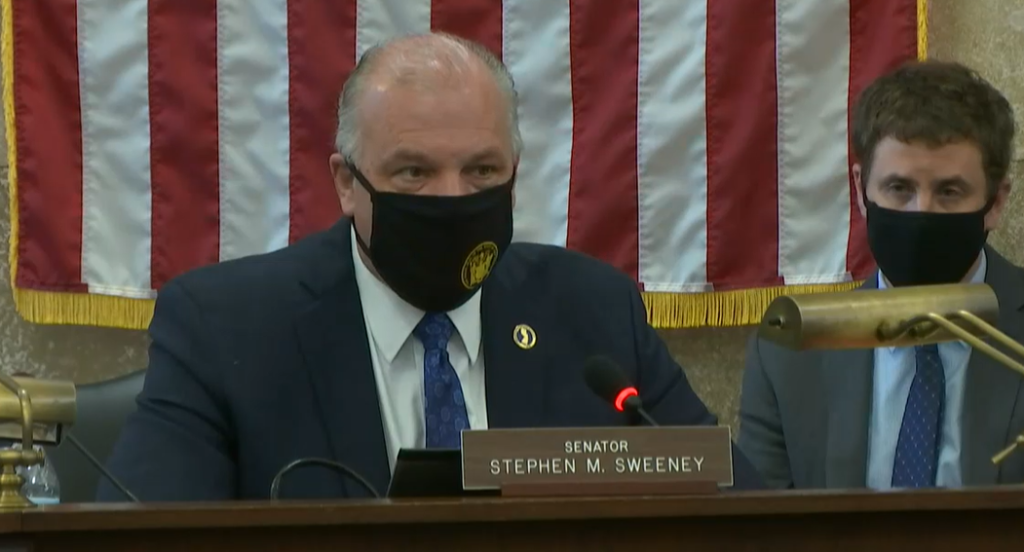

Chair of PERS Fires off a Letter to Lawmakers Objecting to Sweeney’s Bill

Tom Bruno, chair the NJ Public Employees’ Retirement System Board of Trustees, objects to Senate President Steve Sweeney’s (D-3) bill, S-3522, which would split the current PERS into two smaller pieces: the State workers PERS and the “Local part,” which would contain municipal and county.

“The bill is reckless and dangerous and either deliberately so, or simply out of ignorance,” said Bruno.

The Board voted Bruno to run point on behalf of the 800,000 active and retired members of PERS and the Board in an effort to defeat the Bill.

It was defeated in the Senate State Government Committe last Monday but Sweeney pulled it out and sent it to his allies on the Appropriations committee who voted to pass it.

Sweeney said it would be on Thursday’s Senate Agenda for a vote but it never happened (presumably because he doesn’t have the votes yet).

Bruno sent a blanket letter of concern to all legislators (both caucuses in both chambers).

According to the language of S-3522:

The bill creates a board of trustees for the Local Part composed of seven members. There will be three trustees representing public employers who have active members and retirees in the Local Part of PERS, and three trustees representing collective bargaining units that represent active employees in the Local Part of PERS. There will be one trustee appointed in a manner provided by the other trustees.

The board of trustees for the Local Part will manage the Local Part of PERS and develop the policies for the investment of the funds of the Local Part of PERS. The Division of Investment in the Department of the Treasury will manage the investments in accordance with polices developed by the board.

The bill requires the board to hire an executive director, actuary, chief investment officer, ombudsman, and internal auditor, and retain legal counsel.

This bill imposes certain education and experience requirements on the executive director and chief investment officer employed by the board.

The bill provides the board of trustees of the Local Part with authority to modify the system’s member contribution rate; cap on creditable compensation; formula for calculation of final compensation; and standards for special retirement and disability retirement. The bill allows the board to reinstate cost of living adjustments for retirees. At least five votes of the authorized membership of the board would need to approve any enhancement or reduction of a member benefit, or to approve any increase or decrease in the employer contribution that is more than what is recommended by the actuary for the system for the purpose of the annual funding requirements of the system.

This bill requires the board of trustees of the Local Part, at the end of six years following the enactment date of this bill, to conduct a review of the performance and funding levels of the retirement system, as compared to available market data, including, but not limited to, the performance of the State Investment Council and Division of Investment with regard to the investment of other State-administered retirement systems or funds and other appropriate benchmarks, and may, based on a majority vote of the authorized membership of the board, petition the Legislature to consider legislation that reverts control of the system to the Department of the Treasury, or other agency as the State deems appropriate.

The bill does not diminish the non-forfeitable right PERS members have to receive the benefits provided under State law or affirmed by the State’s courts. Nothing in the bill relieves the State or local government employers of any past, present, or future obligations to the PERS or its members.

This attachment was the letter sent last week, followed by discussions regarding investment costs doubling if the funds get split because PERS would lose “bulk discounts” on investments and Administration costs at least doubling as well.

Switch memo to Senate from PERS BoT re S 3522

Leave a Reply