Pascrell, Eshoo Reintroduce Bill to Require Release of President’s Tax Returns

Pascrell, Eshoo Reintroduce Bill to Require Release of President’s Tax Returns

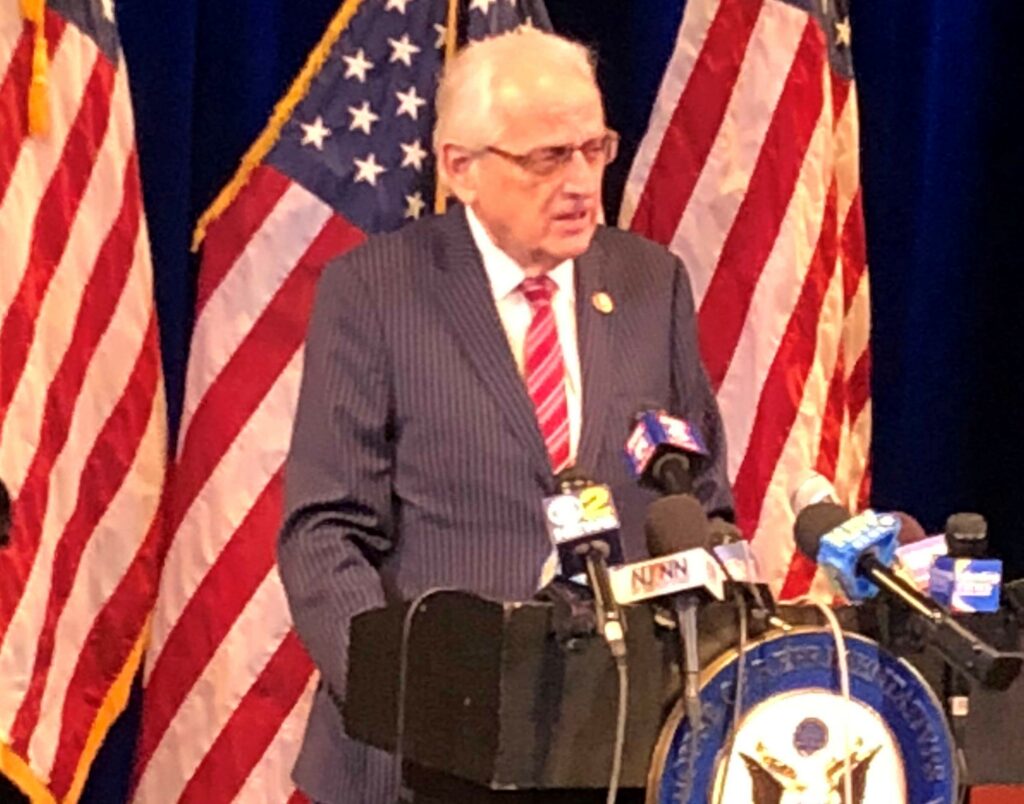

WASHINGTON, DC – Today, U.S. Reps. Bill Pascrell, Jr. (D-NJ-09) and Anna G. Eshoo (D-CA-18) reintroduced the Presidential Tax Transparency Act, legislation requiring sitting presidents and vice presidents and major party candidates for the presidency and vice-presidency to publicly disclose their 10 most recent federal income tax returns.

“The stunning corruption of the Trump regime has made clear for all time the priceless value of absolute transparency in our nation’s highest office,” said Rep. Pascrell who has led efforts to obtain the Trump tax returns in Congress. “Being able to scrutinize the tax returns of a man or woman seeking to attain the most powerful position on earth is a low bar, and one that candidates long abided until 2016. Americans always must know if their President is a crook. Our legislation requires that never again will an occupant of the Oval Office be able to hide their tax returns from this nation.”

“The American people must be confident that the President works in the public interest, not for their own financial gain,” said Rep. Eshoo. “That’s why it’s critical that candidates release their tax returns before the election and continue to do so while in office. The Presidential Tax Transparency Act will mandate transparency from all future candidates and leaders, allowing the American people to properly scrutinize and evaluate their dealings for themselves.”

The House passed Pascrell’s and Eshoo’s legislation in 2019 as part of H.R. 1, the sweeping For the People Act. The Presidential Tax Transparency Act was once again included in the updated version of H.R. 1 reintroduced on January 4, 2021.

According to the Tax History Project, every president since 1976 has released their tax returns while in office until 2016, but this practice is not required by current law. The Presidential Tax Transparency Act requires sitting presidents and vice presidents, and candidates for the presidency and vice-presidency of major parties, to submit their 10 most recent federal income tax returns to the Federal Election Commission (FEC) and make them available to the public. “Major parties” are defined in the tax code as parties whose candidate received more than 25 percent of the popular vote in the previous presidential election. If a president or candidate fails to disclose their tax returns, the IRS is required to provide redacted copies to the FEC for public disclosure.

Rep. Pascrell has been the most vocal proponent of the Congress reviewing Donald Trump’s tax returns. Since February 2017, Pascrell has led the call for the chairman of the Committee on Ways and Means to invoke Section 6103 of the tax code to obtain Trump’s tax returns. In the 115th Congress, Republicans voted 18 times to block Democratic resolutions seeking the tax returns. Last March, Pascrell had a fiery exchange with Treasury Secretary Steven Mnuchin’s illegal refusal to provide Trump’s tax returns to the House Ways and Means Committee.

###