Sweeney Calls for Federal Pension Loan Program to Become Cornerstone of Next Federal Coronavirus Package

Sweeney Calls for Federal Pension Loan Program to Become Cornerstone of Next Federal Coronavirus Package

Senate President unveils push for low-interest pension loan program that provides investment in infrastructure and puts people to work

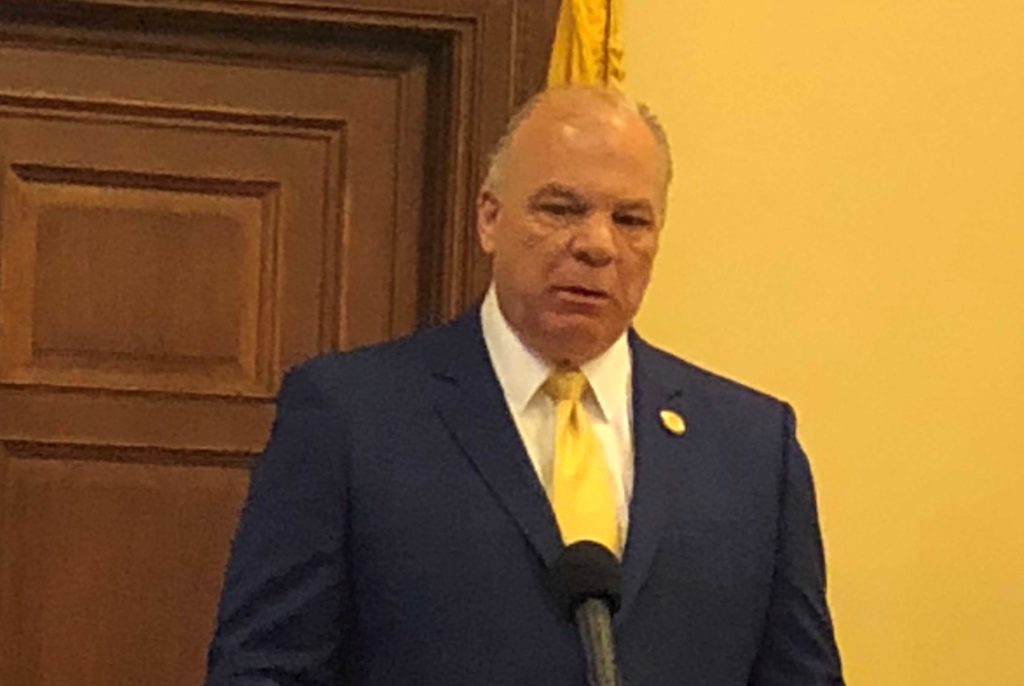

Trenton – Warning that the coronavirus stock market plunge has put a majority of the nation’s public government pension plans “at risk,” Senate President Steve Sweeney today urged the President and Congress to partner with state and local governments to solve pension and infrastructure funding challenges with a federally-financed program in next month’s coronavirus recovery package.

The proposed Pension Infrastructure Finance and Innovation Act (PIFIA) would provide $500 billion in federally-financed low-interest loans to state and local governments to stabilize retiree plans and to provide capital for investments in needed new infrastructure as well as other asset classes. The coronavirus stock market meltdown now threatens the stability of a majority of the nation’s public pension plans covering state, county, municipal and school employees and retirees. Stronger pension plans will stabilize markets and bolster the economy, creating new good-paying jobs.

The 30-year PIFIA loans, which would carry a 1.5 percent interest rate, would be issued only to state and local governments with investment-grade credit ratings. The projected cost to the federal budget would be $5 billion, and the Federal Treasury could finance the program by increasing bond sales and capitalizing on the global “flight to quality” that has increased investor demand for U.S. Treasury securities as an investment safe haven.

“We believe the PIFIA program will have broad support in both red states and blue states because it addresses the persistent underfunding of both pensions and infrastructure,” Senator Sweeney said. “Virtually every state has pension systems that could benefit from participation in the PIFIA loan program.

“While New Jersey, Kentucky, Pennsylvania, Rhode Island, Illinois and other states have implemented important reforms to improve the stability of their pension funds, the coronavirus stock market plunge has pushed a majority of state and local government pension plans below the 65 percent funding threshold that would be considered ‘at risk’ under the ERISA Act for private pension plans,” he noted.

The Pew Charitable Trusts’ Public Sector Retirement Systems project, which has been assessing the impact of the coronavirus stock market plunge on pension portfolios, projects that without positive investment performance over the next three months, the funding gap facing state pension systems could jump from $1.24 trillion in 2018 to $1.7 trillion by the end of the fiscal year. As of 2018, there were $4.3 trillion in assets in the 299 state-administered and 5,977 locally administered pension systems covering 25 million active and retired public employees.

“The pension crisis will get worse if state and local governments grappling with revenue shortfalls and a lingering economic slowdown caused by the coronavirus are unable to make required pension payments,” Sweeney said. “We are committed to keeping up our pension payment schedules in New Jersey, but others may not be able to do so. This plan is a cost-effective way to provide state and local governments not only with short-term relief, but with a long-term solution to a pension crisis that has been building for two decades.”

Senator Sweeney praised Governors Larry Hogan of Maryland and Andrew Cuomo of New York, the bipartisan chair and co-chair of the National Governors Association for their leadership in calling for a $500 billion state aid package, and U.S. Senators Bob Menendez (D-N.J.) and Bill Cassidy (R-La.) for proposing a $500 billion legislative plan.

“The PIFIA pension loan program could easily be incorporated into their efforts as a particularly cost-effective way to provide aid to state and local governments. Including a $5 billion allocation for PIFIA loans in the aid package would generate well over $100 billion in budget savings over the next first three years of the program,” Senator Sweeney said. “Just as important, it will sharply reduce the growing unfunded liability of state and local pension systems across the nation.”

Senator Sweeney thanked Illinois Senate President Don Harmon, with whom he discussed the PIFIA concept two weekends ago, for putting the issue of pension relief on the table

“This is not about Illinois or New Jersey. It is about the country. It is a loan program that will be paid back in full with interest. Loan proceeds would have to be put irrevocably and directly into pension funds to reduce the unfunded liability, and borrowers would be required to maintain Actuarially Required Contributions into their pension funds. The nation needs a program like this now,” Senator Sweeney said.

America’s pension systems were 102 percent funded in the year 2000, dropped to 89 percent funded after the dot.com bubble burst, and fell to 73 percent funded after the stock market plunge of the Great Recession. Pew’s pension experts project that public pensions could be below 65 percent funding in the wake of the coronavirus market plunge.”

While state pension underfunding gets the most attention, there is a real funding crisis in the locally administered pension systems, from the large pension systems serving first responders in Dallas, Fort Worth, Houston and El Paso to the hundreds of smaller pension systems in Florida, Pennsylvania, Illinois and other states with decentralized pension funds.

The PIFIA program is modeled after the federal government’s successful Transportation Infrastructure Finance and Innovation Act (TIFIA) and Water Infrastructure Finance and Innovation Act (WIFIA), and it is closely aligned with these programs in including an infrastructure investment component.

Under the proposed PIFIA legislation governments taking PIFIA loans would be required to invest 20% of the loan proceeds in revenue-generating infrastructure projects to diversify their pension portfolios and begin to address the nation’s $2 trillion backlog in transportation, water and other infrastructure needs. The pension fund investments could include asset transfers, toll roads, bridge or tunnel projects, or infrastructure funds that underwrite such investments.

PIFIA - Pension Infrastructure Finance & Innovation Act - Plan