Prosecution Section within the Division of Law’s Affirmative Civil Enforcement Practice Group, handled the Citibank matter on behalf of the State.