New Jersey Tax Incentive Task Force Releases Third and Final Report Today

Press Conference at 1:00pm

The Task Force will hold a press conference today at 1:00pm EDT to address questions from the media regarding the key findings of its investigation and how they may inform the planning, development and execution of the future structure of New Jersey’s tax-incentive programs. Key findings are outlined below.

To view the report, click here.

When: Thursday, July 9, 2020, at 1:00pm EDT.

Where: The press conference will take place as a Zoom webinar.

RSVP: Members of the media may RSVP to NJEDATaskForce@wmhlaw.com.

Registration is required to access the press conference.

What: A press conference to address questions regarding the final report from Governor Phil Murphy’s Tax Incentive Task Force on the Economic Development Authority’s Tax incentives program.

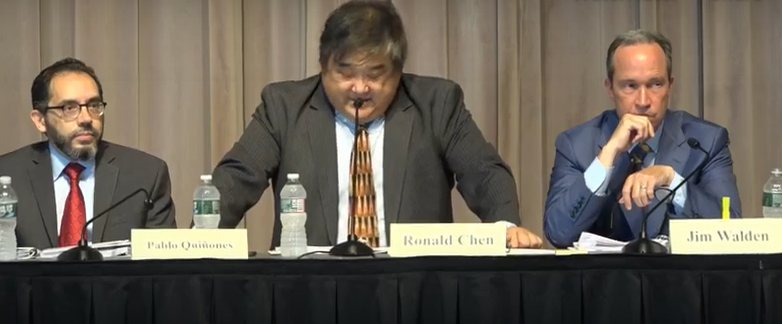

Who: Task Force Chair Professor Ronald K. Chen, former New Jersey Public Advocate, who is receiving legal counsel from Special Counsel Jim Walden, Avni Patel, Derek Borchardt, and Jennifer Prevete of Walden Macht & Haran LLP, a leading law firm in government investigations, and Special Counsel Pablo Quiñones of Quiñones Law PLLC, a boutique law firm with expertise in corporate compliance and integrity monitoring.

Press: Open to all media

Key new findings of the final report which will be discussed in detail during the press conference are as follows:

—The Task Force has made 27 specific recommendations to the EDA to improve their processes.

—The majority of companies that applied to the EDA for incentives under the Grow NJ program did not handle the process alone, but rather engaged professional consulting firms to shepherd their applications.

—The Task Force found that certain consultants played a role in the EDA awarding tax credits to companies that, contrary to the representations in their respective Grow NJ applications, were not actually at risk of leaving New Jersey—and which, therefore, did not qualify for incentives.

—The final report discusses several companies in detail to illustrate the role of tax incentive consultants in incentives awarded under Grow NJ. For example, the report describes in detail evidence showing that one company was already in advanced negotiations with a preferred relocation site in New Jersey before it discussed the possibility of applying for incentives with KPMG.

—The Task Force found that between 2013 and 2019, the EDA approved a total of fifteen companies for tax incentives under the Grow NJ program based on their claims that, absent incentives, they intended to relocate to the Blue Hill Plaza in New York. No other alternative site so frequently appeared on Grow NJ applications submitted to the EDA during the life of the Grow NJ program.

—The Task Force found evidence that consultants and Grow NJ applicants exploited Blue Hill Plaza for lease proposals that were not genuinely under consideration but were merely intended as evidence to show the EDA the purportedly “at risk” nature of the company’s jobs.

—The investigation found that, given the volume of applications claiming Blue Hill Plaza as an alternate out-of-state location, employees at the EDA were suspicious of these applications but did not sufficiently verify the authenticity of the claimed alternate site.

—In its analysis of the Grow NJ and Economic Redevelopment and Growth (ERG) programs, The Task Force identified deficiencies with respect to certain EDA analyses and the EDA’s record-keeping processes. For example, certain documents were frequently absent from the EDA’s files on applicants, such as term sheets, leases, contracts, broker requests for proposal response, or other proposals for a company’s alternative site.

—The EDA Board, in voting to approve a large award to a certain company, relied on the company’s representations regarding false purported alternative locations in South Carolina.