Gottheimer, Suozzi, Young, Garbarino Announce New Bipartisan SALT Caucus to Fight for Tax Relief for Middle Class Families

Gottheimer, Suozzi, Young, Garbarino Announce New Bipartisan SALT Caucus to Fight for Tax Relief for Middle Class Families

32 Democrats and Republicans join

WASHINGTON, DC — Today, April 15, 2021, U.S. Representatives Josh Gottheimer (NJ-5), Tom Suozzi (NY-3), Young Kim (CA-39), and Andrew Garbarino (NY-2) announced the formation of the new bipartisan SALT Caucus to advocate for new tax relief from Congress.

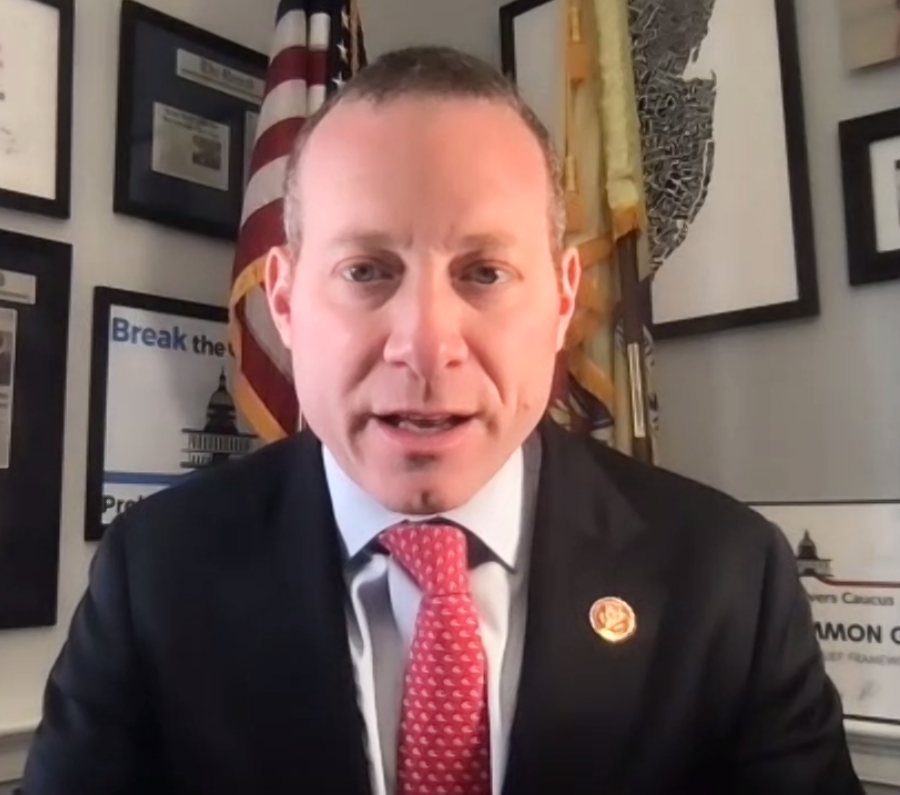

“We’re formally launching a new bipartisan group — the SALT Caucus — because, for all our Members, and for the tens of thousands of middle class families we represent, it is high time that Congress reinstates the State and Local Tax deduction, so we can get more dollars back in to the pockets of so many struggling families — especially as we recover from the pandemic,” said Rep. Josh Gottheimer, SALT Caucus Co-Chair. “This bipartisan group we’re founding today, with members from coast to coast and across the political spectrum, are all banding together to reinstate the State and Local Tax deduction, to find a way to get this done in Congress, and to actually get tax relief for the hard working middle class families we represent.”

“Our effort to restore the SALT deduction is gaining momentum. Together, Democrats and Republicans alike, we will advocate for the restoration of the SALT deduction and highlight the middle class families who have been unfairly hurt by the cap,” said Rep. Tom Suozzi, SALT Caucus Co-Chair. “The cap on the SALT deduction has been a body blow to New York and middle-class families throughout the country. At the end of the day, we must fix this injustice.”

“Hardworking Californians in the 39th District and across my home state have been burdened enough by high state and local taxes. It is estimated that in the 2022 tax year, California’s 39th District will pay on average more than $640 million due to the SALT cap,” said Rep. Young Kim, SALT Caucus Co-Chair. “I am proud to fight for lower taxes for my constituents as Co-Chair of the SALT Caucus and am looking forward to working together to ensure California workers and families can keep more of their hard-earned money.”

“The SALT cap penalizes working class Long Islanders. From firefighters to police officers, to teachers, to nurses, and small business owners, I hear from people every day about what a crushing blow the SALT cap has delivered them. I’m proud to be a Co-Chair of the bipartisan SALT Caucus to fully restore the deduction once and for all,” said Rep. Andrew Garbarino, SALT Caucus Co-Chair.

“A critical component of our overall economic recovery must be the repeal of the state and local tax deduction cap that was imposed by the 2017 tax law,” said Rep. Mikie Sherrill, SALT Caucus Vice Chair. “There is a misconception that the SALT deduction doesn’t help middle class families. But in high cost of living areas like my district, SALT does in fact make a critical difference in helping make ends meet for our middle class residents like teachers and law enforcement officers, who depend on this deduction to afford the high cost of living in our area. To be clear, the 2017 tax bill specifically targeted states and communities like mine that have prioritized key investments in our public schools, living wages for workers, environmental protections, the list goes on. I’m proud to be launching this bipartisan caucus to ensure we deliver a win on this issue for families in New Jersey and across the country.”

“The cap on the state and local tax deduction hurts middle class California families,” said Rep. Katie Porter, SALT Caucus Vice Chair. “During the coronavirus pandemic, our state and local governments have led public health efforts on testing and vaccines—a potent reminder of the important work they do. Restoring the state and local tax deduction, which has been in our tax code since its inception, gives taxpayers and communities the ability to invest in their priorities and levels the playing field across states for federal taxation.”

“Counties are on the front lines of the COVID-19 pandemic, supporting nearly 1,000 hospitals, more than 1,900 public health authorities and other services essential to residents’ safety and well-being. The human and financial impacts of addressing this health and economic emergency are staggering,” said National Association of Counties Executive Director Matthew Chase. “We applaud the formation of this bipartisan caucus committed to repealing the state and local tax deduction cap, which would reinstate our local control of our tax systems and strengthen the ability of our counties and local communities to deliver essential public services, such as emergency response, public health and infrastructure.”

The SALT Caucus leadership consists of:

Co-Chair Josh Gottheimer (NJ-5)

Co-Chair Tom Suozzi (NY-3)

Co-Chair Andrew Garbarino (NY-2)

Co-Chair Young Kim (CA-39)

Bill Pascrell, Jr. (NJ-9), SALT Caucus Vice Chair

Katie Porter (CA-45), SALT Caucus Vice Chair

Mikie Sherrill (NJ-11), SALT Caucus Vice Chair

Jamie Raskin (MD-08), SALT Caucus Vice Chair

Chris Smith (NJ-04), SALT Caucus Vice Chair

Lauren Underwood (IL-14), SALT Caucus Vice Chair

The other founding members of the SALT Caucus include: Reps. Danny Davis, Nicole Malliotakis, Julia Brownley, Judy Chu, Lee Zeldin, Michelle Steel, Mike Levin, Jimmy Panetta, Jimmy Gomez, Brian Higgins, Jerry Nadler, Tom Malinowski, Jeff Van Drew, Alan Lowenthal, Anna Eshoo, Andy Kim, Ted Lieu, Brad Schneider, John Larson, Eleanor Holmes Norton, Mike Garcia, and Gregory Meeks.

###