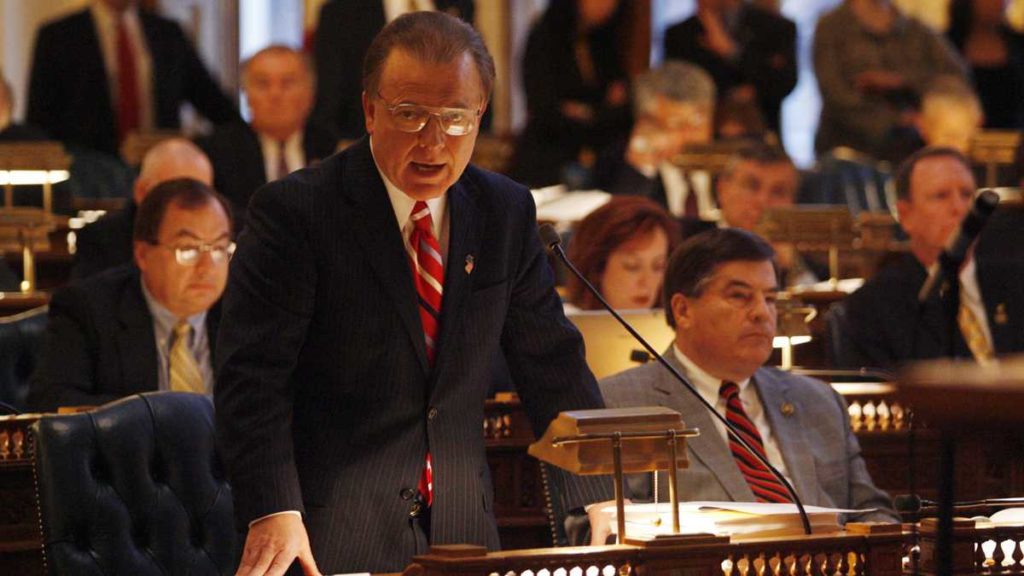

Pennacchio Calls for Tax Incentive Reform, Greater Transparency at Committee Hearing

| Pennacchio Calls for Tax Incentive Reform, Greater Transparency at Committee Hearing

Sen. Pennacchio: “The State should not be in the business of picking winners and losers in the private sector.” Sen. Joe Pennacchio (R-26,) a member of the Senate Economic Growth Committee, today once again called for greater oversight and accountability of tax incentive programs and the NJ EDA, including the Garden State Film and Digital Media Jobs Act. Below are Sen. Pennacchio’s remarks as prepared for delivery during the Feb. 11, 2019 joint meeting of the State Senate Economic Growth and Assembly Commerce and Economic Development Committees: “We are here today to discuss the quote ‘oversight and effectiveness’ of the NJ EDA’s tax incentive programs. “I think that it’s pretty clear from the comptroller’s report last month that “effective” is not a word that any of us would use to describe many of the tax incentives that have been doled out in recent years. “And certainly, there should have been MUCH more oversight of the dollars that were distributed on the backs of our taxpayers. If anyone deserves a tax break, it’s them. As the comptroller’s report illustrated, the extreme lack of oversight has created an environment that is ripe for abuse. “There is one stark example of this that I feel we have a duty to address today – and that is the recent signing of the Garden State Film and Digital Media Jobs Act. “I can’t imagine how any elected official can call tax incentive reform in one breath, and then dole out millions to Hollywood millionaires in the next. “New Jersey faces serious financial challenges. We have the highest property taxes in the country. Our schools are still underfunded, and so are our public employee pension and health benefit systems. “We simply cannot afford to spend money on a single tax incentive program that doesn’t create jobs or produce revenue. “The Garden State Film and Digital Media Jobs Act is a giveaway to special interest groups who have no interest in the long-term financial wellbeing of our state. “Why even call it a tax incentive program? As designed, the program does not give these companies any reason to invest more money into our economy than they have previously spent. It is, in my view, an unconscionable waste of State resources. “Go back and take a look at the fiscal note of that law. OLS is on record as saying that there is absolutely no proof that it will produce a return on investment. “Multiple studies have also shown that in other parts of the country, film industry tax incentive programs simply don’t pay off. “The first study, published by the journal The American Review of Public Administration, ‘examined the impact of the programs on states’ motion picture industry employment and wages. Thom found that the incentives had no sustained impact on wage growth and little effect on employment. The programs also failed to prompt an expansion or relocation of filmmaking businesses from concentrations in California and New York.’ “The second study, published the journal American Politics Research, ‘examined why states kept or terminated their incentives from 1999 to 2015. States that slashed the incentives already had spent very little or had grown skeptical that the program wasn’t working, the researchers found.’ “In fact, more than a dozen states have discontinued film tax credits in recent years, according to the National Conference of State Legislators. “By greenlighting tax incentives for the film industry, New Jersey wasted at least $425 million on companies that will at best, make a temporary investment in our communities before laying off workers and heading back to the Hollywood Hills. “For $425 million, we could have hired more than 6,000 additional special education teachers to help our must vulnerable students, and still pay them the going rate. “I was absolutely appalled to see this tax incentive program signed into law, which is why I immediately began exploring ways to ensure we don’t waste any more money on these unnecessary handouts. “In October, I formally introduced legislation, S-3051, which would require regular audits of every single business tax incentive that is managed by the NJ EDA. “My bill would also ensure that reports on these audits are published prominently on the Legislature and State Auditor’s websites. “The comptroller’s report that brought us here today proves that this Legislature must take action to prevent the continued waste of taxpayer dollars. “We can start by posting my bill for a vote, so that every taxpayer and leader can see exactly where our money is going. “If we really want to create jobs, than we need to focus on cutting taxes and reducing regulations to make New Jersey more business-friendly. “State agencies and politicians should not be in the business of picking winners and losers in the private sector, or using agencies like the EDA as a way to hand out favors to friends and donors. “To protect the public’s trust in government this must change, and it must change now. “I look forward to working with you, as we fight for a more transparent, accountable and affordable state for all.” Click here for a copy of Sen. Pennacchio’s legislation, S-3051.

|