Gov. Phil Murphy: NJ 2020 Budget Falls Short of Tax Fairness, Sustainable Revenues

Governor Phil Murphy today released the following statement on the Legislative Democrats’ proposed budget:

“Four months ago, I presented a budget built on the core principles of returning New Jersey to sound and fiscally responsible practices, with tax fairness and a strong surplus, and, most of all, making investments that ensure that New Jersey’s future works for everyone.

“The budget under consideration by the Legislature shares many similar priorities with the investments I initially proposed. That is encouraging.

“However, the budget introduced today falls short on the principle of tax fairness. It leaves us without the stable and sustainable revenues to secure the investments we seek to make in our people and our state. It makes unnecessary cuts to valuable programs while increasing spending on non-vital ones and eliminates our first deposit in a decade into the state’s empty Rainy Day Fund, leaving New Jerseyans less prepared for an economic downtown. So, at this point, as I have stated again and again, every option is on the table.

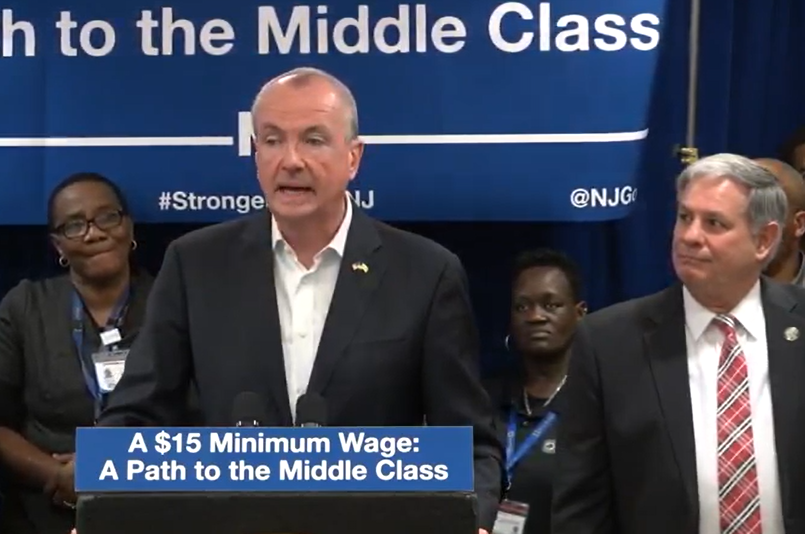

“I will continue to work with Senate President Sweeney, Speaker Coughlin, the respective budget chairs, and leadership teams so we can, together, enact a stronger and more fiscally sound budget. And, through this budget process and beyond, I will continue advocating for tax fairness, a New Jersey that puts the middle class ahead of the special interests, along with sound fiscal practices that will provide stability and set our state up for long-term success

Tax fairness would be cutting taxes for everyone. Tax fairness would mean not basing school funding on zip codes. Tax fairness would mean allowing small businesses to keep more of their money so they could grow and hire more workers. Tax fairness would be us not having to waste billions of our tax dollars on rat hole school districts. That’s tax fairness Phil, not your hypothetical version socialism.

Plus, if you knew anything about Jersey politics, you would know that no Assemblyman will vote for a tax when they are running for reelection – particularly when you want to jack up taxes on their primary donors.