Many Paid More in Federal Taxes This Tax Season, Says NJCPA Survey

Many Paid More in Federal Taxes This Tax Season, Says NJCPA Survey

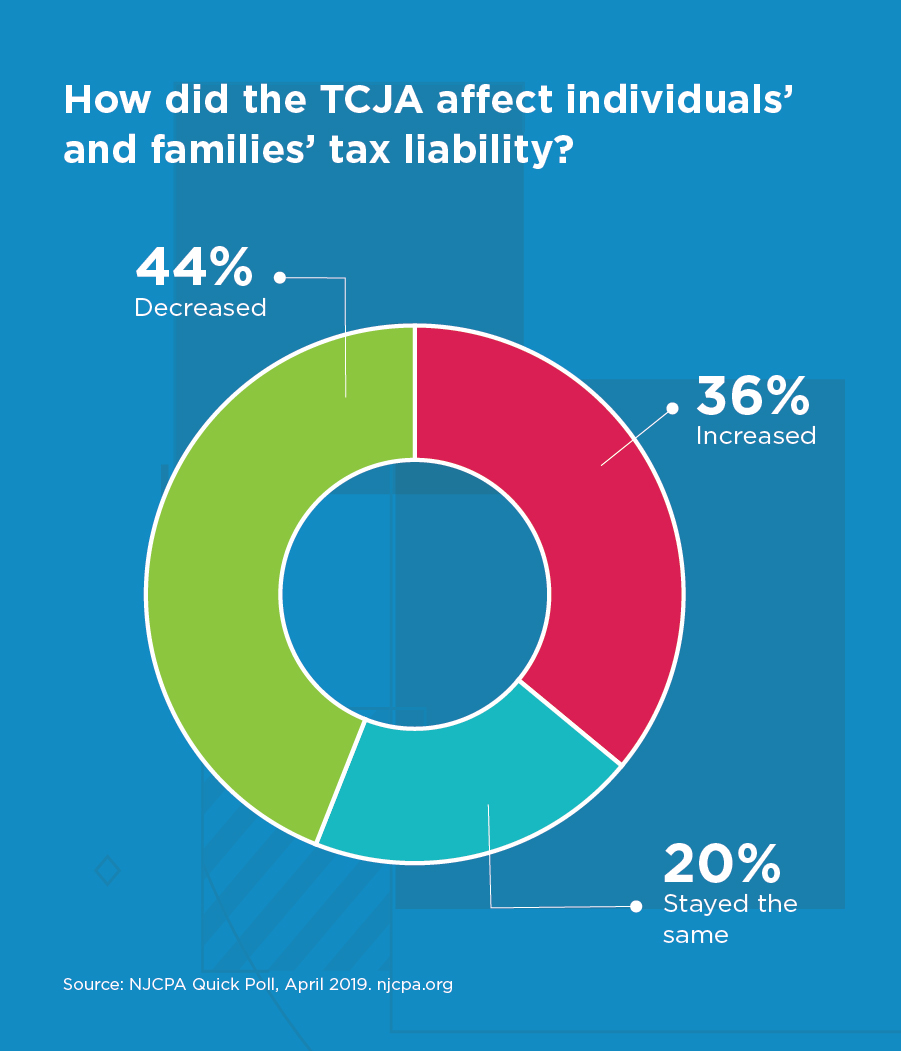

ROSELAND, N.J. – In a New Jersey Society of Certified Public Accountants’ (NJCPA) survey of more than 500 CPAs taken after tax season in April, an average of 36 percent of their clients paid more in federal taxes in 2018. The NJCPA conducted the survey to determine the impact of the Tax Cuts and Jobs Act (TCJA) on individual and family clients’ federal tax liability this tax season.

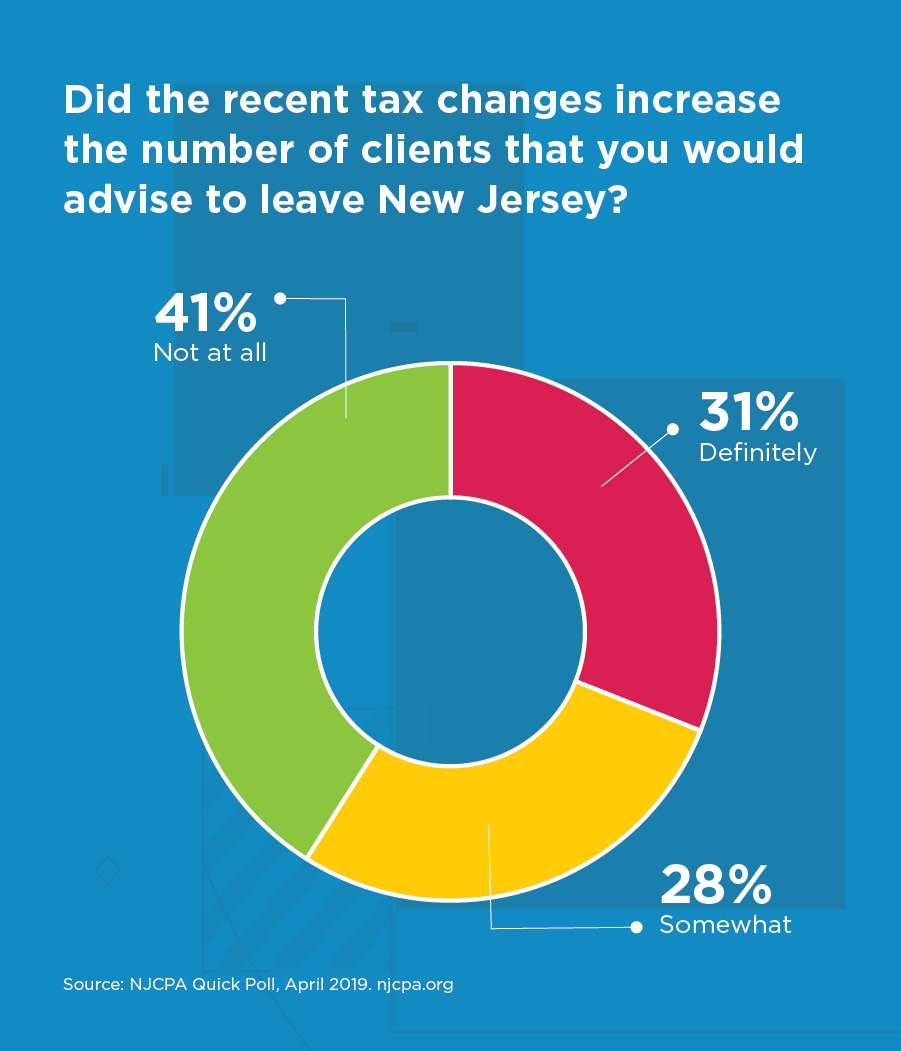

Nearly 60 percent of respondents said that the TCJA either “definitely” or “somewhat” increased the number of clients that they would advise to leave the state. The TCJA’s cap on state and local tax (SALT) deductions has led many taxpayers to consider selling property or leaving the state.

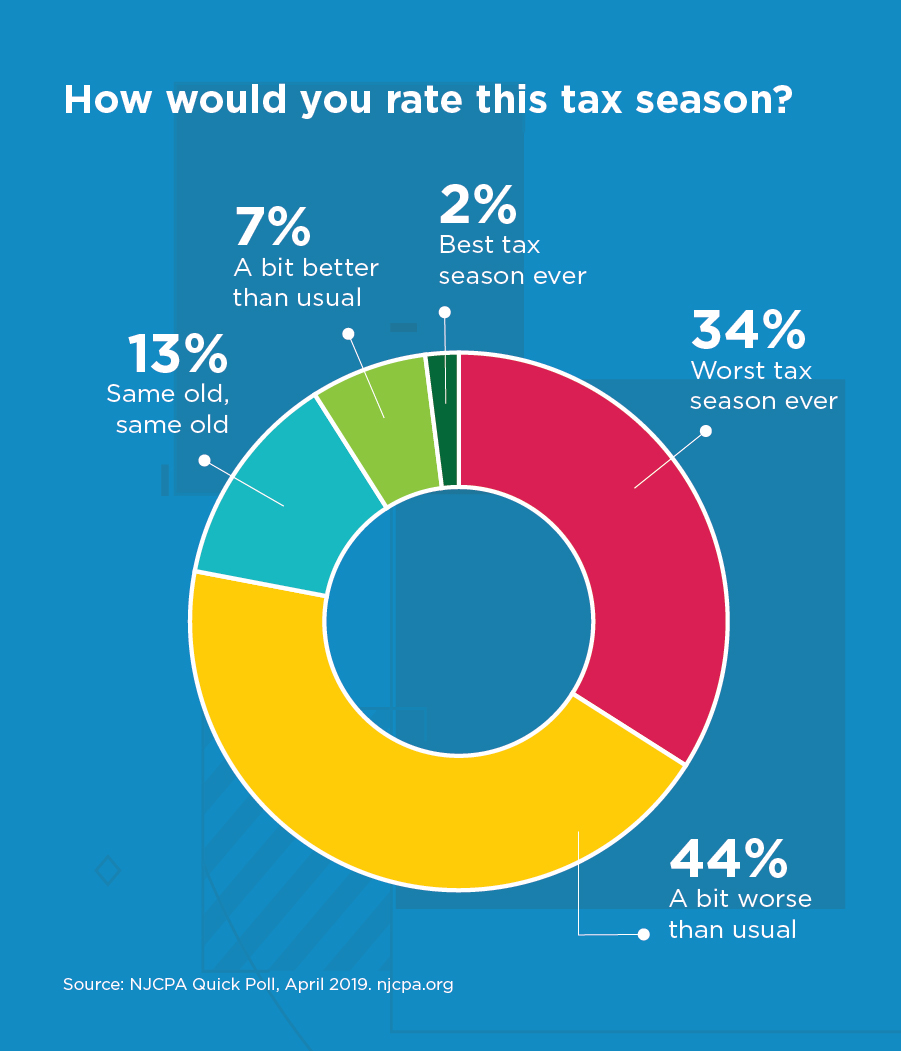

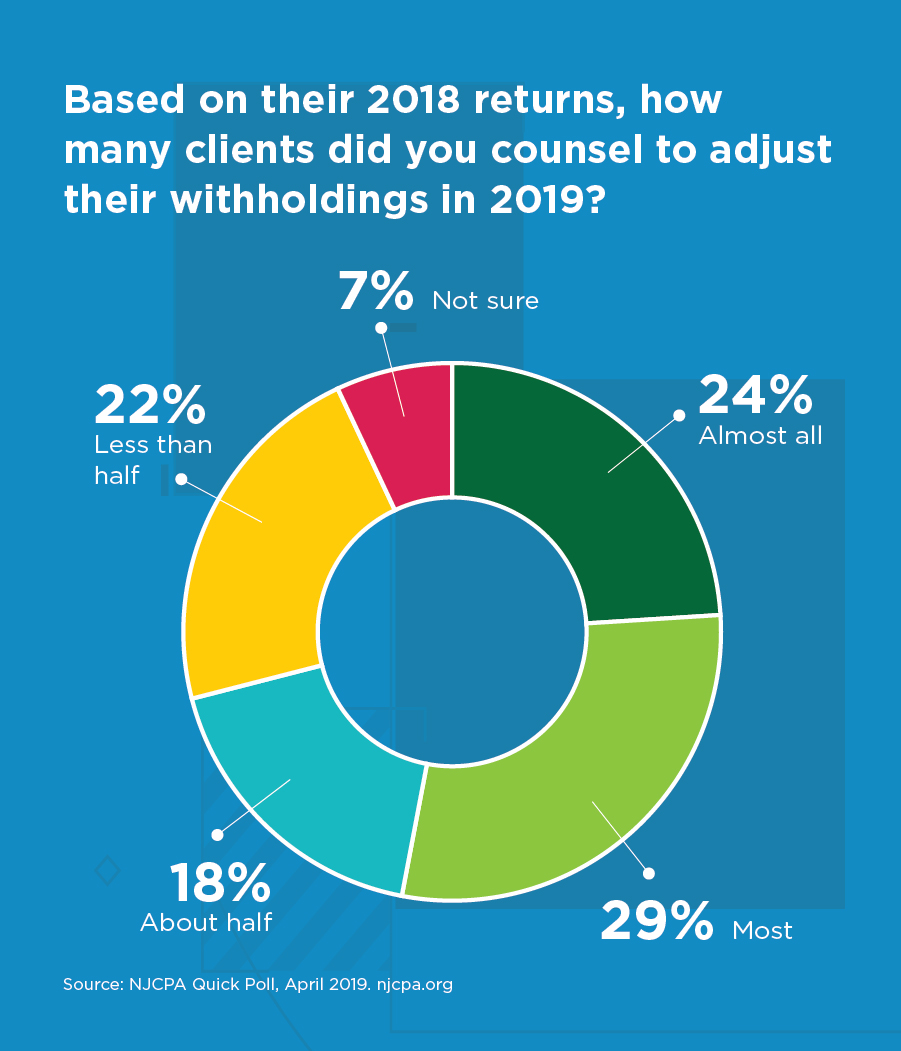

More than 75 percent of respondents noted that this tax season was worse than prior years, with 34 percent noting that it was the “worst tax season ever.” Additionally, nearly 30 percent of the CPAs surveyed said they counseled “most” of their clients to adjust their withholdings in 2019 based on their 2018 tax returns, while 24 percent said they counseled “almost all” of their clients to adjust.

“Surveys like these show the value that CPAs bring to the table and the importance of tax consequences on individuals and corporations,” according to Ralph Albert Thomas, CPA (DC), CGMA, CEO and executive director of the NJCPA. “New Jersey is high-tax state, and our residents did not benefit nearly as much from the tax reform package as many other states. We need to work together on both the federal and state levels to improve the tax inequities so that individuals and companies will stay in New Jersey and thrive.”

# # #

The New Jersey Society of Certified Public Accountants, with more than 14,500 members, represents the interests of the accounting profession and advances the financial well-being of the people of New Jersey. The NJCPA plays a leadership role in supporting the profession by providing members with educational resources, access to shared knowledge and a continuing effort to create and expand professional opportunities.