Sherrill Statement on Senate SALT Vote

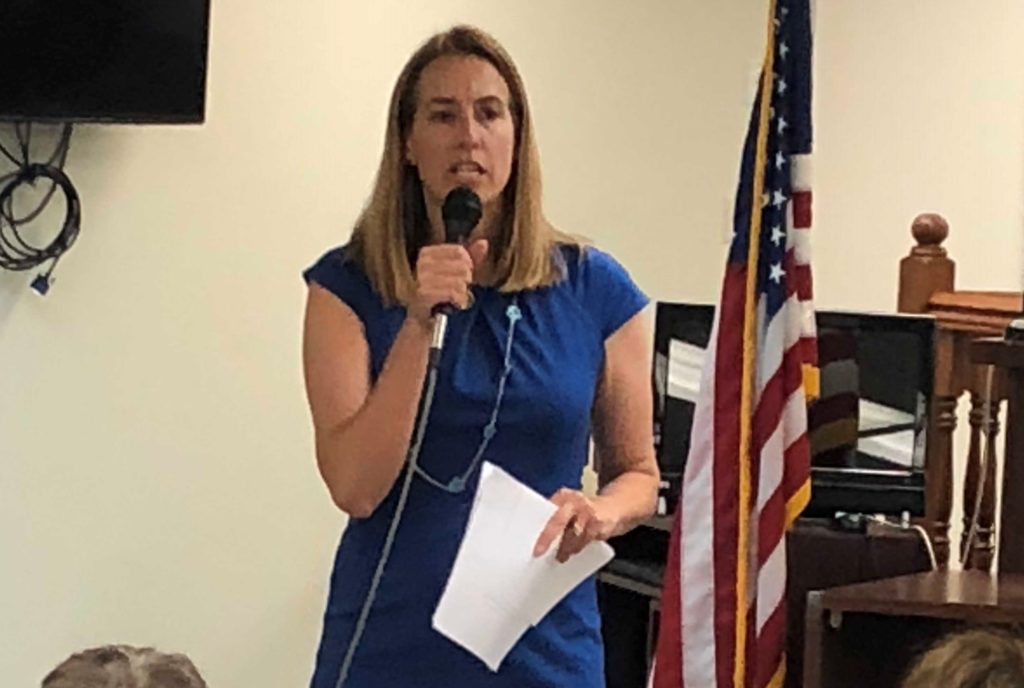

Sherrill Statement on Senate SALT Vote

Washington, DC — Representative Mikie Sherrill (NJ-11) released the following statement after the Senate voted yesterday to reject S.J.Res. 50, a resolution from Senate Minority Leader Charles Schumer (D-NY) to help ease the tax burden for thousands of families struggling with state and local tax deduction (SALT) cap:

“The federal cap on the SALT deduction is an attack on tens of thousands of New Jersey families and taxpayers in my district. It was wrong from day one. That’s why New Jersey passed a state law to ease the tax burden caused by the federal SALT deduction cap. Instead of reversing course, Secretary Mnuchin and the IRS adopted a rule to block New Jersey and New York and the other states with similar laws.

“Let’s be clear: Secretary Mnuchin and the IRS are blocking duly-passed state laws in order to target and double-tax tens of thousands of North Jersey residents. This rule is an assault on state legislatures, particularly in states like New Jersey and New York that pay far more in federal taxes than they receive.

“That’s why I worked with Representative Gottheimer and Senator Schumer to write legislation to get rid of this inexcusable rule. Unfortunately, as they’ve done on so many other bills, Senate Republicans blocked progress yesterday and voted with the IRS over New Jerseyans. Rest assured I will continue to do everything I can in the House of Representatives to lift the SALT deduction cap for hardworking New Jersey residents.”

Representative Sherrill introduced H.J. Res. 72, bipartisan companion to S.J. Res 50, in July 2019. She is a member of the SALT Task Force in the House of Representatives and the author of the SALT Relief and Marriage Penalty Elimination Act of 2019 (H.R. 2624) to end the marriage penalty and make the SALT deduction equal to the standard deduction taken by taxpayers, encouraging homeownership and charitable giving.