Menendez, Cassidy Introduce Bicameral, Bipartisan Bill to Reform National Flood Insurance Program

Menendez, Cassidy Introduce Bicameral, Bipartisan Bill to Reform National Flood Insurance Program

Legislation would reform NFIP, ensure affordability and sustainability, and invest in mitigation and prevention

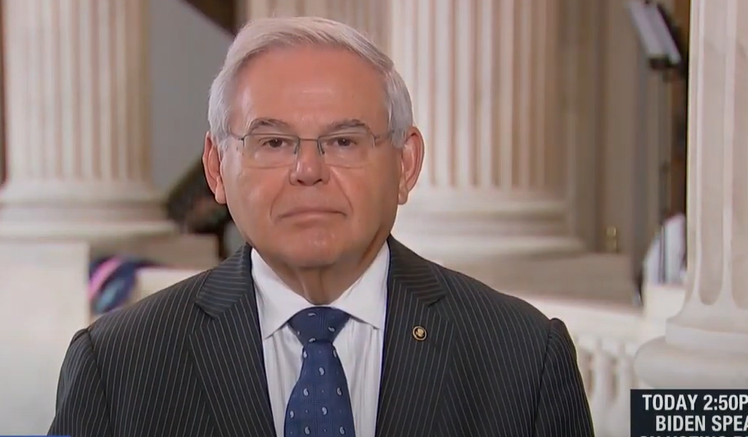

WASHINGTON, D.C. – U.S. Senators Bob Menendez (D-N.J.) and Bill Cassidy (R-La.) today announced the introduction of their bipartisan, bicameral legislation to extend the National Flood Insurance Program (NFIP) for five years, while implementing a series of sweeping reforms to address the waste, abuse and mismanagement plaguing the system. Over five million Americans depend upon the NFIP, including 220,000 New Jerseyans. Congressman Frank Pallone, Jr. (D-N.J.) sponsored the bill in the House of Representatives.

“It is time Congress stops kicking the can down the road with reauthorizations that do not address the systemic problems plaguing this program. With this legislation, we can make NFIP more sustainable, we can make flood insurance more affordable, and we can hold FEMA and its private contractors more accountable,” said Sen. Menendez. “And instead of waiting for the next disaster to strike, we can invest in mitigation that prevents costly flood damage in the first place.”

“We need to reform the NFIP to ensure it is affordable and accessible for the homeowner, accountable to the taxpayer, and sustainable for the future,” said Dr. Cassidy. “This bill is full of real solutions to achieve these goals.”

The National Flood Insurance Program Reauthorization and Reform Act tackles systemic problems with flood insurance, puts it back on solid fiscal ground, and reframes the nation’s entire disaster paradigm to one that focuses more on prevention and mitigation in order to spare the high cost of rebuilding after flood disasters.

Risk Rating 2.0, the Federal Emergency Management Agency’s (FEMA) new rating system, went into effect earlier this month, which is expected to raise premiums on 80% of NFIP policyholders nationwide. Around 900,000 policyholders are expected to drop their insurance because of the hikes. Last month, Sen. Menendez called on FEMA to delay the implementation of Risk Rating 2.0.

Sens. John Kennedy (R-La.), Cory Booker (D-N.J.), Cindy Hyde-Smith (R-Miss.), Marco Rubio (R-Fla.), Roger Wicker (R-Miss), Chris Van Hollen (D-Md.) and Kirsten Gillibrand (D-N.Y.) are cosponsors of the legislation.

“Roughly half-a-million Louisianians depend on flood insurance to safeguard their homes and businesses,” said Sen. Kennedy. “The National Flood Insurance Program protects workers and families who need to take care of their biggest investments—their homes. We have to extend this program and protect it from political games.”

“After experiencing devastating and historic flooding events over the past months, New Jerseyans know just how important flood insurance is to their long-term stability and peace of mind,” said Sen. Booker. “I’m proud to join this bipartisan, bicameral legislation to reauthorize our nation’s flood insurance program and make it more affordable for low-income families while at the same time ensuring that we invest in flood mitigation efforts to make communities more resilient to the growing and devastating effects of climate change.”

“Flooding poses a consistent threat throughout Mississippi and fundamental problems within the National Flood Insurance Program causes unneeded economic and emotional trauma for thousands of families,” said Sen. Hyde-Smith. “It’s time we get serious about fixing what’s wrong with the program, while implementing reforms that will benefit taxpayers and policyholders over the long term.”

“Flood insurance is a necessity in Florida, and getting the National Flood Insurance Program (NFIP) on track to fiscal sustainability is critical to ensuring millions of policyholders maintain coverage,” said Sen. Rubio. “In light of the Biden Administration’s decision to proceed with the chaotic rollout of Risk Rating 2.0, Congress must take real action now to reform the program. This legislation would provide a five-year reauthorization and create stability for millions of policyholders across the state and nationwide.”

“The NFIP is a lifeline for many Mississippi communities that remain at risk of flooding,” said Sen. Wicker. “After an active season of floods, it is clear that the NFIP not only needs to be reauthorized, but also that it needs to be reformed to make it work better for taxpayers and policyholders alike.”

“In this climate crisis, extreme weather events and subsequent flooding are unfortunately now the norm, causing substantial damages and devastation,” said Sen. Gillibrand. “It is essential that Congress brings down the cost of flood insurance, streamlines the program in order to make it easier for families to navigate and refocuses the program on prevention and mitigation. This bill will help us lay the foundation for a stronger, more sustainable future.”

Sens. Menendez and Booker and Congressman Bill Pascrell, Jr. (N.J.-09), a cosponsor of the bill in the House, outlined the legislation at a press conference in Paterson, N.J. last week on the nine year anniversary of Superstorm Sandy.

The National Flood Insurance Program Reauthorization and Reform Act provides:

· Long-Term Certainty. Reauthorizes the NFIP for five years, providing certainty for communities.

· No Steep Rate Hikes under Risk Rating 2.0. Protects policyholders from exorbitant premium hikes by capping annual increases at 9%. Currently, premiums can nearly double every 4 years and FEMA’s new methodology called Risk Rating 2.0 will fundamentally alter premiums on every policy in the country. This new methodology plans to cause a rate shock and lead to unaffordability premiums, forcing homeowners to drop coverage or lose their homes. CBO and FEMA believe that Risk Rating 2.0 will cause nearly 900,000 policyholders to drop NFIP coverage due to the rapid premium increases. We saw all too clearly the negative consequences of hiking premiums after the Biggert-Waters Act of 2012 caused costs to skyrocket, hurting policyholders and disrupting the real estate market. This will put guardrails on FEMA’s new rating methodology, known as Risk Rating 2.0, and safeguard policyholders from sudden rate shocks while responsibly disclosing full flood risk.

· Affordability for Low- and Middle-Income Policyholders. Provides a comprehensive means-tested voucher for millions of low- and middle-income homeowners and renters if their flood insurance premium become overly burdensome, significantly increasing the affordability of the NFIP program.

· Path to NFIP Solvency. Freezes interest payments on the NFIP debt and reinvests savings towards cost saving mitigation efforts to restore the program to solvency and reduce future borrowing

· Limits on Private Insurance Company Profits. Caps Write Your Own (WYO) compensation at the rate FEMA pays to service its own policies and redirects the savings to pay for the means-tested affordability program.

· Increased Cost of Compliance (ICC) Coverage. Increases the maximum limit for ICC coverage to better reflect the costs of rebuilding and implementing mitigation projects. In addition, ICC coverage eligibility is expanded in order to encourage more proactive mitigation before natural disasters strike.

· Strong Investments in Mitigation. Provides robust funding levels for cost-effective investments in mitigation, which have a large return on investment and are the most effective way to reduce flood risk.

· More Accurate Mapping. Increases funding for FEMA’s flood mapping program to implement Light Detection and Ranging (LiDAR) technology for more accurate flood risk across the country, generating data that will lead to better building and land use.

· Oversight of Write Your Own (WYO) Companies. Creates new oversight measures for insurance companies and vendors, and provides FEMA with greater authority to terminate contractors that have a track record of abuse.

· Claims and Appeals Process Reforms Based on Lessons from Sandy. Fundamentally reforms the claims process based on lessons learned in Superstorm Sandy and other disasters, to level the playing field for policyholders during appeal or litigation, bans aggressive legal tactics preventing homeowners from filing legitimate claims, holds FEMA to strict deadlines so that homeowners get quick and fair payments, and ends FEMA’s reliance on outside legal counsel from expensive for-profit entities.

Sen. Menendez has been the leading advocate in Congress for an overhaul of the National Flood Insurance Program (NFIP), since Superstorm Sandy devastated New Jersey nearly nine years ago.

In June, Sens. Menendez and Kennedy introduced the National Flood Insurance Program Consultant Accountability Act, which would enhance the Federal Emergency Management Agency’s (FEMA) ability to protect homeowners from parties found guilty of fraud that involved in NFIP property damage assessment.

In 2019, the he introduced the National Flood Insurance Program Reauthorization and Reform (NFIP Re) Act of 2019 to reform the NFIP and ensure affordability.

Sen. Menendez first exposed the problem of widespread lowballing of flood insurance claims during Congressional hearings he chaired in 2014, and then successfully pushed FEMA to reopen every Sandy flood insurance claim for review, which compensated Sandy victims with more than $260 million in additional payments they were initially denied.

Sen. Menendez authored the Superstorm Sandy Relief and Disaster Loan Program Improvement Act, which extended and expanded access to federal disaster loans through the U.S. Small Business Administration (SBA). His Homeowner’s Flood Insurance Affordability Act was signed into law in 2014 to address skyrocketing rates many Sandy survivors were encountering. In 2013, he shepherded the original $60 billion federal Sandy aid package through Congress.

A copy of the bill text can be found here. A copy of the bill’s section by section can be found here.