Gottheimer Delivers Investment Priorities for North Jersey Families — Keeping Health Care Costs Down, Protecting Our Water, Supporting Law Enforcement, Securing Houses of Worship

RELEASE: Gottheimer Delivers Investment Priorities for North Jersey Families — Keeping Health Care Costs Down, Protecting Our Water, Supporting Law Enforcement, Securing Houses of Worship

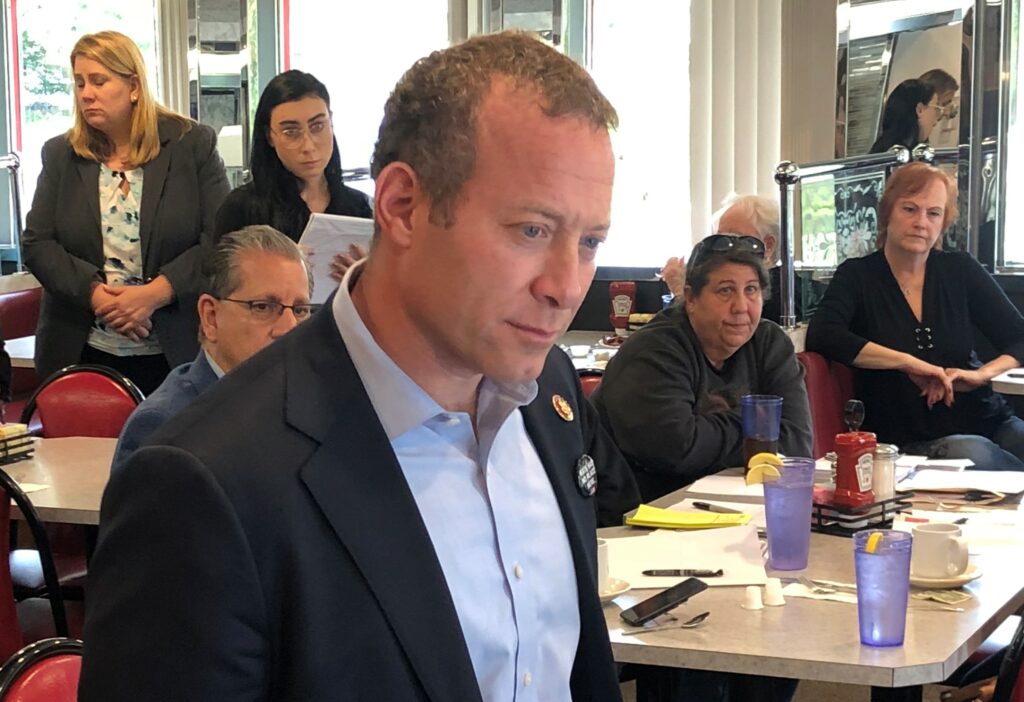

WASHINGTON – Today, Tuesday, December 17, 2019, U.S. Congressman Josh Gottheimer voted to pass a package of vital federal investments to benefit all North Jersey families, including a 3.1 percent pay increase for all military service members; repeals of the “Cadillac” Tax, the Medical Device Tax, and the Health Insurance Tax; increases in security grants for protecting churches and temples; investment in grants for first responder hiring, training, and safety; equipment investment in combating e-cigarette use; risk insurance from terrorist attacks; flood insurance; investment in securing our strategic ally Israel; and investing in clean drinking water.

“It’s already expensive enough to live and do business in North Jersey. With this bipartisan federal investment that I helped pass in the House, we’re clawing more of our federal tax dollars back to New Jersey for our hard-working families,” said Congressman Josh Gottheimer (NJ-5). “I’m proud to be fighting to bring back this investment to help our communities ensure our drinking water is clean, our first responders have the safety equipment they need, help keep health care costs down, and help ensure our houses of worship are protected.”

The bipartisan federal investment bill which passed the House today will:

- Increase pay for all military service members by 3.1 percent

- Keep health care costs down by:

-

- Repealing the Medical Device Tax, a 2.3% excise tax on the price of taxable medical devices sold in the U.S., including X-ray machines, hospital beds, and MRI machines;

-

- Repealing the excessive health care “Cadillac Tax” surcharge, a 40 percent tax levied on employer health insurance plans above certain thresholds set to go into effect in 2022, which would cause health care costs to increase for one in five Americans;

-

- Repealing the Health Insurance Tax, which is a tax on health insurance plans that would whack New Jersey families and small businesses with increased premiums.

- Protect children and families from lead water by:

-

- Increasing investment for both the Clean Water and Drinking Water State Revolving Funds.

- Secure churches, temples, mosques, and schools by:

-

- Increasing investment in the Federal Emergency Management Agency’s (FEMA) Nonprofit Security Grant Program, which provides security for certain tax-exempt organizations that are at risk of an attack from homegrown and lone-wolf terrorists.

- Help hire, train, and provide needed safety equipment for first responders

- Combat e-cigarette and tobacco use by:

-

- Raising the minimum purchase age of tobacco to 21;

-

- Increasing Health and Human Services (HHS) investment in state-wide education campaigns to address tobacco and e-cigarette use.

- Protect North Jersey’s businesses, hospitals, schools, and major landmarks from terrorist attacks with Terrorism Risk Insurance (TRIA)

- Protect North Jersey communities and families from drowning in flood insurance premiums

- Secure American interests in the Middle East by:

-

- Ensuring investment for Israeli cooperative research and development programs, including David’s Sling and Arrow-3.

###