Sweeney-Pou-Oroho Bill to Enact Job-Sharing Furlough Program Passes Senate, Assembly

Sweeney-Pou-Oroho Bill to Enact Job-Sharing Furlough Program Passes Senate, Assembly

Lawmakers urge Governor to sign bill and launch program immediately to generate millions in savings for employers, workers, taxpayers

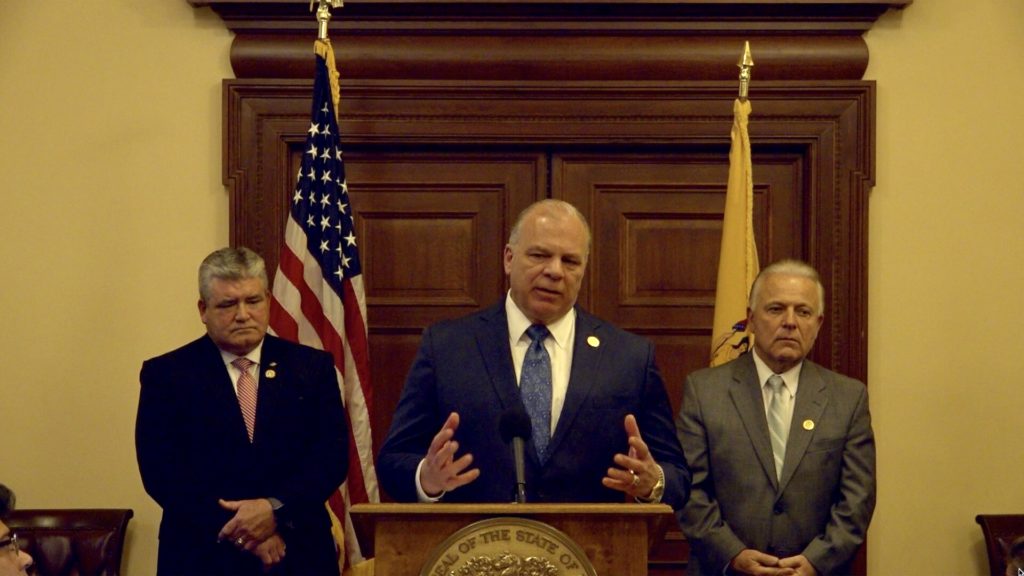

TRENTON – The Senate and the Assembly today approved bipartisan legislation sponsored by Senators Steve Sweeney, Nellie Pou and Steve Oroho to implement a New Jersey Job-Sharing Furlough Program that capitalizes on key provisions of the federal CARES Act. The furlough bill, S-2350, would generate hundreds of millions of dollars in savings for employers and maximize payments to furloughed employees while fully protecting their health and pension benefits.

The legislators urged the Governor to sign the bill and direct the Department of Labor and Workforce Development to launch the program immediately to maximize savings for both public and private employers and to pump as much money as possible into the pockets of furloughed employees before the extra $600-a-week federal unemployment payments end on July 31.

The bill, which has been endorsed by the New Jersey Education Association, the NJ State League of Municipalities and the NJ Business and Industry Association, passed the Senate 37-0-3 and the Assembly 80-0.

“Launching a statewide Job-Sharing Furlough Program is the ultimate win-win for public and private employers whose revenues have been plunging because of the coronavirus recession, and for furloughed employees who would get more money in their pockets without any loss of health or pension benefits,” said Senate President Sweeney (D-Gloucester/Salem/Cumberland). “That’s why this program has such strong support from municipalities, counties, school boards and public employee unions.”

The New Jersey Job-Sharing Furlough Program capitalizes on two provisions of the federal Coronavirus Aid, Relief and Economic Security (CARES) Act, the $2.2 trillion economic relief package signed into law on March 27. The first provides a Federal Pandemic Employment Compensation payment of $600 a week to workers laid off or furloughed during the health crisis. The second provides for 100 percent federal reimbursement of the cost of state unemployment benefits for any state that enacts a job-sharing furlough program under an existing state law.

“This program will be particularly beneficial for municipal and county governments that would otherwise be forced to lay off workers to avert future budget problems. This legislation will save jobs and protect employee benefits,” said Senator Pou (D-Passaic). “We should do everything we can to put more money in the pockets of New Jerseyans today so they will have more money to spend to recharge our economy when the coronavirus crisis ends.”

“Every day we delay costs us money. We have to do everything we can to save tax dollars now to avoid a bigger budget crisis later, and this program will save hundreds of millions of dollars,” said Senator Oroho (R-Sussex), the Senate Republican Budget Officer. “The federal government included this special furlough program in the CARES Act because it was better to keep people working part-time with full health benefits during the crisis than laying them off without health insurance and overburdening the unemployment system.”

New Jersey qualifies for full federal reimbursement of state unemployment benefits for furloughed workers because it already has a 2011 job-sharing furlough law. That law requires participating employers to continue to pay furloughed employees between 40 percent and 90 percent of their regular salary and maintain full pension, health insurance and other benefits.

The bill would guarantee furloughed employees that their future pension benefits would not be reduced and that they would continue to accrue seniority. It would allow public and private sector employers to launch furlough programs in compliance with the New Jersey law now for approval retroactively. It also would increase from 20 percent to 40 percent the amount of income that unemployed workers can earn without affecting their unemployment benefits, and allow pre-certification of unemployment benefits for workers scheduled to be furloughed or laid off.

Implementing the New Jersey Job-Sharing Furlough Program under the 2011 law in combination with the two federal CARES Act provisions would put $1,000 to $6,000 more in the pockets of furloughed workers over a three-month period than they would receive by continuing to work full-time.

Lower-paid workers would benefit the most, but all employees making up to $89,000 would receive greater compensation from the combination of their 40 percent furlough pay, state unemployment benefits that are 25 percent higher for workers on furlough than those who are laid off, and the $600 per week federal unemployment subsidy than they would be continuing to work fulltime.

Public employers would save $2,000 to $13,000 per employee from reduced payroll costs and federal reimbursement for state unemployment benefits. Private employers participating in the CARES Act’s Payroll Protection Program would save even more because the U.S. Small Business Administration program provides loan forgiveness for 100 percent of payroll and benefit costs for furloughed workers whose benefits they continue.