| TRENTON, N.J. – New Jersey’s struggling small businesses have prioritized paying for employee health insurance premiums as the country faced its biggest public health crisis in modern history. Now small employers who purchase insurance through Members Health Plan NJ are looking at a 5.5 percent monthly Covid surcharge – and it has prompted Assemblyman Kevin J. Rooney to sound the alarm.

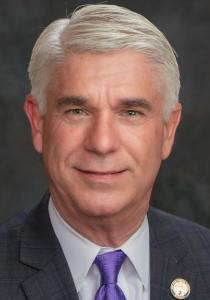

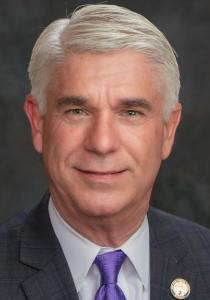

“Forcing our surviving small businesses to pay a surcharge on health insurance during the middle of a pandemic could hurt their ability to keep their doors open,” said Rooney (R-Bergen). “The consequences of such an increase need to be thoroughly considered. The state either needs to step up their financial support or step in and investigate if such a hike is really necessary.”

Members Health Plan NJ is one of two licensed Multiple Employer Welfare Arrangements or MEWAs in the state. These plans allow small employers to join together to offer health benefits to their employees. They are regulated by the state Department of Banking and Insurance and statutorily required to meet certain solvency and surplus requirements to pay out claims.

“These group health plans make it possible for many of our state’s small businesses to provide health insurance to their employees – even though the small businesses are not required to do so,” explained Rooney.

The insurer recently informed employers that a 5.5 percent monthly surcharge would be included on their bills beginning in February because of increased costs associated with Covid. In a letter to employers in the group, they justify the charge by citing an estimated $10 million in Covid‐19 claim expenses, in addition to their normal anticipated claim volume. They will also not pay for Covid testing unless it is deemed “medically appropriate” by a health care provider.

“At a time when most health insurers are reporting record profits because elective surgeries were put on hold and people did not go to appointments or annual screenings because they were told to stay at home, it seems suspect that this health insurer had higher than normal claim volume,” said Rooney. “The scrutiny over Covid testing also seems unfair when officials tell people to get tested even if they are not experiencing symptoms. One has to wonder if this is an issue that is unique to MEWAs?”

Members Health Plan NJ includes a contingent liability statement that allows the plan to assess employer groups if it is unable to meet its claims obligations. They are also not letting employers with financial hardship to stretch the surcharge payments over time.

“We can’t keep punishing our small businesses that have played by the rules during this pandemic. Our small businesses really got the short end of the stick when it came to financial assistance,” said Rooney. “First, Governor Murphy wouldn’t disperse the federal CARES Act money while businesses were going under and then he vetoed legislation that would have made $100 million of additional CARES Act funding available to small businesses. It’s inconceivable. If we ever want our economy to recover, we have to support our small businesses.” |