Ahead of Year-End Tax Package Negotiations, Gottheimer Releases Report Highlighting Rising NJ Taxes and Lower Home Values Due to SALT Cap

Ahead of Year-End Tax Package Negotiations, Gottheimer Releases Report Highlighting Rising NJ Taxes and Lower Home Values Due to SALT Cap

Calls on Congress to Reinstate SALT Deduction by Year’s End

Focuses on Bipartisan Bill

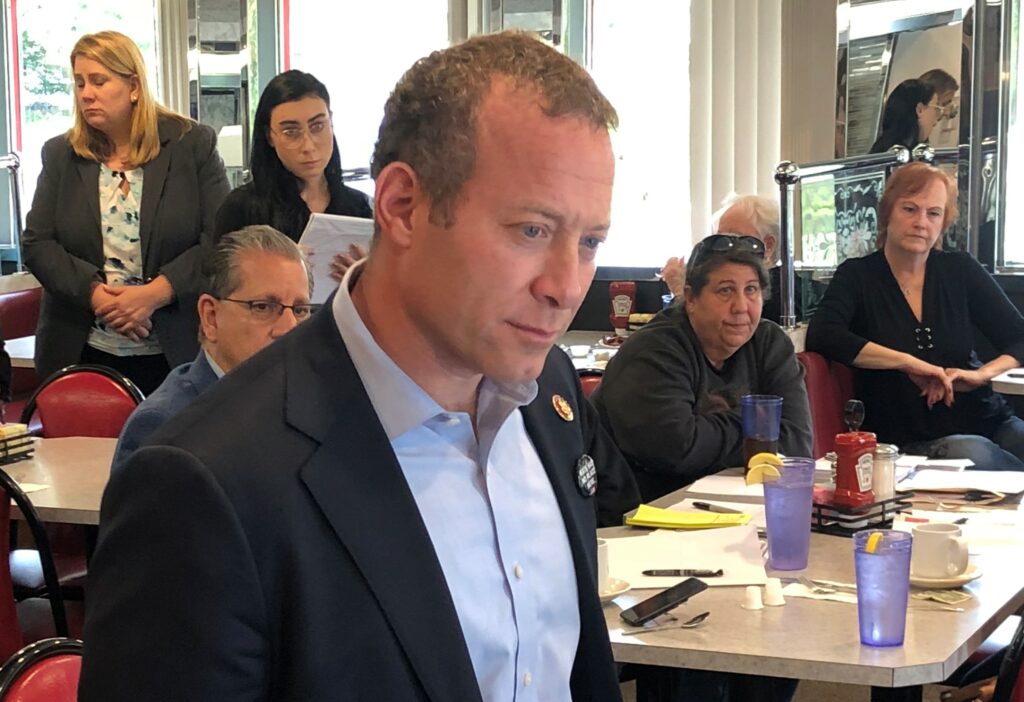

Above: Gottheimer releases a new report, highlighting the negative impacts of the SALT deduction cap on all four counties in the Fifth District.

RIDGEWOOD, NJ – Today, U.S. Congressman Josh Gottheimer (NJ-5) released a new Fact-Based Report on the State and Local Tax Deduction Cap and its Impact on New Jersey’s Fifth Congressional District, citing rising taxes, decreasing home values, and massive outmigration from New Jersey. Right now, congressional leadership is negotiating an end-of-year tax package to correct the many flaws of the 2017 Tax Hike Bill. Today, Gottheimer called for reinstatement of the State and Local Tax (SALT) deduction be included in the year-end package.

“This new report I’m releasing today highlights the incredibly negative impact the Tax Hike Bill and the gutting of the State and Local Tax deduction is having on the hardworking residents, jobs, and home values in all four counties I represent,” said Congressman Josh Gottheimer (NJ-5). “The report also makes the case that we must take action before the end of the year to fully reinstate the SALT deduction, and, once and for all, cut taxes for the families in northern New Jersey. It’s why there is a bipartisan push in our state, and across the country, to fix it, starting with my bipartisan bill co-sponsored by Congressman Lee Zeldin. That’s also why I’m calling on congressional leadership — both Democrats and Republicans — to make sure the reinstatement of SALT is in the year-end tax package currently being negotiated. It’s time for both sides to work together to get this all done. It’s just common sense. Working together, I know we can cut taxes.”

In Congress, Gottheimer has led the introduction of the bipartisan bill, H.R. 4274, to reinstate the State and Local Tax deduction. Additionally, Gottheimer has sought other avenues of tax relief by leading a bipartisan coalition that introduced H.J. Res. 72 which allows Americans in States like New Jersey to deduct more in charitable contributions.

Gottheimer was joined today by Ridgewood Deputy Mayor Susan Knudsen; Randy Lyn Ketive, Vice Chair, New Jersey REALTORS Legislative Affairs Committee; Ralph Albert Thomas, CEO & Executive Director, New Jersey Society of CPAs; Norm Fleischer, Member of the Board, New Jersey Society of CPAs; Fair Lawn Mayor Kurt Peluso; Park Ridge Mayor Keith Misciagna; and Midland Park Mayor Harry Shortway, Jr.

Gottheimer’s Fact-Based Report on the State and Local Tax Deduction Cap and its Impact on New Jersey’s Fifth Congressional District noted the following findings:

- Moocher States like Mississippi, Alabama, and West Virginia all take more from the federal government than they pay in — $4.38, $3.14, and $4.23, respectively, for each dollar they send to Washington. While New Jersey, historically, has only received 77¢ for every dollar we send to the federal government.

- Before the Tax Hike Bill gutted the State and Local Tax deduction, all four counties that make up the Fifth District had an average SALT claim above the $10,000 cap:

- In Warren County, the average deduction was $12,588

- In Sussex County, the average taxpayer claimed $14,267

- In Passaic County, the average deduction was $14,714

- In Bergen County, the average deduction was $24,783

- Nearly 60 percent of New Jersey CPAs said they would advise clients leave New Jersey because of the higher taxes.

- Nearly 80 percent of New Jersey residents complained about higher property taxes.

- New Jersey is the number one state in the nation for outmigration. In fact, twice as many people moved out of New Jersey last year as moved in.

- The SALT deduction cap contributed to reducing average home values in all four counties that make up the Fifth District. In fact, all four District counties are within the top thirty counties nationwide with the largest estimated reduction in home value:

- Bergen County home values are down an estimated 9.9%

- Warren County home values are down an estimated 7.1%

- Sussex County home values are down an estimated 8.2%

- Passaic County home values are down an estimated 9.8%

- The Tax Hike Bill will add $2.3 trillion to our national debt over the next decade.

Moocher States start their budget planning every year with the expectation of our dollars from the federal government. For instance, nearly 50 percent of Louisiana’s state revenue comes from federal funds; in Mississippi, it’s 42 percent; and in Alabama, it’s nearly 40 percent. Compare that to only 27 percent in the Garden State.

Gottheimer’s full remarks as prepared delivery are below.

I’m here today to release a new report — my Fact-Based Report on the State and Local Tax Deduction Cap and its Impact on New Jersey’s Fifth Congressional District. It highlights the incredibly negative impact the Tax Hike Bill is having on people, jobs, and home values in all four counties I represent. The report also makes the case, like you just heard from everyone today, about why we must take action before the end of the year to fully reinstate the State and Local Tax Deduction, and, once and for all, cut taxes for the families in northern New Jersey. It’s also why there has been such a strong, bipartisan push in our state, and across the country, to fix it, starting with my bipartisan legislation — the cutting local taxes by reinstating salt act.

Right now, as congressional leadership are considering a year-end tax package to correct all the problems created by the Tax Hike Bill, why would they not include a fix to the biggest problem – fixing the State and Local Tax deduction cap?

New Jersey couldn’t ask for a better gift for this holiday season.

What’s clear is that since the Red States jammed us with the Tax Hike Bill, our state and property taxes here in New Jersey are through the roof, people are leaving New Jersey in droves, and our home values are plummeting.

Before we all voted “No” on the Tax Hike Bill, back in 2017, we all said that it would kill property values in New Jersey and raise taxes. Everyone here actually.

The Fact-Based Report on the State and Local Tax Deduction Cap I’m releasing today only reinforces that. There are facts in black and white and you will hear them reinforced by the accountants, mayors, and realtors here today.

This isn’t a pretty picture for Jersey. It’s time to stand up to the Moocher States who have literally robbed us blind and put our state and others at a significant disadvantage. The Red States made out like bandits and got tax relief for themselves – and we in Jersey paid for it.

It’s time we said enough is enough to the Moocher States – we aren’t going to pay your bills anymore.

We have to fix this. We have to reinstate SALT this year, and cut our taxes. We simply can’t afford to delay.

The report I’m releasing today reinforces the massive tax hike on our families and businesses, not only on our property and state income taxes, but on home equity loan deductions and slashed the mortgage interest deduction.

Before the bill gutted our State and Local Tax deduction, all four counties I represent had an average SALT claim above the $10,000 cap.

In Warren County, the average deduction was $12,588. In Sussex County, the average taxpayer claimed $14,267. In Passaic County, the average deduction was $14,714.

Here in Bergen, the average taxpayer claimed $24,783 in State and Local Taxes – more than half of which is now subject to double taxation under the recent law. That’s something we’ve never believed in – double taxation, and it’s why the deduction dates back to 1913.

But now, with the Tax Hike Bill, we have the $10,000 cap — completely whacking each county in North Jersey with a two-by-four.

It’s outrageous and it’s making living here and doing business here just too expensive.

The data backs it up: a Rutgers-Eagleton poll found that 79 percent of New Jersey homeowners complained about higher property taxes.

In addition, according to the New Jersey Society of Certified Public Accountants, nearly 60 percent of New Jersey CPAs said they would advise clients leave New Jersey because of the higher taxes.

That’s right, they would tell their clients to move out. And that’s what’s happening. Just this week, a recent survey done by Fairleigh Dickinson University and Garden State Initiative found that nearly half of all New Jersey residents are planning to leave the state in the “not so distant future” with some of those planning to leave within the next five years. High property taxes and a high cost of living were cited as the main reasons for survey respondents.

Right now, New Jersey is the number one state in the entire nation for outmigration. Twice as many people moved out of New Jersey last year as moved in. This is terrible for our families, our economy, and our businesses. Jobs, not just people, are leaving.

When families try to move, they’re having trouble selling their home, too — all because of the $10,000 cap on our state and local tax deductions. This cap is drastically reducing the average value of homes in counties across our state.

According to a recent report from Moody’s Analytics studying the county-by-county home price impact of the Tax Hike Bill, Bergen home values are down an estimated 9.9%. In Warren, it’s down 7.1%. In Sussex, it’s down 8.2%. In Passaic, it’s down 9.8%. All four counties District are within the top thirty counties nationwide with the largest estimated reduction in home value. Yes, and Randy made this point, you heard that stat right.

It’s offensive.

Just as a quick reminder, just so we don’t forget, this double taxation grenade was lobbed at New Jersey by the Moocher States.

In fact, the only way they footed the bill was to gut the SALT deduction. The Moocher States stole more than $668 billion dollars out of our pockets here in the SALT states.

This isn’t a new concept. For decades, they’ve taken our federal tax dollars and had us pay their budgets and pay to fix their roads, and now they’ve taken our SALT dollars. Moocher

For states like Mississippi, this was just one huge hand-out. As the report show, states like Mississippi historically receive $4.38 for every dollar they send to Washington, compared to about 70 cents in New Jersey. We’re on the path to fixing that here in the Fifth District, up 57 percent, but there’s more to do.

To put a fine point on this, the Moocher States start their budget planning every year with the expectation of our dollars from the federal government. For instance, nearly 50 percent of Louisiana’s state revenue comes from federal funds; in Mississippi, it’s 42 percent; in Alabama, it’s nearly 40 percent. Compare that to only 27 percent in the Garden State. It must be nice to have us pick up the tab.

I think we all know, especially this Thanksgiving week, that this is all for the birds.

My challenge to the Moochers – DON’T take one more dime than you put into the pot. Yes, do the fiscally responsible thing Red States claim they believe in – don’t take more than you put in. Make that pledge.

This seems like a pretty fiscally responsible concept to me and, of course, gives us our SALT back, which — again — dates back more than 100 years. State and local taxes have been deductible since the inception of the federal income tax in 1913.

I’m calling on those Red States to not take one more dime than they put in.

One more point. To add insult to injury, at the end of the day, all of the rosy predictions about the tax hike bill haven’t panned out. It’s estimated that the Tax Hike Bill will add $2.3 trillion to our national debt over the next decade, at a time when the debt already exceeds $20 trillion. And the growth numbers are a fraction of what was predicted, the GDP grew at an annual rate of about 2%.

So, enough is enough. New Jersey has paid more than its fair share of taxes. Let’s reinstate SALT. And let’s keep fighting against the heavy hand of the IRS that keeps playing games, like they did when they moved to block New Jersey and others from utilizing the charitable tax deduction — something that’s been in place for decades, and use in 33 other states, most red states, to provide families with tax relief.

I helped lead not one, but two bipartisan resolutions overturning the harmful Treasury regulations that have been aimed at restricting residents here in Jersey from deducting charitable contributions on their federal taxes.

Thankfully, New Jersey, New York, and other states decided to filed suit against the Treasury Department and the IRS over the SALT cap and the charitable deduction, since Congress didn’t give the IRS permission to interpret the tax law as they see fit.

I will not stop there.

It is imperative we work together to get our tax policy right. Our hardworking families need real tax relief now.

I am calling on congressional leadership — Democrats and Republicans — as part of the tax package being considered, to restore the SALT deduction before this year’s end and give Americans the tax relief they deserve.

This is a fight for North Jersey, for North Jersey families, and for New Jersey’s future. To make life more affordable for our district.

It’s time for both sides to work together – Democrats and Republicans – to get this all done. It’s just common sense. Working together, we can cut taxes.

We are blessed to live in beautiful, safe communities like this one, in a state we all love so much.

If we work together, I know that, in the greatest country in the world, our best days will always be ahead of us.

Thank you, happy thanksgiving, God bless you, and may God continue to bless the United States of America.

###