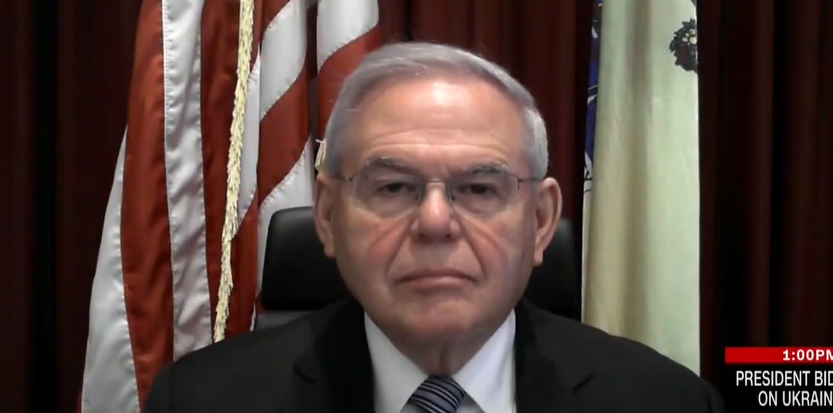

Menendez Statement on Biden Administration’s Actions on Student Debt Cancellation

Menendez Statement on Biden Administration’s Actions on Student Debt Cancellation

JERSEY CITY, N.J. – U.S. Senator Bob Menendez (D-N.J.) released the following statement after President Joe Biden announced the federal government will cancel $20,000 in student debt for borrowers who attended college on Pell Grants and $10,000 for those who didn’t receive these grants, with forgiveness limited to those making less than $125,000 annually. Since President Biden took office, Sen. Menendez has called for him to use his authority to cancel up to $50,000 in student loans debt.

“I commend President Biden for not only extending the student loan payment pause, but also cancelling up to $20,000 for many federal borrowers who attended college with Pell Grants and $10,000 for those who didn’t receive these grants during school. As a result of my work with Senator Warren in authoring and passing the Student Loan Tax Relief Act, which was successfully included in the American Rescue Plan last year, millions of Americans will not face a surprise tax bill next year because of the President’s historic decision to cancel student debt.

“For many who have long postponed buying their first home, opening a small business, or even starting a family because of their student debt, today’s announcement will make a profound difference and help unleash the economic potential of thousands of student borrowers in New Jersey and millions across the country. While this is not the full cancellation amount I have advocated for, I do urge the Biden Administration to seize this opportunity to develop and implement a unified plan for improving federal student loan programs, including addressing longstanding issues with income based repayment (IBR), public service loan forgiveness (PSLF), and problems with federal student loan servicers. By waiting to restart student loan payments until a unified plan is in place, the Administration would provide transformative economic relief with minimal disruptions to borrowers.”

###