Booker, Stabenow, Warnock, Smith Reintroduce Legislation Eliminating Tax Liability for IRA Assistance for Distressed Farmers

Booker, Stabenow, Warnock, Smith Reintroduce Legislation Eliminating Tax Liability for IRA Assistance for Distressed Farmers

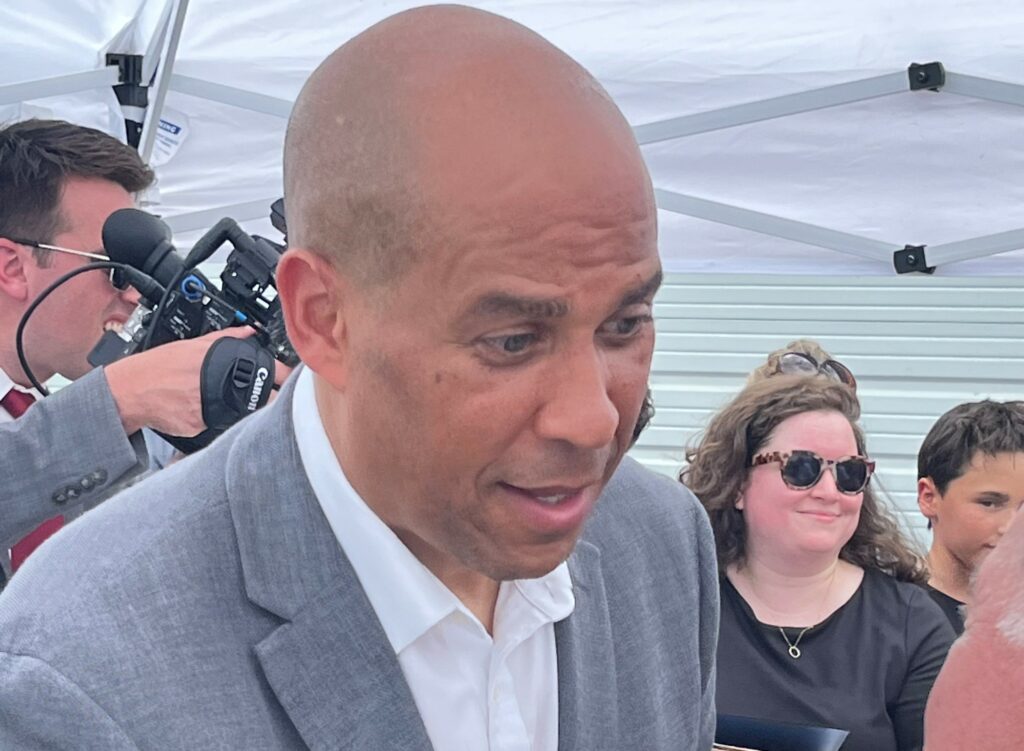

WASHINGTON, D.C. – Today, U.S. Senators Cory Booker (D-N.J.), Debbie Stabenow (D-MI), Raphael Warnock (D-GA), and Tina Smith (D-MN), all members of the Senate Committee on Agriculture, Nutrition, and Forestry, reintroduced the Family Farmer and Rancher Tax Fairness Act, legislation that would remove the tax liability for distressed farmers on the assistance provided under Sections 22006 and 22007 of the Inflation Reduction Act (IRA). Currently, farm loan borrowers who are already at financial risk are facing tax liability on the IRA assistance.

“The critical financial assistance we fought to include in the Inflation Reduction Act is a lifeline for farmers around the country struggling to hold on to their farms,” said Senator Booker. “However, those same farmers are now facing a burdensome tax liability that can plunge them into deeper debt. Congress must quickly remove these tax liabilities to ensure that farmers who received assistance stay on the path back to financial stability.”

“I fought to include robust relief for farmers in the Inflation Reduction Act so Georgians can stay on their farms and keep operating at full force to feed our country and support our local economies,” said Senator Reverend Raphael Warnock. “Passing the Family Farmer and Rancher Tax Fairness Act is an important part of getting these farmers the full relief they deserve, and I’m proud to be a part of this coalition working to make economically distressed farmers in Georgia and across the nation whole.”

“Agriculture is the backbone of Minnesota’s diverse economy – we need to make sure the industry is as strong as possible,” said Senator Smith. “As a member of the Senate Ag Committee, I’m proud to support this bill, which will help Minnesota farmers who face unique barriers take full advantage of key federal programs. I look forward to working with my colleagues to pass this legislation, and will continue looking for ways to level the playing field for disadvantaged farmers in Minnesota and across the country.”

Section 22006 of the IRA authorizes payments to distressed farm loan borrowers, particularly those borrowers whose agricultural operations are at financial risk. Section 22007 of the IRA provides much-needed financial assistance to Black farmers and others who have suffered discrimination through USDA’s farm lending programs. Distressed borrowers with qualifying USDA farm loans have already received nearly $800 million in assistance as part of the $3.1 billion for distressed farm loan borrowers provided through Section 22006, and these farmers are now facing the imminent threat of hundreds of millions of dollars of IRS tax liability if Congress does not act. The Family Farmer and Rancher Tax Fairness Act exempts these payments from federal income taxes.