Scharfenberger Tells Congress NJ Needs More SALT to Combat High Tax Diet

Scharfenberger Tells Congress NJ Needs More SALT to Combat High Tax Diet

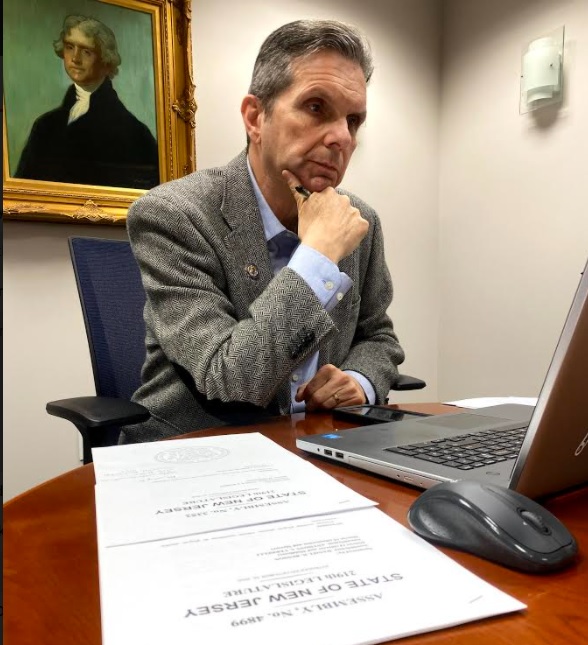

Middletown, N.J. –Assemblyman Gerry Scharfenberger (R-Monmouth) has introduced a resolution (AR229) calling on Congress to remove the $10,000 State and Local Tax Deduction (SALT) cap that was implemented in 2017. Residents suffering in high taxed states, such as New Jersey, need to utilize the full deduction to offset the inability of failed economic policies which ultimately impact their lives:

“The SALT deduction for New Jersey residents is a necessary, crucial lifeline in such a high taxed state,” said Scharfenberger. “Until Trenton gets its act together and lessens the highest in the nation tax burdens, the SALT deduction is absolutely critical for many, particularly property taxpayers.”

The push to have the federal government re-implement the full deduction comes as New Jersey eclipses a statewide property tax average of over $9,000, forcing many to abandon their homes or dreams of ever having one. Compounding the issue, residents face the constant influx of toll, gas and a myriad of other tax increases on top of economic ruin facing many from the pandemic lockdown measures and issues with Unemployment Claims:

“Seniors cannot afford to live in their households, young families are forced to move to other states and lower income households are deterred from ever having an opportunity to buy a home – it is truly outrageous,” Scharfenberger continued. “Our residents need help now, they should not be penalized for the state’s lack of financial literacy. The fact that the SALT deduction is such a necessity underscores just how desperate the need is to fix New Jersey’s broken tax system which has only increased in weight these past few years, further crushing our residents.”